The Art Market Is More Regulated Than You Think

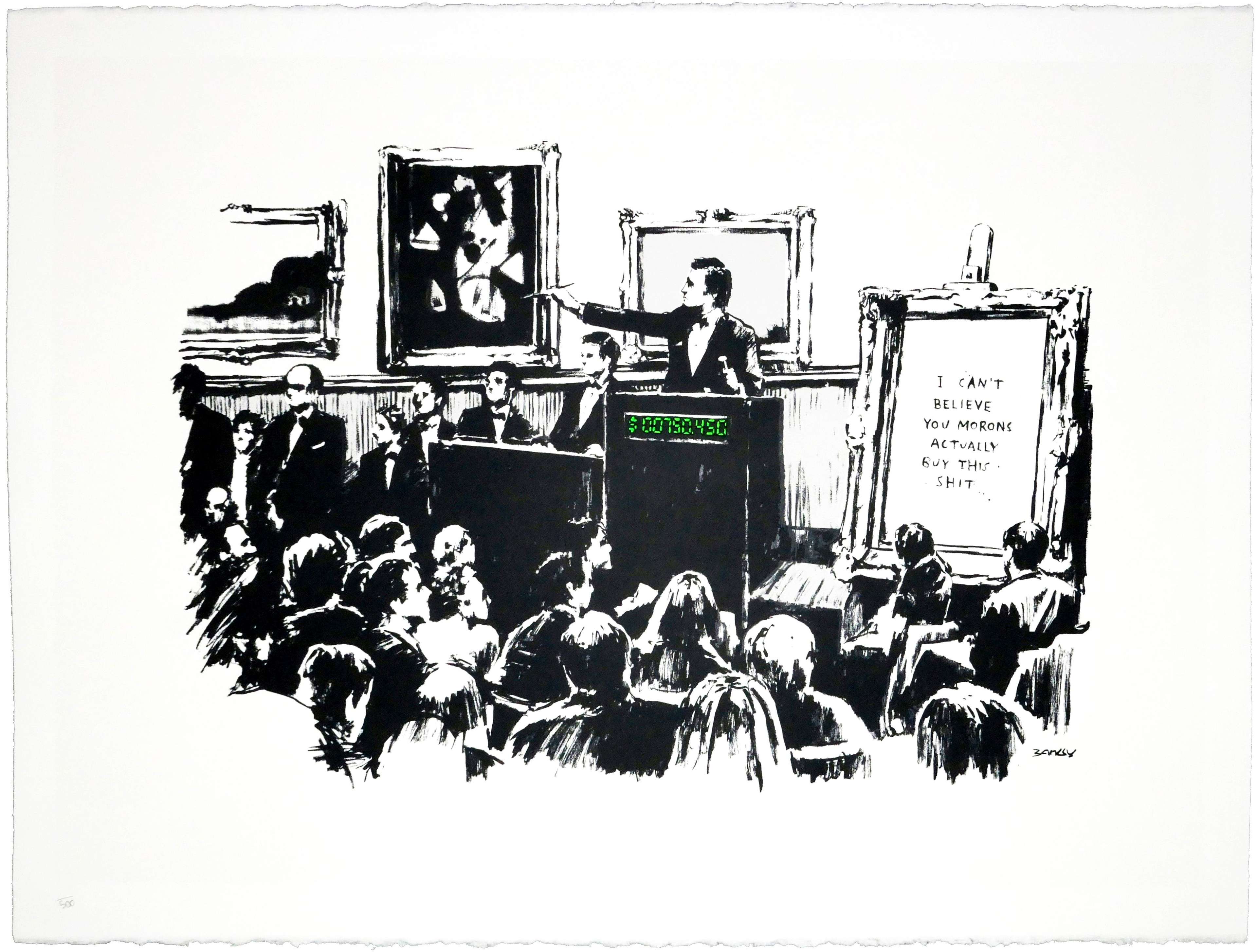

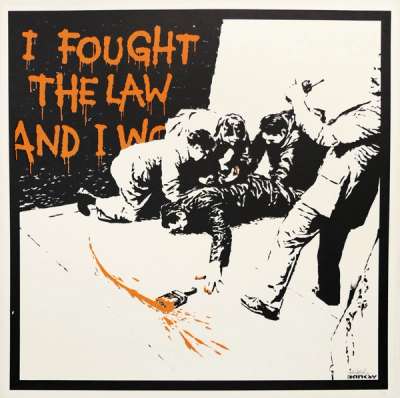

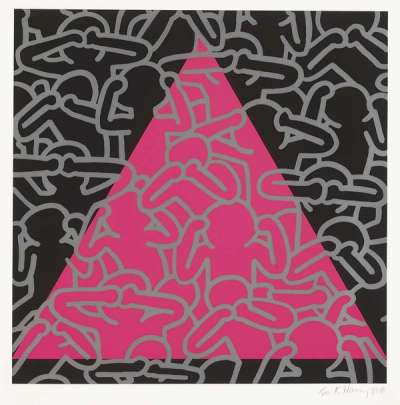

I Fought The Law © Banksy 2004

I Fought The Law © Banksy 2004Market Reports

The notion that the art market operates in a legal vacuum is outdated. While it remains less regulated than traditional financial markets, significant changes in international law have brought greater transparency to high-value transactions. “The art market is claimed by everyone to be this unregulated Wild West - it's not,” said Simon Chadwick, Partner at Mishcon Private Client Department. In recent years, compliance measures have strengthened, protecting both buyers and sellers from legal and financial risks.

Art Prints As An Asset Class: Why You Should Consider Adding Prints To Your Investment PortfolioThe Myth of the Unregulated Art Market

In recent years, increasing scrutiny, new regulations, and legal frameworks have transformed the way art transactions occur. With stricter compliance requirements now in place, collectors must be aware of their responsibilities and protections when entering the market. While risks still exist, understanding the evolving legal landscape can help buyers make informed decisions and safeguard their investments.

Like other areas of the wider art market, high-value prints and editions are increasingly subject to regulatory scrutiny, with buyers and sellers required to adhere to compliance measures that protect against fraud, forgery, and financial crime. “There is a lot of legislation that actually regulates the art market,” Chadwick added, highlighting that legal safeguards exist at multiple levels to ensure greater transparency.

Anti-Money Laundering (AML) Regulations & Buyer Verification

Since 2020, new Anti-Money Laundering (AML) regulations have reshaped art transactions, particularly in the UK and EU. Dealers, galleries, and auction houses are now required to verify buyer identities for transactions above a certain threshold to prevent illicit financial activities. AML regulations aim to curb money laundering by requiring entities in the art trade to conduct due diligence on clients, report suspicious transactions, and maintain clear transactional records. In