How to Diversify Your Portfolio: Art as an Alternative Investment

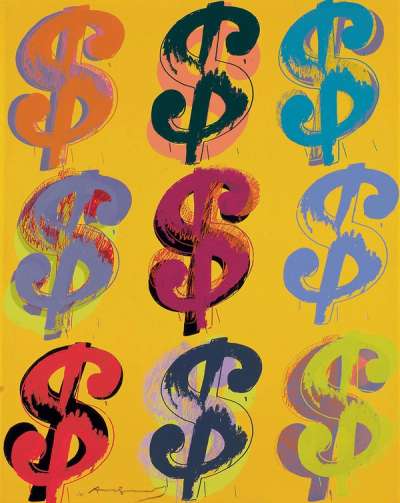

Dollar Sign 9 (F. & S. II.285) © Andy Warhol 1982

Dollar Sign 9 (F. & S. II.285) © Andy Warhol 1982Market Reports

Art as an investment has become an increasingly popular way to diversify and strengthen a traditional portfolio, offering substantial potential reward within a fast-changing changing landscape.

Download our complete 2023 Print Market Report here, to explore expert opinions on the prints and multiples market over the last five years.

Whether it's a Banksy print or a Damien Hirst NFT, art is an exciting alternative investment asset. As ever, fully anticipating how investments will perform is difficult. Spreading risk across a portfolio is important to its consistent performance over a long time.

What are alternative investments?

Financial assets that by their very definition do not fall into established categories from stocks and bonds, to annuities, mutual funds, currencies and EFTs, are known as alternative investments. These count as real estate, as well as consumable and non-consumable commodities, such as watches, wine, whisky, designer fashion, collectables and fine art. Alternative investments can strengthen and diversify traditional portfolios by seeking returns independent from equity and bond markets.

Art as an alternative investment

Many have long argued that you cannot compare art to traditional investments. There is little correlation between the access and management of equities, but art can have high rewards when an investor knows where to place their interest. The sheer enjoyment of the market and the asset itself, makes art a highly attractive investment. The timing of auction sales, and significant and complex commission structures, combined with the holding period of an investment are considerations that sometimes concern those looking to invest. Knowing who to trade through to generate the most significant return is the key to unlocking the potential of your investment.

The global art market was valued at £40 billion in 2020, and is still re-stabilising itself post pandemic. However, the pandemic has been one of the key triggers for greener investors joining the market. The riskier the stock market returns, and the level of economic slow down directly affects the demand for alternative investments.

What makes art as an investment so important is that there are major markets that have witnessed sustained demand, continue to have limited supply, and can endure economic downturns.

There are a multitude of things to consider when comparing art to equity investment, not least capital gains tax, insurance, conservation, and storage - but art does not behave in the same way as other assets.

Are prints and multiples the best alternative investment?

Prints and multiples are identical artworks produced in series - with a unique edition number, as a signed, or unsigned limited edition, made specifically for the purpose of multiple commercial opportunities.

With reproduction built into their definition, prints and multiples are plentiful when compared with other forms of unique artworks, such as paintings or sculptures.

Easy to photograph, upload and appraise through a computer screen, prints and multiples are also easy to manage. Prints provoke fewer unexpected costs than other assets, the value of which can quickly depreciate when management costs increase, and can be bought and sold as swiftly as stocks - with the right broker.

Unlike hedge funds, private equity or venture capital, prints and multiples are also tangible and familiar; rather than being a simple number denoting financial value in its purest sense, artworks can be deeply emotional assets.

There are multiple alternative assets on the market today, each with its own set of variables. The print market is the same, each market, from Lowry and Warhol to KAWS and Banksy, has its own trends, access points and considerations.

The key, for any investor looking to buy into the market for the first time is to do the homework via a trusted specialist broker. Request complimentary market advisory, transparency and expect to receive it. Our brokers offer this for free and only work in the prints and multiples market, making them some of the most knowledgeable people in the market.

