Art Investment, Tax, Inheritance, and Pensions: A Guide

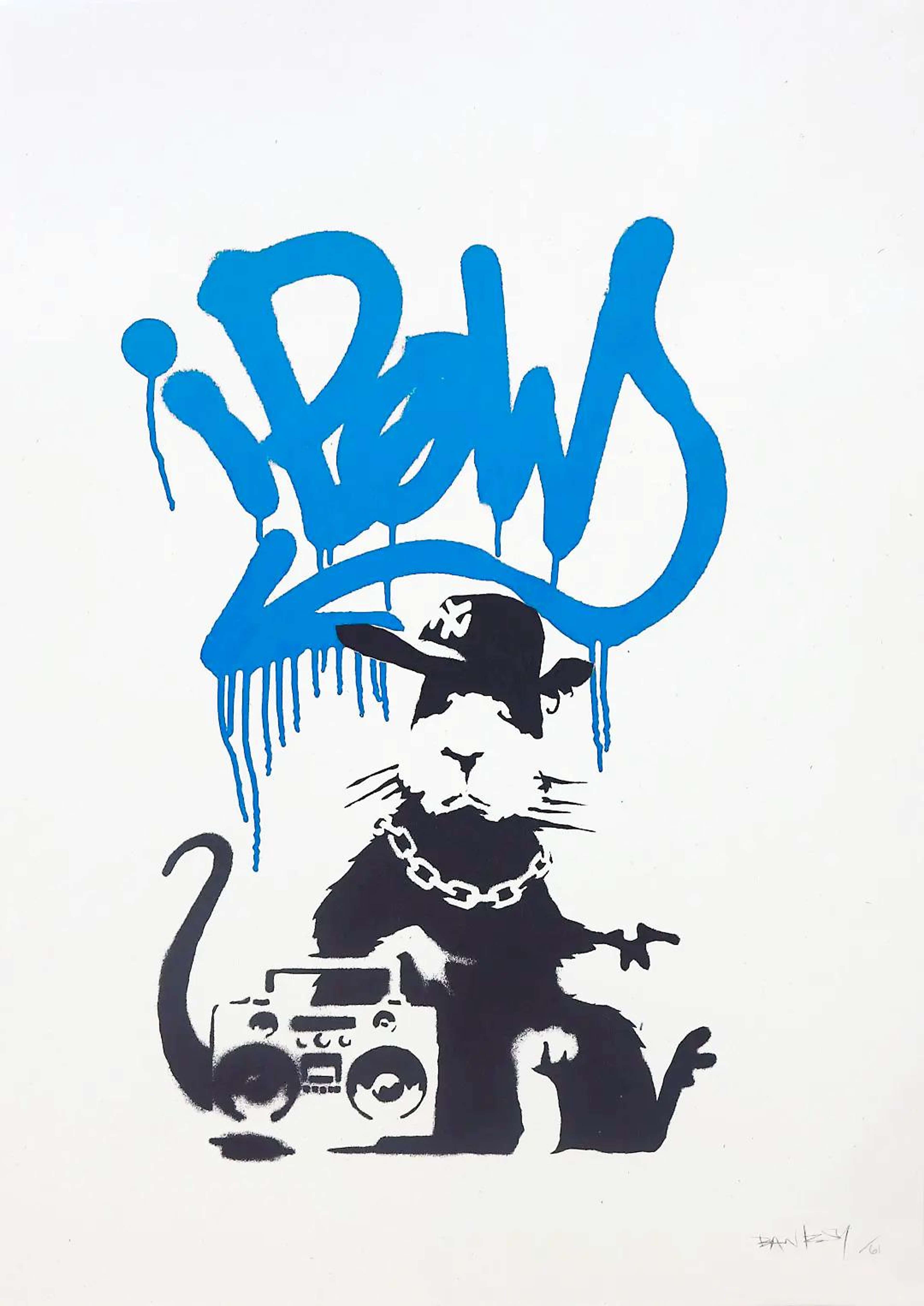

Sale Ends © Banksy 2006

Sale Ends © Banksy 2006Market Reports

In the art investment world, three key words pop up time and time again: tax, inheritance, and pensions. How do you make the right decisions when it comes to art investment and financial planning?

MyArtBroker sat down for a chat with independent financial advisor Adriana Lokman (DipPFS, Cert CII (MP)) from 2plan wealth management Ltd., who took us through the implications of tax, inheritance, and pensions, and what needs to be considered when it comes to investing in art, passing a collection on, and starting your own art collection.

