Market Watch: Market Editor's Report October 2024

Dollar Sign 9 (F. & S. II.286) © Andy Warhol 1982

Dollar Sign 9 (F. & S. II.286) © Andy Warhol 1982Market Reports

October swept through with a surge of online auctions, pivotal business conferences, survey insights, and the buildup to November's auctions–all while bracing for the UK’s budget announcement and Frieze’s imminent change in ownership. This October newsletter will unpack the month’s most impactful art market events, offering insights into what these developments mean as we inch closer to the year’s end.

Framing The Future: UK Budget Adjustments and Their Effect on the Art Market

Throughout 2024, global markets have struggled under the weight of geopolitical instability and high interest rates, with the art market experiencing a noticeable downturn. On 30th of October, Chancellor Rachel Reeves introduced the Labour Party’s first Budget in 14 years. This announcement is especially significant for art collectors for several reasons. The first concerning capital gains tax (CGT) rate increases, which affects profits made from selling shares and other assets. Effective immediately, the lower rate will increase from 10% to 18%, and the higher rate will increase from 20% to 24%, meaning that investors will pay more tax on profits from share sales.

How Will These Changes Affect Auctions and Sellers Considering Consignment?

With auction sales already showing a decline, ArtTactic recently reported that London evening sales totalled £110 million, coming in below the pre-sale low estimate and marking decline from October 2023. While the new CGT adjustment is considered modest and lower than most other EU countries, this adjustment will directly affect sellers and consignors within the art market and may potentially shrink the volume of publicly sold pieces.

High-value collectors, investors, and galleries are expected to feel the greatest impact, potentially leading to an even greater shortage of top-tier works, which could reduce overall market vibrancy and inflate prices. Buyers may also feel indirect impacts, as sellers are likely to seek higher valuations to offset the increased tax burden. This could create ripple effects across the art and finance sectors, where auction houses, dealers, and galleries are already working to adjust valuations in response to the current economic climate.

Inheritance Tax

The 2024 UK budget introduced changes affecting inheritance tax (IHT) relief on shares in the Alternative Investment Market (AIM), particularly for investors and collectors who use AIM-listed shares as part of estate planning. Previously, these shares were fully exempt from IHT, making them a popular choice for tax-efficient investments. Under the new rule effective from April 2026, AIM-listed shares will only receive a 50% relief, translating into a 20% effective IHT rate for inherited AIM assets.

For the art market, this means high-net-worth individuals (HNWI) and collectors who used AIM shares to mitigate IHT on their estates may need to reconsider their strategies. Given that many art collectors rely on diverse investment portfolios to manage tax liability on valuable art collections, these new rules could lead to even further conservative spending. Although, the upcoming $80 trillion wealth transfer from Baby Boomers to younger generations could sustain market activity, inheritance planning will be critical, especially as Millennials and Gen X prepare to inherit large collections.

Considering new taste preferences and economic policies, we can expect to see spending habits change. As noted in The Art Basel & UBS Survey of Global Spending, Gen X leads purchases on both high-value and accessible art, yet the realities of economic shifts may drive art buyers toward more tax-efficient choices. Clare McAndrew, Art Economist and author of the report, further suggests that collectors are favouring more affordable works showing an increasing interest in prints and multiples, a market trend that may intensify as collectors seek to manage tax burdens effectively.

Is Frieze Art Fair Up For Sale?

The Potential Deal

Last week, the art and finance world buzzed over the news that entertainment giant Endeavor is exploring the potential sale of Frieze Art Fair. Announced on 24th of October, this move aligns with Endeavor’s strategy to streamline by divesting from non-core assets. Alongside Frieze, the company has already offloaded other lifestyle and culture-focused assets like Professional Bull Riders, On Location, and various parts of IMG, reported by Puck journalist Bill Cohan. These assets have been acquired by TKO, a public affiliate of Endeavour, created through the merger of UFC and WWE, global leaders in Combat Sports and Entertainment.

Endeavor CEO Ari Emanuel also holds an executive role at TKO and the recent transactions have increased Endeavour’s stake in TKO to 59% granting $3.25 billion in TKO stock. Through a strategically planned financial move, announced by Endeavor as part of its shift to reinforce its position in the global sports market, Emanuel and his team are poised to secure substantial bonuses by orchestrating asset sales and reallocations. This approach marks a significant transition for Endeavor, prioritising core sports assets and positioning key executives for considerable financial rewards.

Endeavor’s Potential Exit From Art Fairs

Endeavor’s concentrate on sports and entertainment is a strategic pivot that signals a potential exit from the art fair sector, where Frieze stands as a unique player. While Frieze offers prestigious appeal, it aligns less directly with Endeavor’s core revenue streams.