practice, this means that galleries, auction houses, and dealers must identify the source of funds for high-value purchases, verify client identities through official documents, and flag any unusual payment patterns. For example, a sudden large cash transaction from an unknown buyer may trigger a review and require further documentation before the sale can proceed. These measures align the art world with broader financial regulations, ensuring that artworks, including prints and multiples, are not exploited as vehicles for money laundering. Failure to comply with AML rules can result in severe legal and financial penalties for dealers and auction houses.

How Buyer Verification Works

Collectors should expect to undergo ‘Know Your Customer’ (KYC) checks when acquiring high-value artworks. KYC is a standard process in regulated industries that requires buyers to verify their identity, source of funds, and past transactional history to prevent financial crime. These checks help ensure that art transactions do not facilitate money laundering, fraud, or other illicit activities. “All of our users have to provide KYC documents as well, so we’re really making sure not only in the purchasing process but also by the payouts of money that these people are complying with KYC standards,” said Anna Oerter, Collectibles Manager at Timeless Investments. The process can include providing proof of identity, proof of address, and documentation showing the legitimacy of funds used for the transaction.

While these procedures may feel intrusive, they are designed to protect collectors from unknowingly participating in fraudulent schemes. Verification also helps maintain the integrity of the art market by ensuring that transactions are conducted with legitimate financial sources.

Authenticity & Due Diligence: How the Law Protects Buyers

Authentication is a major concern in the print market, where the risk of forgery is heightened due to the reproducible nature of prints. Buyers must be vigilant and demand thorough documentation before committing to a purchase. “Ask questions, ask questions of the person you're buying from - where have they got it from? Who's had it before? Where has it passed through?” advised Chadwick.

COAs & Provenance – Are They Legally Binding?