From ‘tax bands’ and ‘thresholds’ to ‘taper relief’ and ‘tangible moveable property’, this is your introductory guide to the relationship between art, investment, tax, inheritance, and pensions.

Art & Tax

What Tax Considerations Should I Make When Amassing A Collection Of High Value Artworks?

Several factors can affect the kind of taxes you are obliged to pay on your artworks - which, in financial and tax terms, are classed as ‘assets’.

What are the key factors? Intention and value.

When you’re deciding whether or not to start a collection of high value artworks, personal motivations should always be at the front of your mind.

When it comes to art and taxation, ‘intention’ is the most important thing to consider.

For example, think about how you would answer the following questions:

Why did you buy it? What purpose does it serve? Are you collecting your artworks for personal use? or as part of a business? Is your artwork for personal pleasure, or did you buy it to make a profit or pass it on to family?

Depending on your answer, you may have to consider Value-Added Tax (VAT), Capital Gains Tax (CGT) , and/or Inheritance Tax (IHT).

What Do These Mean?

- Value-Added Tax (VAT)

VAT is the tax you have to pay when you buy goods or services. There are two rates of VAT: standard rate (20%); reduced rate (5%).

The standard rate applies to most goods and services, whilst the reduced rate must be paid only on some, such as home energy or children’s car seats.

- Capital Gains Tax (CGT)

Capital Gains Tax (or CGT) is a tax on profit. You may have to pay CGT when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value.

Under CGT, it is the gain that is taxed, not the amount you receive from the sale.

Depending on what the asset is, it may be exempt from CGT, fall under your tax free allowance, or be above this allowance. The rate of CGT that you pay depends on your own personal (income) tax rate.

For more information on personal tax rates, take a look at this section of the HMRC website.

- Inheritance Tax (IHT)

Inheritance Tax (or IHT) is a tax on the estate of someone who has died.

After intention, value is the second most important thing to consider.

When it comes to art, the complexity of tax is largely determined by the value of a given artwork, or an art collection as a whole.

It is really important, therefore, to know the value of your artwork at all times.

In this context, ‘value’ is measured according to criteria such as the following:

- The date on which an art was created

- Where the artwork was created

- The media used to create an artwork

- Size

- The price paid for the artwork (its sale price), or its monetary value when gifted

- If it’s original or a copy

- If the artwork belongs to part of a series

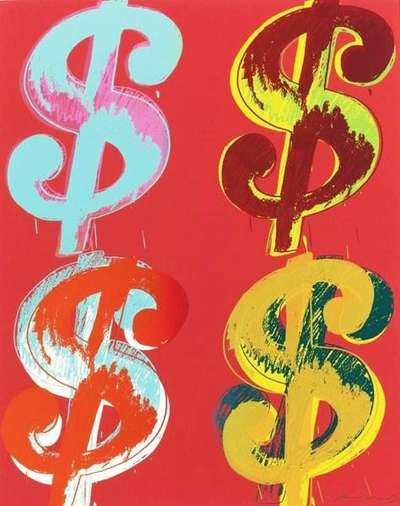

When trying to determine the value of your artwork, however, it is always best to involve experts like that can provide a free valuation service, as well as expert advice on what to consider when investing in and selling art by a particular artist or creator, such as Banksy, Damien Hirst, or Andy Warhol. MyArtBroker can help with this.

Inheritance & Family Investments

What exactly should I consider when it comes to my personal art collection and Inheritance Tax?

Once you’ve determined your personal motivations behind investing in an artwork (or a collection of artworks), and their value, it is important to define your short, medium, and long-term investment strategy.

This should mean looking into the implications that Inheritance Tax - or IHT - may have for your artwork, or art collection. “Make this a priority - don’t kick the can down the road!” advises Lokman.

You might end up having a lot to unravel in the future, so future-proof your estate with an understanding of its potential growth going forward.

If you are looking at keeping an artwork or art collection for your children - i.e. if you have a ‘long-term’ mentality for your asset(s) - it may be worth exploring whether you could set up a limited company, for example. A limited company (LC) is a form of incorporation that limits the amount of liability undertaken by the company's shareholders.

Under the limited company structure, you wouldn’t incur the same inheritance-related taxes as an individual investor.

