Five Key Art Market Predictions In 2025

Silence Equals Death © Keith Haring 1989

Silence Equals Death © Keith Haring 1989Market Reports

The 2020s have taken the art market on a rollercoaster of highs and lows. While the pandemic years sparked innovation in online sales, the post-pandemic period has been shaped by geopolitical unrest, ongoing conflicts, and inflation resulting in a cooling of the market. However, as we approach the midpoint of the decade in 2025, there’s a sense of cautious optimism marked by significant strides in digital innovation and a growing acknowledgment of the value and relevance of emerging mediums within the art market.

I’m thrilled to kick off 2025 the same way I began 2024 - by outlining five key predictions for the print market. Last year, I focused on broad trends, particularly around technology, and I was delighted to see many of these come to fruition. The art world is evolving, and while numbers are important, the meaningful shifts happening across the market deserve far more attention than the usual doomsday narratives.

For 2025, my predictions are more refined and specific, grounded in the extensive market research conducted by MyArtBroker throughout 2024. This year, I’ll focus on the growing influence of emerging art hubs, anticipated record-breaking sales, the future of print fairs, the evolving auction landscape, and, of course, the continued integration of art technology.

Global Sales: Mid-Year Growth and a Record-Breaking Print Sale in Paris or the Middle East

In 2025, global sales in the print market are expected to remain resilient, with a percentage increase reflected in mid-year results. While concerns have been raised about the mid-tier segment - particularly due to anticipated tax policy changes in the USA, which could discourage some buyers in the $100,000 to $1 million (USD) range - we foresee stability. Mid-year analysis over the past two consecutive years has underscored the vital role of works within this price bracket as the foundation of the global market, offering both accessibility and strong investment potential. This stability will be further supported by the continued value appreciation of iconic works by blue chip artists demonstrated in last year's auctions. Additionally, we predict at least one new auction record for a print will be set in either Paris or the Middle East, two regions steadily rising as influential and competitive hubs in the global art market.

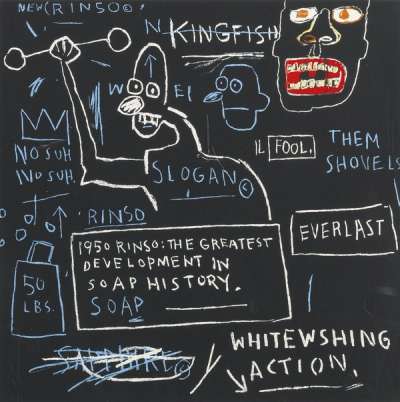

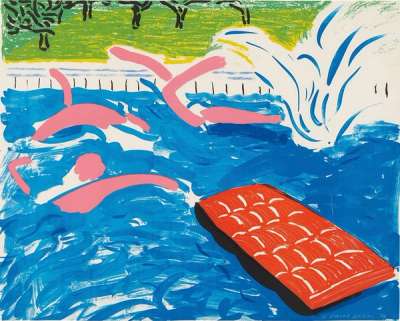

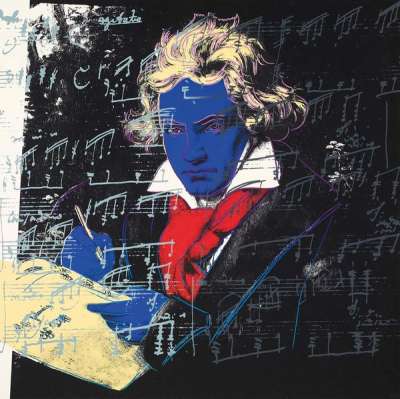

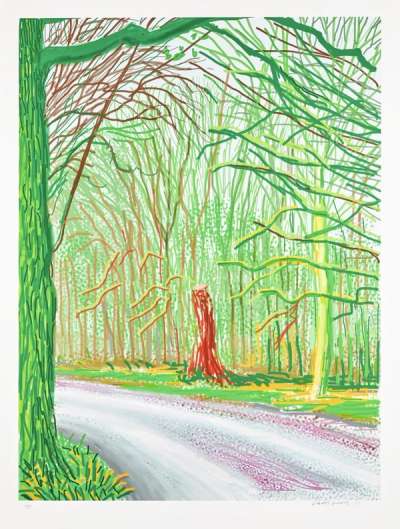

Artist Market: Growing Demand for Complete Sets by Andy Warhol and David Hockney's Arrival of Spring

Andy Warhol and David Hockney remained two of the most compelling blue chip markets to watch in 2024. While certain individual trophy works by Warhol experienced slight corrections, his overall market demonstrated commendable strength, driven by Trial Proofs (TP) and complete sets. Warhol's Endangered Species series stood out, setting a new record in November 2024 with a sale of $4.3 million (USD). The appeal of complete sets lies in their ability to offer collectors a cohesive, culturally significant collection - often at the comparable price points of small-scaled originals. Meanwhile, TPs attract buyers with their unique colour variations and rarity. Beyond Endangered Species, Warhol's Flowers, Marilyn, Ten Portraits of Jews, and Myths series continue to drive market demand. Looking ahead to 2025, we anticipate at least one new auction record for both a TP and a complete set by Warhol.

