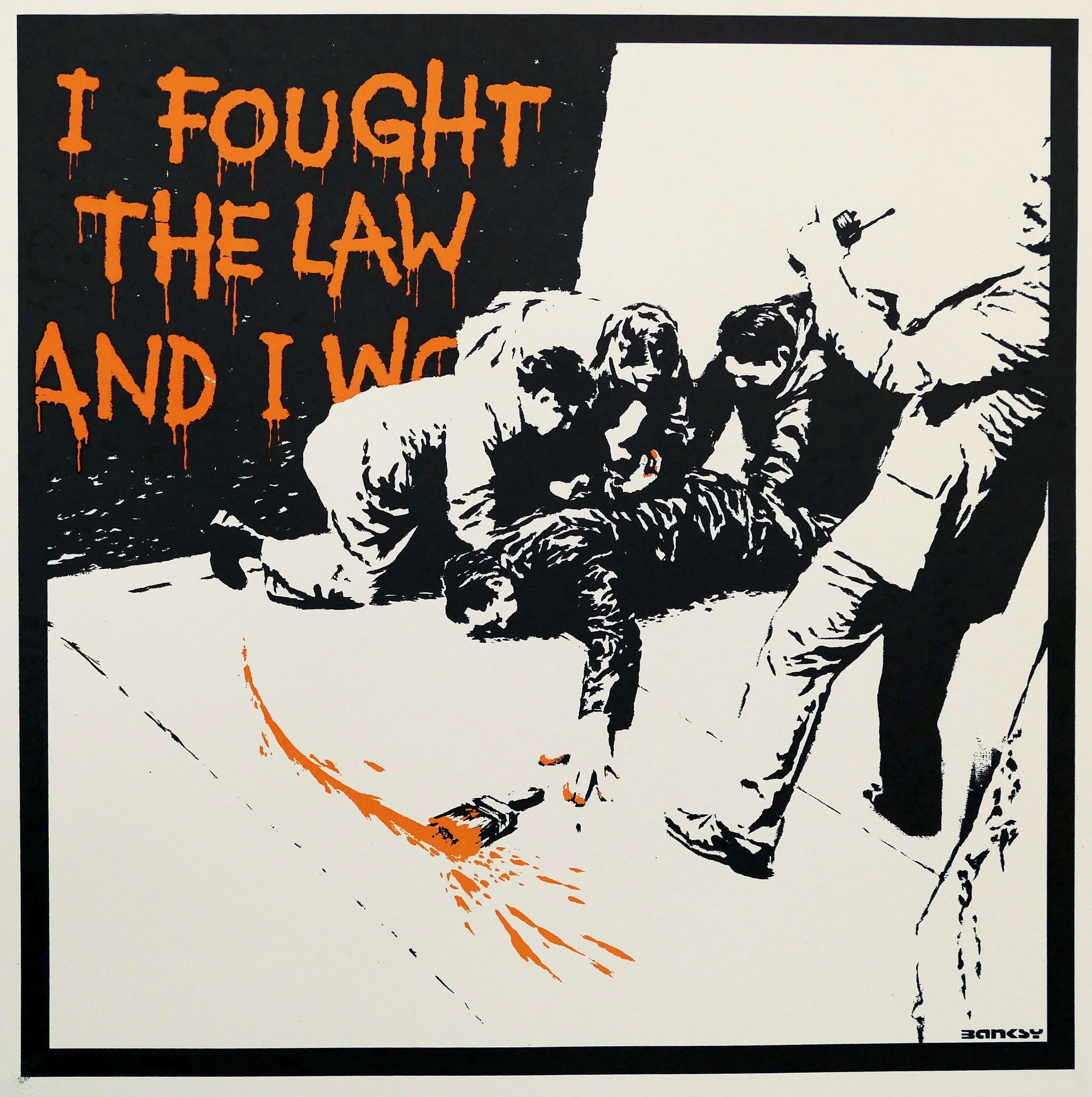

H5-8 Raffles © Damien Hirst 2018

H5-8 Raffles © Damien Hirst 2018Market Reports

The Currency series is Damien Hirst’s first venture into the NFT market, published by HENI Editions in 2021.