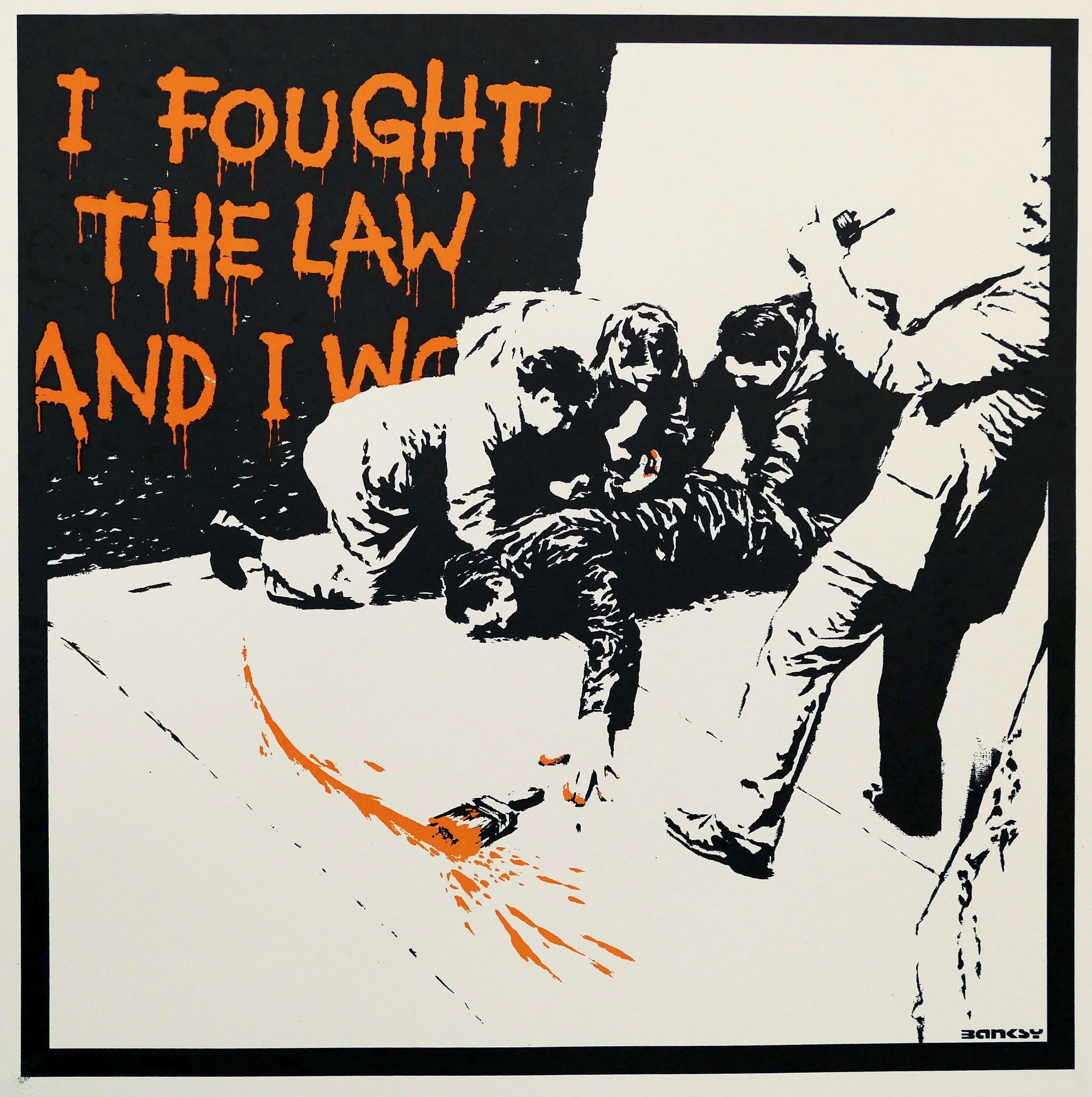

For many, the Banksy market is the focus of the prints and multiples investor market. The Banksy market has had high returns in the last 10 years, and an even sharper return in just a few months at the peak of the pandemic in 2020. Banksy is a special case, and will continue to be.