David Hockney's print market also presented intriguing dynamics. While his market saw a correction in 2024, Hockney's influence remains unparalleled. It can be argued that collectors are holding onto trophy works, awaiting more favourable selling conditions. One of Hockney’s most coveted print collections is his Arrival Of Spring series. These works were scarcer on the market in 2024 compared to previous years, yet they remain highly influential. If a standout piece from this series - featuring the right colour scheme and composition - comes to auction in 2025, we anticipate a record-breaking result for a work from this collection.

Print Fairs: Regional Art Fairs Gain Prominence Over Global Mega-Fairs

Print fairs have long been a cornerstone of the art market, offering not only transactional opportunities but also vibrant cultural experiences and international networking. However, in recent years, major fairs have faced mounting pressures from escalating exhibitor costs, increased competition from regional hubs, and economic challenges exacerbated by Brexit and other tax and broader uncertainties.

One of the earliest indicators of this shift was the cancellation of Masterpiece London in 2023, following a turbulent few years marked by pandemic-related disruptions and declining international participation. Similarly, Frieze London faced significant challenges in 2023, with its presentation overshadowed by geopolitical tensions following the war in Gaza. While Frieze appeared to regain stability in 2024 with a refreshed outlook, its subsequent announcement of being up for sale cast doubts over its long-term sustainability. In contrast, Art Basel Paris remains the exception, showing relative stability and strong market engagement.

Looking ahead to 2025, with impending, and new, election policies in both the US and the UK adding further uncertainty - rising taxes in the US and lingering Brexit-related complications in the UK - major fairs are likely to remain under pressure. In response, we anticipate the rise and expansion of mid-tier fairs, similar to the London Art Fair and Woolwich Contemporary Print Fair. This expansion could come either in the form of entirely new fairs or regional extensions of existing successful models. These mid-tier platforms, with their more flexible structures and localised focus, are well-positioned to capture growth and engagement in these rapidly developing markets and with changing audience preferences and social media culture, we anticipate galleries and the fair structure prioritising immersive experiences to attract younger and tech-savvy audiences.

Print Auctions: Auction Houses to Scale Back on Banksy-Only Sales While Hosting an Andy Warhol-Only Auction

Dedicated print sales function similarly to single-owner auctions, offering a carefully curated narrative around an artist's body of work. These sales are particularly compelling for artists with extensive portfolios, allowing collectors to experience their evolution across decades in a cohesive presentation.

The success of this approach has been exemplified by Phillips, which in 2024 hosted its third annual David Hockney-only sale and its first-ever Damien Hirst-only online sale, both of which were met with solid results.

However, the market for Banksy-only sales tells a different story. With his print market stabilising, appetite for dedicated auctions has begun to wane. In 2025, both Sotheby’s and Forum Auctions are expected to scale back or step away from hosting Banksy-exclusive sales, but conversely, a major auction house - likely Phillips - would be poised to host a landmark Andy Warhol-only print sale. Given the proven demand for Warhol's complete sets, TPs, and culturally significant works, the offering could be a resounding success, setting multiple records and reaffirming Warhol’s dominance in the print market.

Art Tech: Digital Collection Management Systems Become Essential Across the Art Market

Art tech predictions are arguably the most challenging to forecast due to the sector's rapid evolution and growing sophistication. However, one certainty is that the intersection of art and technology will continue to deepen in 2025. This will be particularly evident in the print market, where blockchain technology and AI tools are set to become standard practices. Blockchain will play a crucial role in securing provenance, creating immutable ownership records, and boosting buyer confidence in both public and private transactions. Beyond reducing fraud, these technologies will streamline the buying and selling processes for prints and multiples, making transactions more transparent, efficient, and reliable. We’ll be keeping a close eye on these developments throughout the year.

Simultaneously, AI-powered tools will become more sophisticated, extending beyond valuation algorithms and forgery detection. These tools will provide deeper insights into market trends, real-time pricing data, and predictive analytics, empowering collectors, galleries, and auction houses to make data-driven decisions. Digital art portfolio management systems will also see a widespread adoption among collectors, which reports will show a percentage increase once they become available.

Overall, 2025 will mark a pivotal year where art tech shifts from being an optional enhancement to an essential component of art market infrastructure.