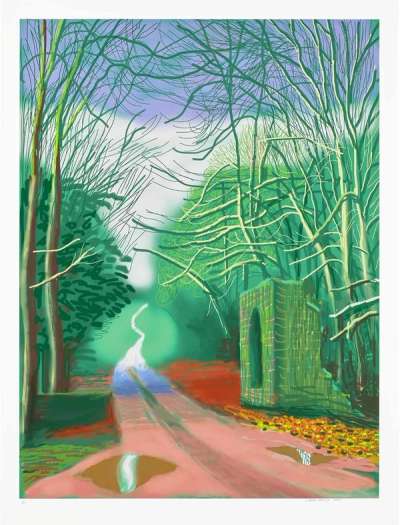

Certificates of Authenticity (COAs) are often assumed to be ironclad proof of legitimacy, but their reliability varies. “The authenticity guarantee will only be viable if it’s not a case of one scholar at one point saying the print was by Hockney and then suddenly the point of view is changed,” noted Chadwick. Instead, buyers should examine past auction records, provenance history, and additional documentation to verify authenticity before purchasing.

What About Fractional Ownership & Art Funds?

Fractional ownership platforms have introduced new ways for investors to access the art market. However, they also carry potential risks, such as liquidity concerns, since reselling fractional shares may be more challenging than selling a whole artwork. Investors should also be wary of high management fees and varying exit strategies that can impact profitability. Understanding the platform’s regulations and past performance is crucial before committing to fractional investments. These platforms, where multiple investors own shares in an artwork, have gained popularity, but they come with unique regulatory considerations. "As a platform, we don’t give investment advice - all we do is provide the information to the best of our knowledge," explained Oerter.

Collectors interested in fractional ownership should check that platforms are financially regulated and transparent about their investment structure. These models can offer a way to diversify a portfolio with lower upfront costs, but investors should be aware that liquidity and returns may vary depending on market trends and platform policies.

Are Auction Houses & Dealers Liable for Fakes?

If a collector unknowingly buys a fake or misattributed print, determining liability can be complex. “The terms and conditions of auctions generally provide an authenticity guarantee, but scholarly opinion can change,” said Chadwick.

Private sales require even greater due diligence, as legal recourse may be limited. Buyers should work with reputable dealers and auction houses that offer clear authenticity guarantees and documented past sales data.

