Art News: From The Art Market People 2nd - 8th September 2024

Details Of Renaissance Paintings (Sandro Botticelli, Birth Of Venus, 1482) (F. & S. II.316) © Andy Warhol 1984

Details Of Renaissance Paintings (Sandro Botticelli, Birth Of Venus, 1482) (F. & S. II.316) © Andy Warhol 1984Market Reports

As the global art market rears its lulling head after the summer season, familiar rhythms begin to reassert themselves: the auction house calendar gears up, international art fairs open their doors, and the world’s collectors and dealers swing back into action. Yet, this year, the landscape feels notably different. Auction houses, traditionally regarded as the barometers of the wider market’s health, are reporting sharp declines in earnings for the first half of 2024, while the energy surrounding once-thriving art fairs seems to be dwindling.

At the heart of this shift is a fundamental questioning of the art world’s traditional pillars. Several sources this week have probed at the long-held notion of ‘connoisseurship’ - the expert judgement in matters of taste - which is increasingly falling out of fashion. As these dynamics evolve, the fall season offers a crucial moment to assess: is tradition still relevant and needed, or are we entering a new era where access to information and a more democratic approach to the arts simply holds more sway?

The Unsustainable Circus of Art Fairs Continues: The Armory Show in New York & Frieze Seoul

The calendar of international art fairs has been a ceremonial, rather than essential, fixture of the art world for some time now. Once dynamic platforms which brought together gallerists, dealers, and collectors, fairs such as The Armory Show and Frieze are now grappling with an identity crisis. The 30th edition of The Armory Show, featuring 235 exhibitors from 30 countries, struggled to reignite its original fervour. Despite efforts to attract collectors from neighbouring cities and employing guest curators, the fair’s significance feels increasingly more about maintaining tradition than necessity.

Frieze Seoul echoes this dynamic, buzzing with institutional presence but underwhelming in terms of sales. While nearly 120 galleries participated, the reported slow pace of sales highlighted a broader market trend: with dealers noting a decline in market trust and demand for contemporary art, compared to the rapid sales of previous years. Economic uncertainty and shifting priorities have cooled the once-frenzied art fair scene. Considering the huge cost to galleries participating in these fairs, let alone the sheer environmental unsustainability of shipping works across the globe for the sake of keeping up appearances, you really do begin to wonder - what’s the point of it all?