Charlotte Stewart, one time auction director at a major auction house, and now MyArtBroker’s Managing Director suggests, “Invest like a collector - if rewards are high in the very short term, see that as a bonus not a given. There are certain things that will always be true: Artists with longer running secondary markets, like Warhol, Lichtenstein and Picasso will always hold their value.

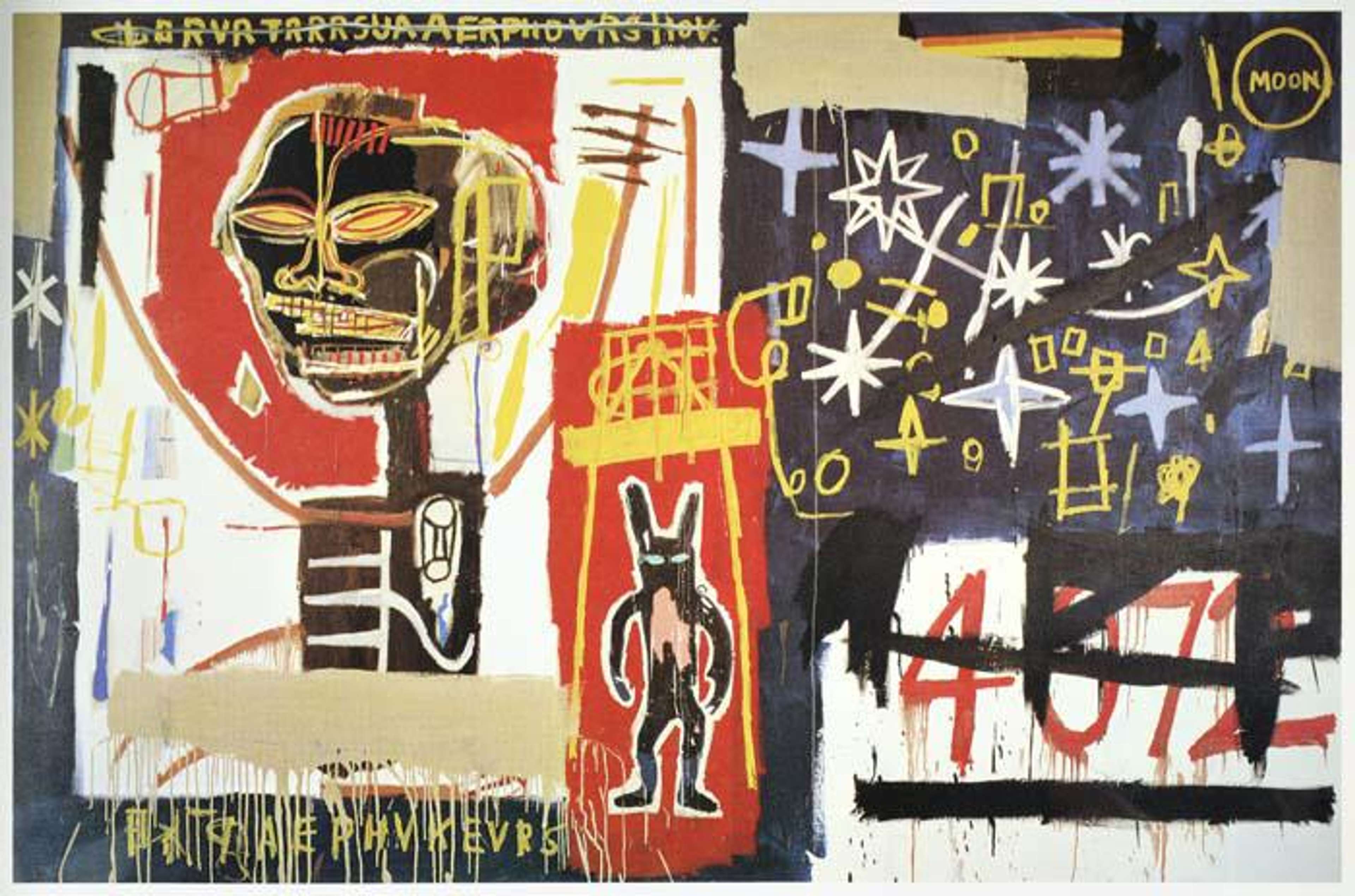

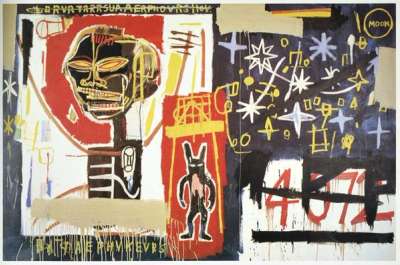

Those that produced less because of their lives being cut short will always be in very high demand: Haring and Basquiat; and those that have commanded consistently high prices for many years, will always be safe.

Don’t look outside of the secondary market unless you’re extremely comfortable with taking a punt.

Look out for Artist Proofs, they represent that sweet spot between an edition and a unique, and whilst you’ll pay higher, they’ll always remain special.

Buy in mint condition if you can afford it, one dealer’s ‘good condition’ can be another’s ‘fair condition’, but equally get the right advice and seek out opportunity - expert conservation specialists can work magic.

Buy what you love enough to pass onto the next generation, then you’ll never be disappointed.”

Why should I buy from the Modern & Contemporary prints and multiples market?

The market for Modern, Contemporary & Urban prints and multiples is one of the strongest performing – and most consistent – in the ever-complicated art world of today. Contemporary Art—whether that's American Pop Art, Urban or Post-war Contemporary—represented almost half of all sales in the international art market; during the same year, as reported by ArtTactic and Pi-eX, Contemporary Art auctions saw a five-fold increase in their revenue.

When lockdowns and persistent uncertainties provoked an abrupt and almost-overnight shift towards online marketplaces in 2020, the market in Modern & Contemporary prints and multiples managed to evade global shifts in consumer trends; as such, online-only fine art sales at major auction houses such as Christie’s, Sotheby’s, and Phillips exceeded $1 billion USD.

Having proven their ability to retain monetary value many times over, the unparalleled resilience of prints and multiples has seen them carve out a niche within an already burgeoning market.

Unlike well-known and large-scale paintings or sculptures, which sometimes appear at auction only once in a lifetime, prints are bountiful. On the 13th March 2020, Bloomberg reported that investors stockpiled a record $137 billion of cash in just 5 days. When Covid-19 panic saw investors flee from risk, the secondary Banksy market experienced unprecedented interest, effectively becoming the most liquid asset on earth at that time.

Why are prints the art market’s most collectible item?