Selling Frieze could attract private investors looking to expand their global influence and, potentially, drive growth for the fair itself. Industry expert Marion Maneker suggests Art Basel as a natural buyer, but this move would come with several complexities. Such a sale could consolidate “the entire fair ecosystem,” effectively creating a market monopoly–a scenario where a single entity controls the majority of the market, limiting competition and potentially increasing prices while reducing variety for consumers. Beyond concentrating power, this would also risk diluting Frieze's unique brand identity in favour of a more homogenised art fair landscape.

Could Sotheby’s Boldly Acquire Frieze?

I'd like to present another angle to consider: could Sotheby’s be a potential buyer? To start with the obvious, there are serious financial challenges to weigh in this scenario. With $1.8 billion in current debt and a pending billion-dollar investment from ADQ (an Abu Dhabi sovereign wealth fund), on paper Sotheby’s is not well-positioned for another acquisition. Acquiring Frieze would likely require Patrick Drahi to take on additional debt and make strategic, well-justified resource adjustments. However, Drahi has a history of bold financial manoeuvres, building his empire through calculated risk, such a move aligns with his approach to high-stakes investment and would hardly be surprising.

To toy with the idea, this partnership could create compelling brand synergies, broadening Sotheby’s client base and revenue channels beyond traditional auctions. Not only would this acquisition diversify the auction houses customer demographics, but it would also place Sotheby’s in a stronger position within the Contemporary art market, further enhancing its leverage and insight into market dynamics and trends.

Interestingly, should this acquisition align with a future Sotheby’s IPO or a minority stake sale, having Frieze in its portfolio could become a strong draw for investors. This would inject valuable capital, potentially easing (a portion of) Drahi’s debt load, and could even fulfil Tim Schneider’s early-year prediction about Sotheby’s selling a minority stake to private investors, albeit a bit later than the anticipated October 1st milestone.

October Auctions

October ushered in New York’s print sales, yielding $16.2 million across three major auctions (Christie’s, Sotheby’s, and Phillips). This result came in just 9% below last year’s equivalent sales despite 118 fewer lots, aligning with the strong competition and resilience reported in this market segment. For a deeper analysis, explore our auction reports on Phillips and Christie’s sales, with Sotheby’s detailed results below.

Sotheby’s Prints & Multiples

Sotheby’s Prints & Multiples sale, held online from 15-22 of October, brought in a hammer total of $4.8 million–the lowest of the three major auction houses this month, but the only one to surpass its previous year’s total of $4.7 million with a similar number of lots. Thus, marking an increase where its competitors saw slight declines.