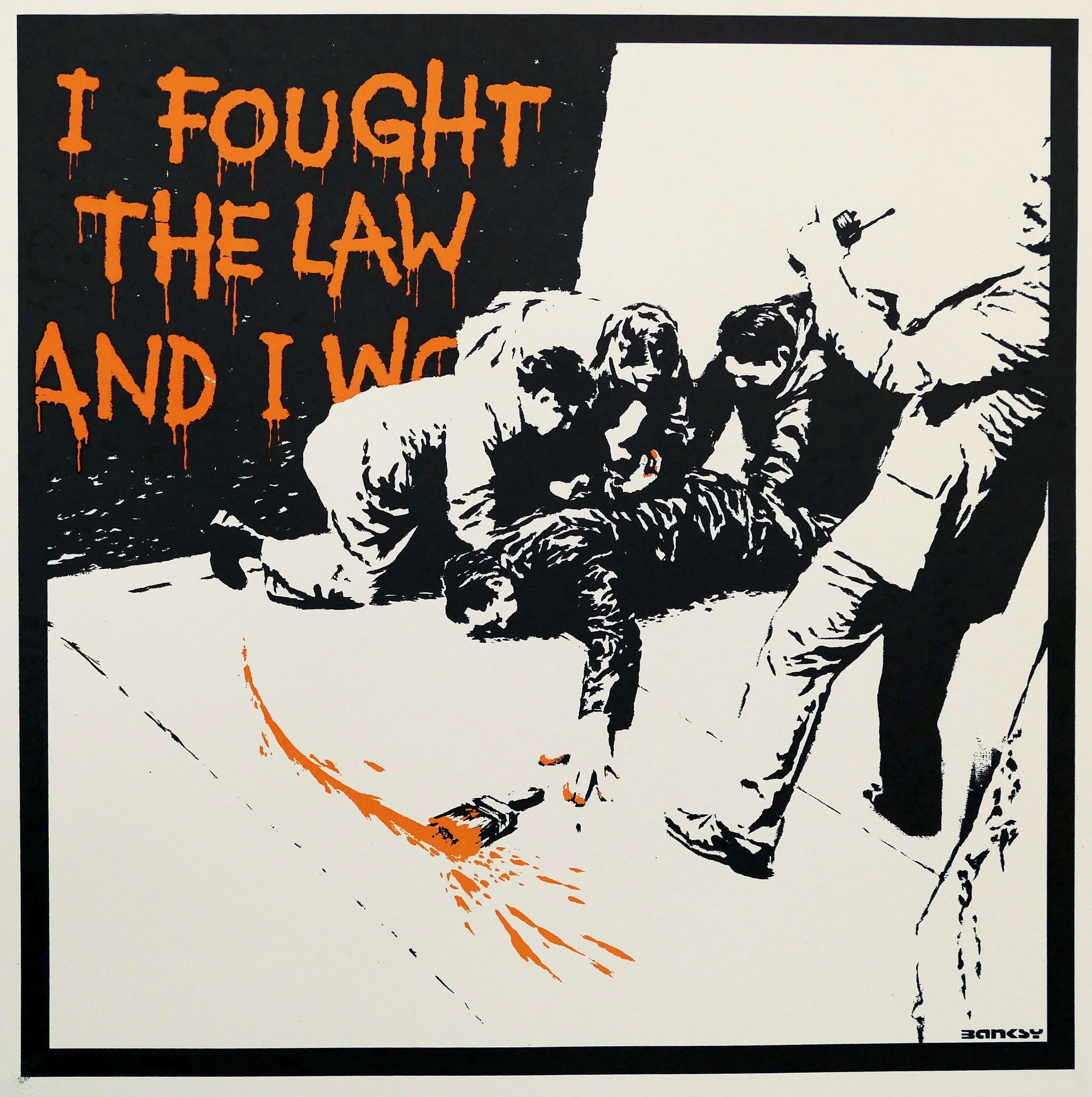

The Biggest Risks Collectors Still Face

Despite stronger regulations, collectors still encounter risks, from undisclosed condition issues to misleading COAs. Many prints, especially those that have changed hands multiple times, may have unseen damage or restoration that isn't immediately obvious. “At any price point, you want to know what the back of the print looks like - condition is a massive driver,” said Jasper Tordoff, Banksy and Modern British Specialist at MyArtBroker. Examining framing, paper quality, and any potential fading can be crucial steps in assessing a print's true market value. Transparency from sellers and access to past condition reports can help buyers avoid costly surprises.

Market Manipulation & Artificial Pricing

Some sellers manipulate pricing by making multiple purchases at auction or through controlled private sales, creating an illusion of demand and higher value. “You’ve had cases where galleries are buying their own artworks to show inflated returns and entice new buyers,” noted Chadwick. This practice, sometimes referred to as ‘wash trading,’ artificially boosts prices and can mislead collectors into overpaying. Collectors should be cautious when evaluating market trends, cross-checking auction results, and seeking independent valuations to avoid falling for artificially inflated valuations. Transparency from sellers and independent verification are key to navigating these market distortions.

Misleading ‘Limited Editions’

Not all ‘limited editions’ are truly limited. Some prints marketed as exclusive may have open-ended editions or secondary runs. "Timed releases become very, very large, marketed far and wide on social media, and eventually flood the market," said Tordoff. Collectors should verify edition sizes and publishing details before making a purchase. This can be done by checking official catalogue raisonnés, consulting auction house records, or reviewing information provided by reputable dealers and galleries. Additionally, collectors should confirm whether the artist or publisher has ever produced additional editions, as this could impact the work’s value over time.

How to Stay Protected When Buying Prints & Editions

To safeguard investments, collectors should:

- Work with reputable sellers and platforms.

- Verify provenance and track past auction results.

- Understand their legal rights and potential recourse.

- Conduct thorough due diligence, including obtaining condition reports from reputable sources such as auction houses, galleries, or independent conservators. Expert verification should involve consulting specialists in the artist’s work or printmaking techniques to confirm authenticity and quality.

- Be aware of the risks of misleading marketing and artificial price manipulation.