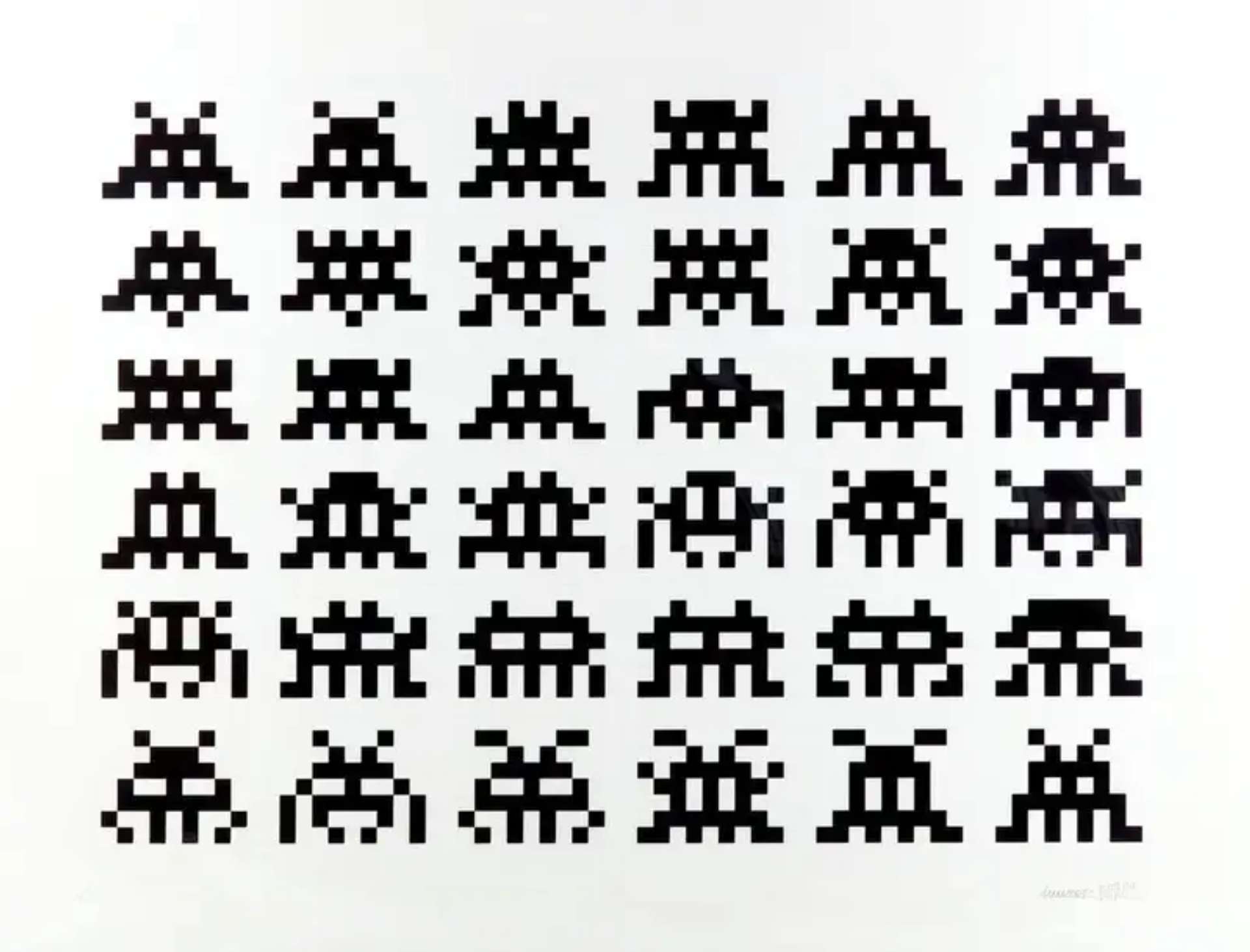

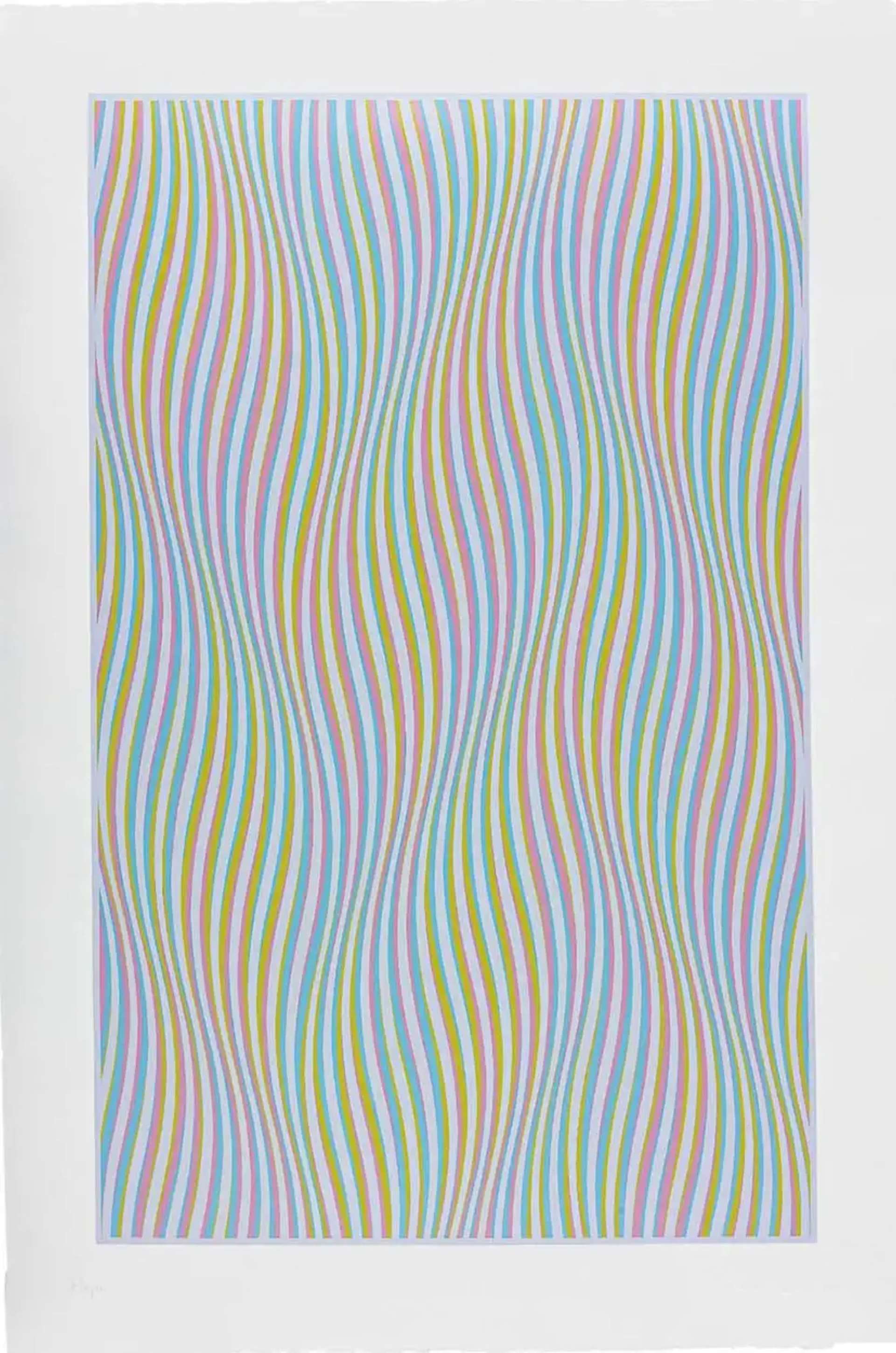

With a less hefty price tag than their large-format cousins, prints can enable you to own original and highly sought-after works from the likes of Stik, KAWS, Banksy, Damien Hirst, David Hockney, Bridget Riley, Invader, and Julian Opie.

The system of ‘editions’ – the number of prints made using a single printing plate, often in one sitting – contributes to the eminently collectible nature of this unique visual and artistic format.

‘Limited editions’ describe an edition of prints with a fixed number. These usually bear the signature of the artist, as well as a fraction (56/200, for example) indicating the number of an individual print and the overall edition size. ‘Open editions’, on the other hand, have no upper or lower limit as to the number of prints created.

The size of an edition has a direct impact on prices. Smaller editions mean there are fewer prints made; each print is therefore more valuable, and more expensive. Despite being lower in value, however, prints in larger editions are easy for even those with a relatively small budget to collect. In summary, editions make for an exciting way of amassing and selling art that everyone can get involved in, and which can pay off financially – if you are able to navigate the market with the right advisor at your side.

Girl With Balloon, voted the UK’s favourite artwork in 2017, for example, is one of British street art maverick Banksy’s most iconic and sought-after works. It was released in 2004 in a signed edition of 150, and an unsigned edition of 600. In that year, a signed version of the print cost a relatively inexpensive £150; they can now fetch upwards of £475,000 each.

Download Our 2023 Print Market Report here.

As the only dedicated prints & editions platform, we are committed to helping our clients make educated decisions about buying something they love and selling when the time is right; our combination of private sales, our vast network of collectors, and our precision data, offer autonomy and guidance in these matters unlike any other.