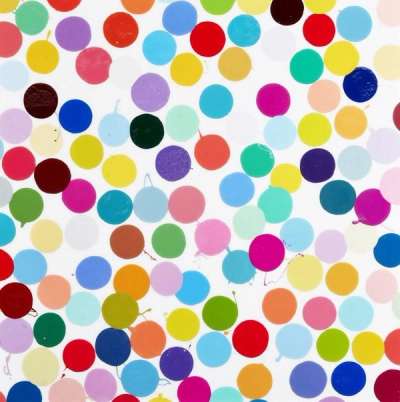

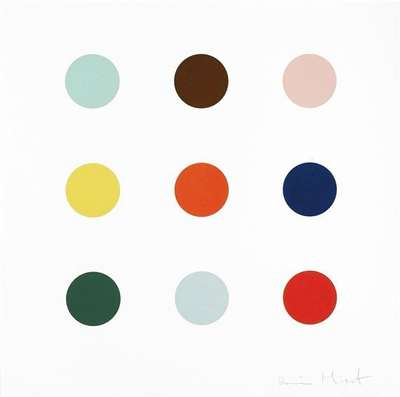

Always one to shock, Hirst’s NFT project throws up questions of value through the subject of art and money. The Currency is made up of 10,000 spot works of paper with corresponding NFTs, where after a period of three years on Wednesday 27th July 2022 the buyers had to choose which they would like to exist, with the other destroyed.

What is an NFT?

Most people have heard about NFTs. The term ‘Non-Fungible’ is so often thrown around without context in the news, the gallery, social media or just in conversation. To avoid delving into an article concerning this phenomenon without any attempt at real definitions, it is worth looking at what these online works really are and why they are so important. Deemed Collins Dictionary’s word of 2021, NFTs - or Non-Fungible Tokens - are essentially unique digital tokens that can be exchanged but not replicated, and while they can in theory be anything, digital artwork has dominated the NFT conversation over the past few years.

Think along the lines of a digital trading card: NFT artworks are images that bear a specific stamp, meaning that while of course they can be screenshot or downloaded, the original can always be identified - in the same way that anyone can own a reproduction of a Picasso print, but only one person actually owns the original. Aside from the bragging rights of owning an NFT, the blockchain technology in which NFT transactions take place means that a record of every purchase is kept - adding a greater level of authenticity to the work and (in theory) making it harder to steal or flip. For many, NFTs are the future of fine art collecting in the 21st Century, yet the debate is still in full swing around their true artistic value and whether they are essentially just pokemon cards for the mega-rich.