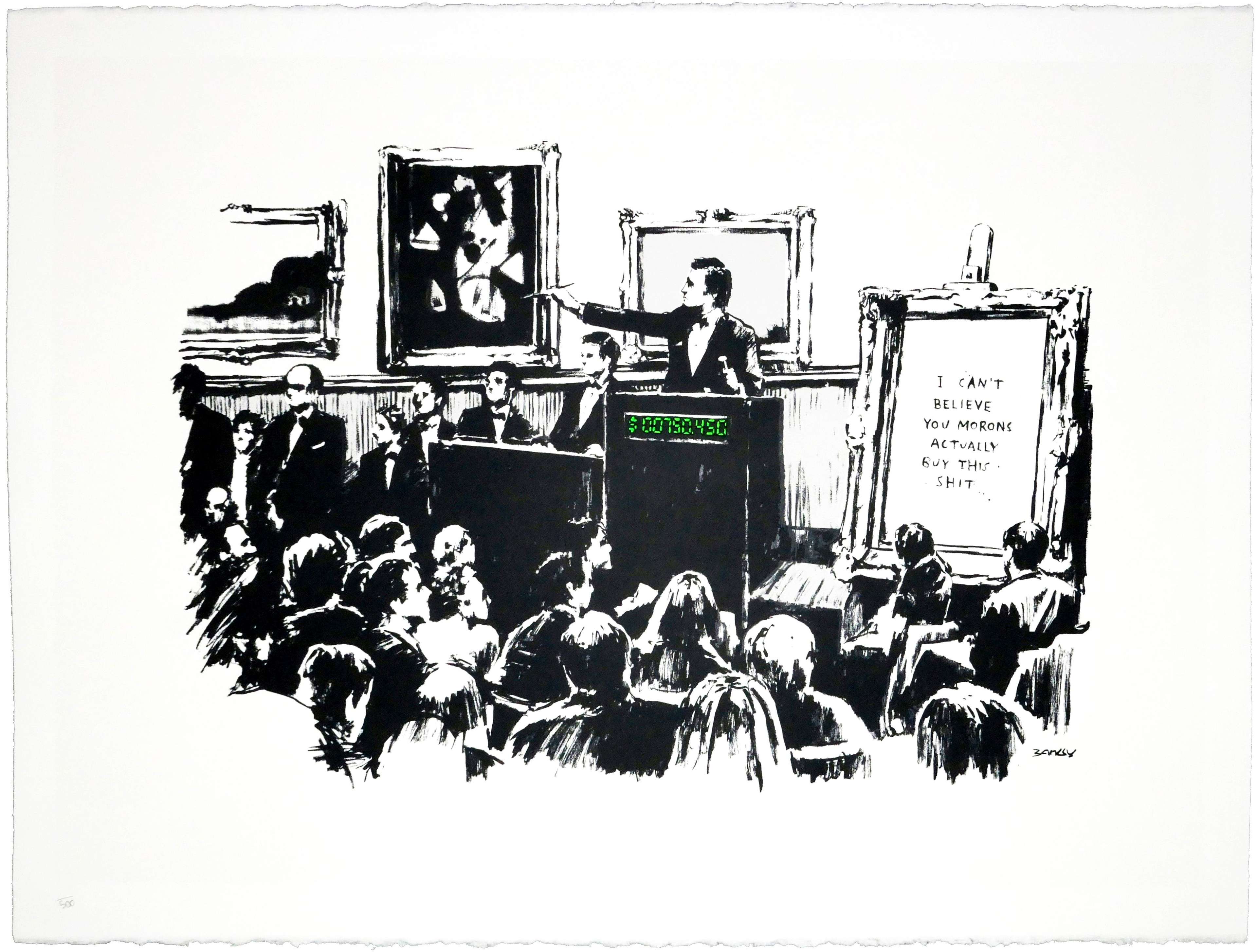

Auction Houses Record Tanking Numbers in the First Half of 2024

It comes as a shock to no one that the first half of 2024 has been a sobering period for the auction houses that traditionally dominate the high-end of the art market. Sotheby’s reported a staggering 88% decline in core earnings, alongside a 25% drop in auction sales, a significant contraction that casts a shadow over the resilience of the auction model. A financial lifeline in the form of a $1 billion investment from Abu Dhabi’s sovereign wealth fund (ADQ) has been a necessary move to help the auction house manage its debt. However, the stark decline in earnings before this suggests deep challenges are being faced by the luxury market monolith.

Christie’s, while not as severely impacted, also recorded a 22% year-on-year drop in auction revenue. Despite this, the house maintained strong performance metrics, with an 87% sell-through rate and a steady hammer price to low estimate ratio. While the top end of the market is facing headwinds, the demand for quality works remains, albeit at lower levels. Both Sotheby’s and Christie’s have felt the brunt of reduced spending from buyers in Asia, traditionally one of their strongest regions. While there is no doubt that these declines speak to broader market instability, with high interest rates and political uncertainties cooling the once-frantic pace of art sales, there are simply better deals to be made privately.

Art World Connoisseurs: Outdated Definers of ‘Good Taste’?

The notion of ‘connoisseurship’ has also been dissected this week in the Financial Times and The Art Newspaper. I myself have always taken an issue with the idea of ‘taste’ and, more importantly, who gets to define it. The very concept of connoisseurship - where a select few with supposed superior knowledge dictate what is valuable or worthy of our attention - feels elitist and exclusionary. Historically, connoisseurs were the gatekeepers of the art world, using their expertise to determine what was worth collecting and defining the ‘great’ artists of their time. While this reflected a particular way of valuing art at the time, one tied to cultural prestige and status, such judgments are plainly out of place in today’s market. With investment potential one of the key motivations for serious collectors, we have outgrown the idea that only a privileged few can truly appreciate and define quality.

As we move through H2 2024, the art world finds itself at a crossroads. In this changing landscape, the need for tradition - whether that comes in the form of connoisseurship or long-established market models - is diminishing. The art world is evolving, moving towards a space where access to information and financial pragmatism far outweigh the subjective judgments of a select few. Transparency and a more inclusive approach now hold greater value than the old gatekeepers. Simply put, tradition is no longer the bedrock of the art market.