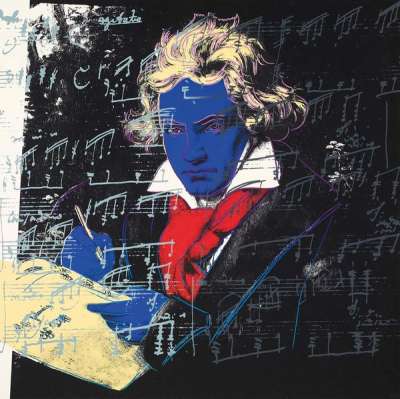

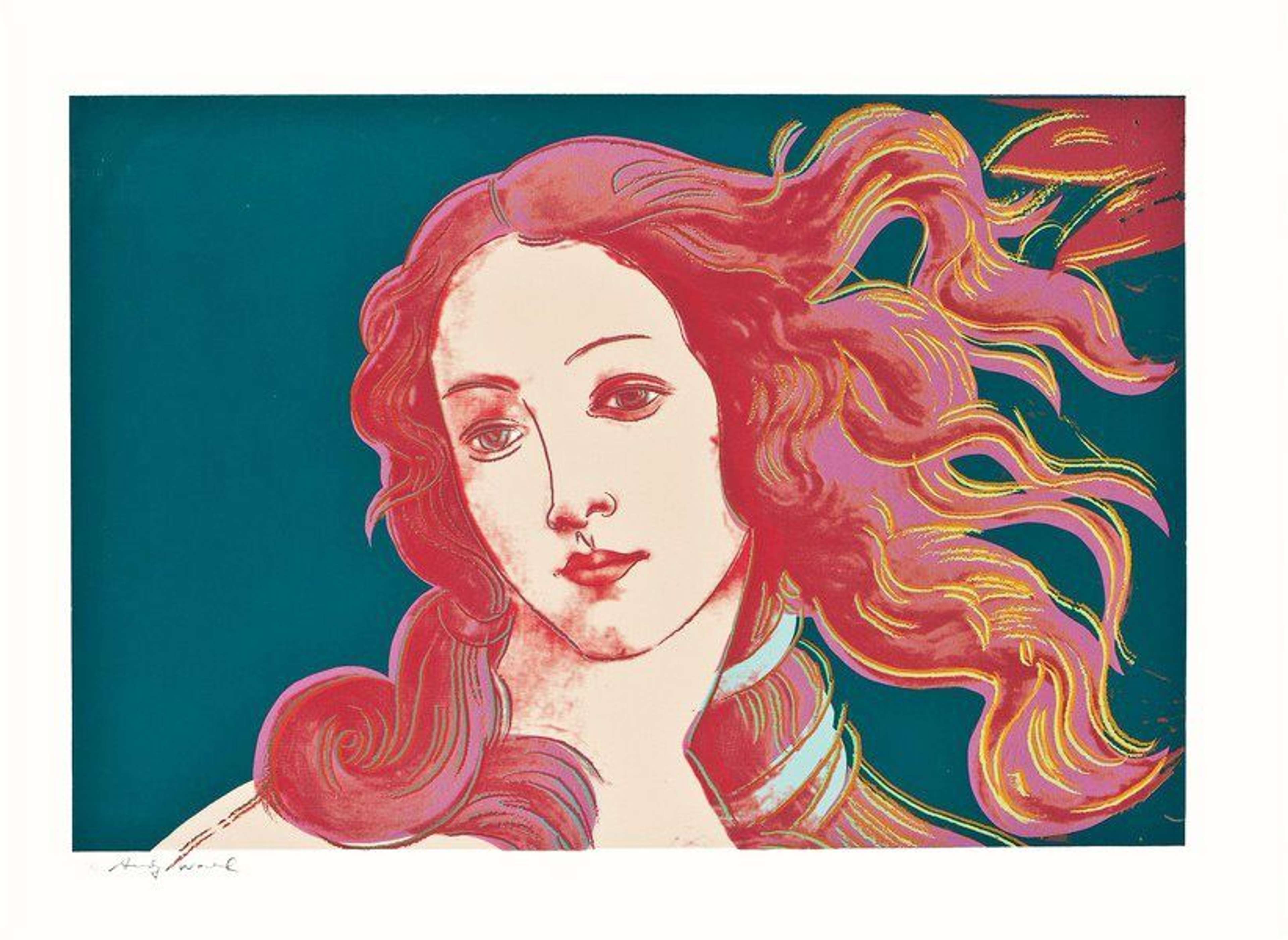

Andy Warhol

The top lot of Sotheby’s sale was Andy Warhol’s Ten Portraits of Jews (complete set), which hit within estimates (with fees) at $312,00–a steal of a price for a full set of artist proofs (AP).

$ (9) (F. & S. II.285-286) was a top performer, exceeding its $150,000 high estimate, closing at $192,000 with fees.