Damien Hirst and The Currency

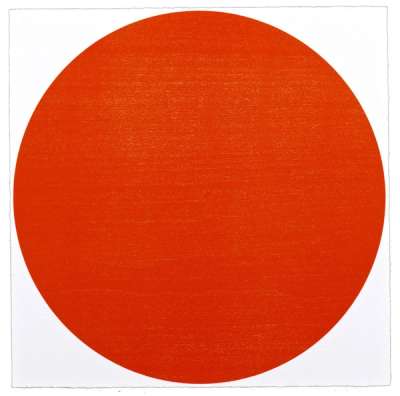

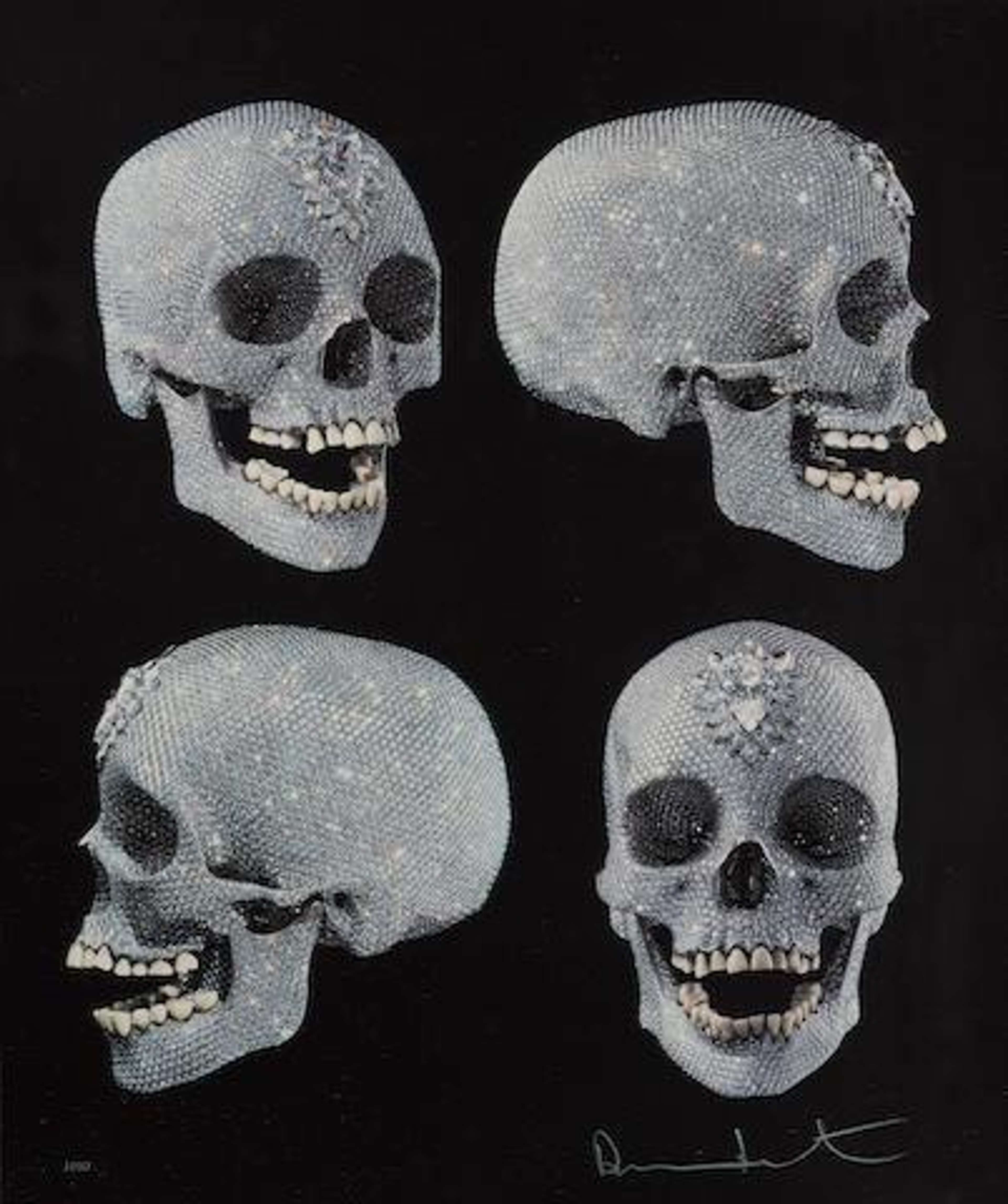

Cue entrance from the king of controversial contemporary art, Damien Hirst. No stranger to creating works that encapsulate the interconnected relationship between currency and physical art - see, for example, For The Love of God, - it is unsurprising that he has thrown himself headfirst into the world of NFTs. His first and most important contribution: The Currency.

Originally conceived in 2016, Hirst created 10,000 individual physical prints for this project, each comprising his signature multi-coloured dots. Published by HENI editions, every print, or Tender, was then made available to buy during the week of July 14th-21st 2021 for $2,000. Each print has its own individual microdot, hologram and watermark of the artist’s head to make it harder to forge, and to directly reference a banknote. During this period, 32,472 people applied for a total of 67,023 NFTs.