If you are investing as an individual and not as a company, however, three other factors are very important to consider when it comes to your art collection and inheritance tax. These are:

1. Estate value

2. The IHT threshold

3. Capital Gains Tax and inherited property

On 30th of October, 2024, Chancellor Rachel Reeves introduced the new UK Budget, detailing changes across these key financial areas, which we have outlined below.

Estate Value

Each person has an inheritance tax-free allowance of £325,000. If an estate's value exceeds this amount, only the excess is subject to inheritance tax at a rate of 40%.

The IHT Threshold - are you single, or married/in a civil partnership?

The new UK budget keeps the inheritance tax (IHT) threshold frozen at £325,000, unchanged since 2009, and it will remain so until at least 2030. This means that estates up to £325,000 can be inherited tax-free, with amounts above taxed at 40%. Married couples or civil partners can transfer any unused allowance, doubling their threshold to £650,000.

From April 2027, inherited pension pots will now be subject to IHT, a shift that removes their previous tax-free status. Additionally, starting in April 2026, changes to agricultural and business property relief will allow 100% IHT relief only on the first £1 million in assets. After this limit, a 50% relief rate applies, impacting approximately 2,000 of the wealthiest estates annually. The Office for Budget Responsibility (OBR) expects these reforms to generate an additional £2 billion for public services.

It is also important to be aware that there are in fact two IHT thresholds: one for single persons, and one for married couples and civil partners. For single persons, the income tax threshold remains at the standard £325,000. Currently, UK-based spouses or civil partners can transfer assets between each other without IHT. However, if one partner is non-UK domiciled, transfers above £325,000 are taxed unless they elect to be treated as UK domiciled for IHT. This status lasts until they reside outside the UK for four consecutive tax years.

Starting 6th of April, 2025, the rules will change. Non-UK domiciled spouses can elect to be “long-term residents” for IHT purposes, lasting until they’ve been outside the UK for 10 consecutive tax years. Pre-existing elections stay valid, transitioning to the new rules in 2025.

Capital Gains Tax and Inherited property

The UK’s 2024 Autumn Budget includes significant Capital Gains Tax (CGT) changes impacting the art market. CGT will increase from 10% to 18% for basic-rate taxpayers and from 20% to 24% for higher-rate taxpayers. These changes align CGT on art and other assets with residential property rates. For art investors, this rise in CGT may reduce net returns on sold assets, encouraging more careful timing and tax planning around the sale of valuable collections.

What about gifting art? How does gifting affect CGT and IHT?

All of the above changes when gifting enters the picture.

When it comes to gifting art, there are two rules that you might consider. These are the 7 Year Rule and the 2 Year Rule.

1. Gifting Strategy - The 7 Year Rule

If you gift an artwork to someone, no tax is due on that artwork if you live for 7 years after giving it. Unless that artwork is part of a trust.

A trust allows the managing of assets (be they buildings, land, investments, or simply money) on behalf of others. Trusts will always involve a ‘settlor’ (a person who puts assets into a trust), a ‘trustee’ (the person who manages the trust), and a ‘beneficiary’ (the person who benefits from the trust). When a gift is made using a trust or trusts, it can count as a ‘Chargeable Lifetime Transfer’ - or CLT. [For more information on CLTs, refer to the HMRC Inheritance Tax Manual.]

If you were to die within 7 years of giving a gift, and there’s Inheritance Tax that needs to be paid, then the amount of tax due depends on when you gave the gift.

To work this out, there is a simple rule: gifts given in the 3 years before your death are taxed at 40%; gifts given 3 to 7 years before your death are taxed on a sliding scale called ‘taper relief’.

Taper relief works as follows:

Years between gift and death Rate of tax on the gift

3 to 4 years 32%

4 to 5 years 24%

5 to 6 years 16%

6 to 7 years 8%

7 or more 0%

If you survive over 7 years after you make a gift, this becomes a Potentially Exempt Transfer - or PET. PETs enable an individual to make gifts of unlimited value which will become exempt (i.e. escape tax) if the individual survives for a period of seven years.

If you’re thinking of gifting your artwork or art collection, gift regularly and stay within each threshold. Consider the value of the work(s) and have a strategy in place to make gifts at certain tax year ends.

2. The 2 Year Rule (**For the seasoned investor**)

Whether you choose to go for the ‘2 Year Rule’ or not tends to be dependent on what is called ‘attitude to risk’. This is usually calculated by answering a questionnaire and measured on a 1-10 scale.