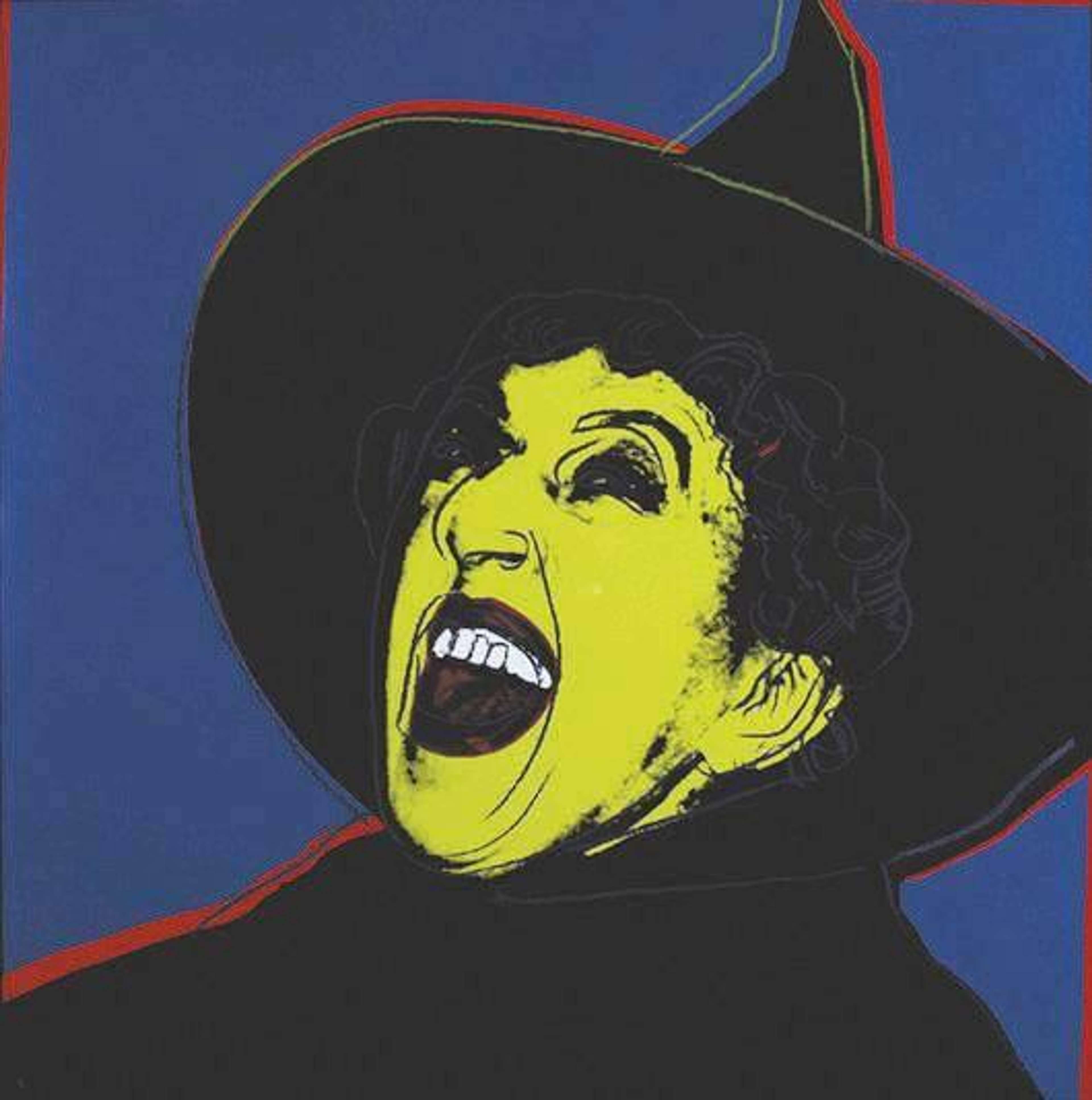

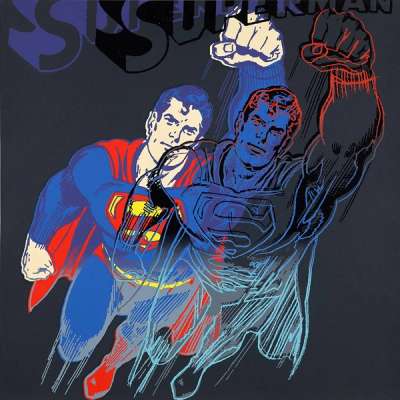

Other Warhol highlights came from Myths, Superman (F. & S. II.260) and The Witch (F. & S. IIB.261), a trial proof (TP), outperformed estimates achieving $228,000 and $66,000 (respectively) marking the second-highest results for these works.

Although no new records were set, two Mick Jagger prints expectedly met expectations: Mick Jagger (F. & S. II.145) selling for $90,000 and Mick Jagger (F. & S. II.146) for $108,000.

Looking To Buy Warhol Prints?

Browse Andy Warhol on the Trading Floor and sign up to MyPortfolio Collection Management.

David Hockney

David Hockney print works set various new records. An Image of Celia, State I from the Moving Focus series achieved a new record, selling for $132,000 in its third-only auction appearance. Wind from The Weather Series set a new record at $31,200, surpassing the previous high of $25,400 achieved in 2023. Another strong result came from Panama Hat On A Chair With A Jacket, which achieved $48,000 against a $30,000 high estimate, also setting a new benchmark for this work.

Looking To Buy Hockney Prints?

Browse David Hockney on the Trading Floor and sign up to MyPortfolio Collection Management.

Ed Ruscha

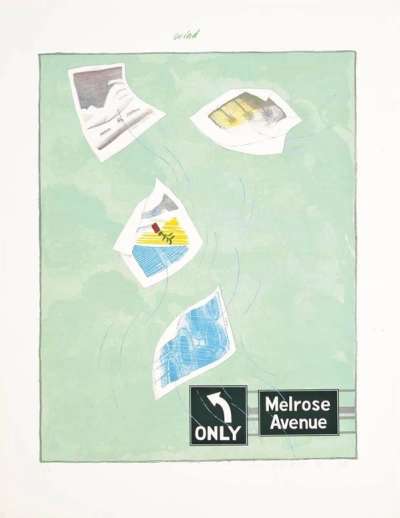

Ed Ruscha's Hollywood continues to draw strong interest, surpassing estimates and achieving a final price of $120,000.