Key to this project is that Hirst asks the buyer to decide whether the NFT or physical print has more value. As of August 2022, 4,851 people have decided to keep the NFT version of the print they purchased and 5,149 have traded their digital tokens for the physical artworks, according to HENI.

The sticking point here is that whichever version of The Currency is not chosen is then destroyed - the disposed-of prints in a ceremonial burning. In the wake of the recent NFT market crash, most buyers have opted to keep their physical work of art. Buyers who decided to buy the Tender in the whirlwind of the NFT hype six months ago, have now redeemed their old-school physical print instead.

Hirst has announced that the burning of the over 5,000 physical artworks will take place during an exhibition at Newport Street Gallery in London, also titled 'The Currency', starting in September 2022.

The Currency goes a step further than the typical NFT purchase. It asks the buyer to participate in the project through their decision making. It also forces us to acknowledge the theoretical nature of money itself, its existence as a construct rather than something physical, much like the NFT asks us to consider the constructs of artwork and ownership instead of a work’s physical attributes. The Currency embodies Hirst’s own admission that he has always been fascinated by “the concept of value through money and art.” When interviewed about the project he was quick to state that he has never really understood money and its “ethereal” existence, and thus the creation of physical artworks that can be used in the same way as money is “the most exciting project [he] has worked on so far.”

How much are Damien Hirst NFTs worth?

Every print in The Currency series was $2,000 to purchase when they were first put on the market, published by HENI editions. As of February 2022, the average price of a Tender NFT is approximately $20,900, according to OpenSea, an enormous increase in value.

It is hard not to admire the way Hirst has woven questions of money’s conceptual validity into these projects, particularly when those same questions dominate discussion of NFT artwork more generally. Yet, one mustn’t forget that the artist amassed a cool $22.4 million dollars for The Currency alone, so for a man who ‘doesn’t understand’ money, Hirst has done pretty well for himself.

What Now for Hirst and NFTs?

While The Currency does indeed represent an exciting intervention in the art market, it does still raise some questions—namely, whether NFT creation is the future of Hirst’s practice. A recent report revealed that The Currency NFT collection may not have been entirely created when he claimed. While Hirst said the physical artworks for the collection were completed in 2016, evidence shows at least 1,000 were produced as late as 2019. Despite this, many NFT collectors remain unfazed, viewing the discrepancy as irrelevant to their investment. Some collectors argue that backdating art to its conceptual start date rather than its completion is not unusual in the art world, and they don’t see Hirst’s actions as misleading. This approach, while controversial, aligns with Hirst’s past practice in conceptual art projects, though some believe clearer distinctions between conception and completion dates would be beneficial.

The Currency is not Hirst's only NFT project; The Empresses, a series of kaleidoscopic, deep red prints containing butterflies, was released in January 2022. These five prints were made available in the same way as The Currency, with the buyer offered a choice of a physical or NFT work. Ultimately, we can assume that Hirst will continue to produce NFT works if the market itself continues to move towards digital art collecting—he is not one to create works that are behind the commercial times.

While NFTs are at the forefront of art-world conversations, are works like The Currency actually more 'exciting' than a shark suspended in formaldehyde? Or a real human skull covered with over 8,000 diamonds, for that matter? Surely, once the conceptual novelty of creating a simultaneous digital and physical print has worn off—an inevitability if they are produced en masse by Hirst and others—they may not bear the same in-vogue appeal they currently enjoy. This point is only further exacerbated by the recent NFT market crash of mid-2022, which may deter many contemporary artists from pursuing such creations.

Damien Hirst is an artist who likes to shock and disrupt, so whether NFTs become the norm or not, they certainly won’t define his oeuvre forever. Not only does his financial savviness suggest flexibility, but his desire to stay outside the status quo means he is unlikely to be pinned to any single medium.