If - like some seasoned investors - you are comfortable with risk, you might be able to use schemes such as Business Property Relief (BPR), or the AIM ISA portfolio/2 year ISA wrapper.

Once assets have been held in an AIM Inheritance Tax ISA portfolio for 2 years, they should be zero-rated for inheritance tax. Should a relative inherit the contents of an AIM Inheritance Tax ISA portfolio after your death, in theory, they will not have to pay inheritance tax on its contents.

“Before considering these kinds of options, though, my advice would be to ‘take a step back’.” Says Lokman.

“Have a look at your whole estate, and ask yourself how much of its value would you be comfortable losing - what is your ‘capacity for loss’? Then, make a judgment as to whether an AIM ISA would be right for you.

But - caution! Decisions like this should always be made with the guidance of an experienced and regulated independent financial advisor.”

Art & Pensions

Finally, there’s the issue of art & pensions. Can I buy art with my pension?

Lokman explains: “When answering this question with a client, the first thing I would do would be to talk with them about their retirement plans. I would ask them questions like, What do you think your monthly expenditure is? It’s important to start with the ‘boring’ stuff and to first make sure you have a solid basis for pension, i.e. a personal or work pension, before going on to anything else.

If you are thinking of using your pension to invest in art, there are issues to be aware of.

Firstly, there is no possibility of receiving any tax relief on contributing art into your pension. Artworks fall under the HMRC’s definition of Tangible Moveable Property - i.e. they are an asset of the same type as residential property, classic cars, and gold coins.

As such, they incur a significant tax charge.

In light of this, it is very unlikely that any reputable pension provider would be willing to consider art as a pension investment.

When dealing with art, it is important to remember that it is an ‘illiquid’ asset. ‘Illiquid’ refers to the state of an asset that cannot easily and readily be sold or exchanged for cash without a substantial loss in value.”

Simply put: art ‘comes and goes’. With art, you can’t get all the benefits that come from contributing cash into a pension fund, as it cannot be exchanged quickly and its value is likely to fluctuate.

For those that already have a strong pension, art could be a ‘plan B’. But in tax terms, selling art could be seen as either an income and/or disposal of an asset - so make sure you’re clued up about income tax and CGT.

Could your art collection factor into your pension planning?

When it comes to art and your pension, it is best to adopt a different asset strategy.

Rather than using your pension to buy artworks - or using art as your pension - it is a much better idea to factor artworks into your prior retirement planning.

Another good thing to do is decide which of your assets fit in with your ‘short’, ‘medium’, and ‘long’ term plans, and ‘tag’ them as such.

Art would be a ‘plan B’ or ‘plan C’ based on current trends and how quickly you need a return on your investment - i.e. not a ‘long term’ pension investment - so be sure that you are not relying on it as the only source of your pension.

Lokman advises: “Consider the different asset classes at your disposal. Ask yourself: How much do I have in cash? Bonds? Property? Alternative investments? Don’t put all your eggs in one basket!”

So, to sum up, what are the most important things to remember when considering investing in art, or starting an art collection?

When considering starting an art collection or investing in art, it is prudent to follow three steps:

1. First, speak to an art specialist, like MyArtBroker, to get an understanding of the art market. Gather short, medium, and long-term views of the sector.

2. Second. Sit down with a regulated financial advisor and discuss your plans. They will have knowledge of all the important considerations to make. It’s important to have a holistic plan for intergenerational wealth, as well as an overview of your whole estate.

3. Lastly, speak to an accountant. They would be able to help you set up a limited company structure as part of your long-term investment strategy, if that were the direction you planned to go down, for example.’

[**Although the information contained in this article is up-to-date as of June 2022, it is important to note that it is liable to change at any time. Before making any investment decisions, always check the guidelines set out on the HM Revenue and Customs website, and be sure to enlist the help of a regulated financial advisor.]

Interview between MyArtBroker and Adriana Lokman:

Adriana Lokman DipPFS, Cert CII (MP)

Independent Financial Adviser

Tel: 07940 559633

Email: adriana.lokman@2plan.com

2plan wealth management Ltd is authorised and regulated by the Financial Conduct Authority. It is entered on the FCA register (www.fca.org.uk ) under reference 461598. Registered office: 2plan wealth management Ltd, 3rd Floor, Bridgewater Place, Water Lane, Leeds, LS11 5BZ.

Registered in England Number: 05998270]