Pablo Picasso

Pablo Picasso achieved impressive results in the sale, with multiple works surpassing expectations. Figure Composée II doubled its $35,000 high estimate to reach $72,000 with fees. Tête de femme achieved commendable success, nearly quadrupling its $12,000 estimate to close at $45,600.

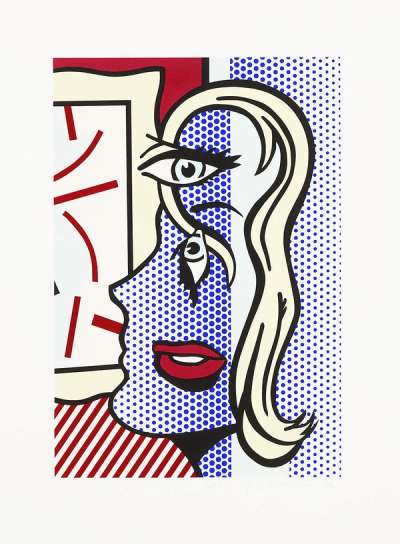

Roy Lichtenstein

Roy Lichtenstein’s Art Critic set a new auction record, reaching $57,600 and surpassing its $35,000 high estimate.

Red Barn, created in 1969, hasn’t made an auction appearance since 2021. This rare work achieved $50,400 with fees–more than doubling its $20,000 high estimate.

The Solomon R. Guggenheim Museum set a new benchmark, also doubling its high estimate to sell for $20,400, showcasing strong demand for Lichtenstein's works across various years or creation and subjects.

Banksy

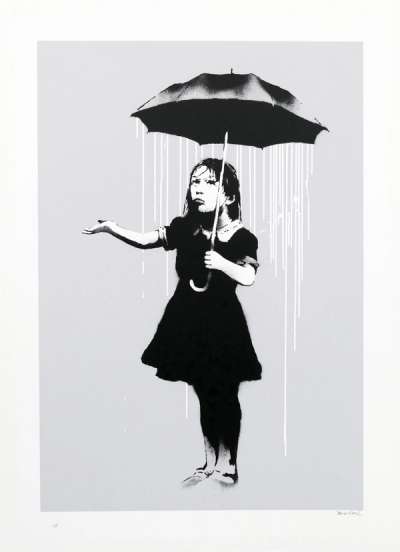

Banksy’s unsigned works are worth mentioning. Morons achieved $33,600 with fees, surpassing its high estimate of $24,000, and Monkey Queen doubled its $12,000 high estimate, selling for $24,000. Both sales highlighting continued interest and market value for unsigned Banksy works.

Looking To Buy Lichtenstein and Banksy Prints?

Browse Roy Lichtenstein and Banksy on the Trading Floor and sign up to MyPortfolio Collection Management.

Jean-Michel Basquiat

Jean-Michel Basquiat’s Thyroid, from his Anatomy Series, was offered without reserve and set against a modest $12,000 high estimate. This rare signed print achieved three times the estimate landing at $33,600, with fees, underscoring the value of scarcity in Basquiat’s market for signed prints.

Frank Stella

Frank Stella’s works met, and exceeded, expectations in this sale through several works. Feneralia achieved $26,400; Moby Dick hit above its $18,000 high estimate, reaching $24,000; The Hyena set a new record at $26,400, surpassing the $15,000 estimate; and Then Came A Fire And Burnt The Stick broke previous records, achieving an impressive $45,600.

These results reflect strong interest in Stella's work and continued upward momentum in his print market.

Looking Ahead

As we look forward, several key shifts in the art market are on the horizon. While major announcements, such as the recent UK budget release, may seem daunting–especially given their potential effects on the art trade in an already slowing market–this is not unexpected news, and it should be seen in context rather than as cause for alarm. This analysis draws on insights from recent, detailed reports by Deloitte and ArtTactic, along with the UBS Art Basel Global Survey, to connect broader market shifts with real-world circumstances that impact the art market alongside others.

Reports like these are important resources that help us navigate the inevitable changes shaping the market landscape. Looking back from October, print sales have performed impressively, showcasing renewed interest in this established medium. There is a continued demand for art, growth in art technology, and the upcoming November auctions signal opportunities ahead. By harnessing these insights and preparing strategically, we can enter the new year with a clear understanding of the trends and factors at play.