Art and Asset Management

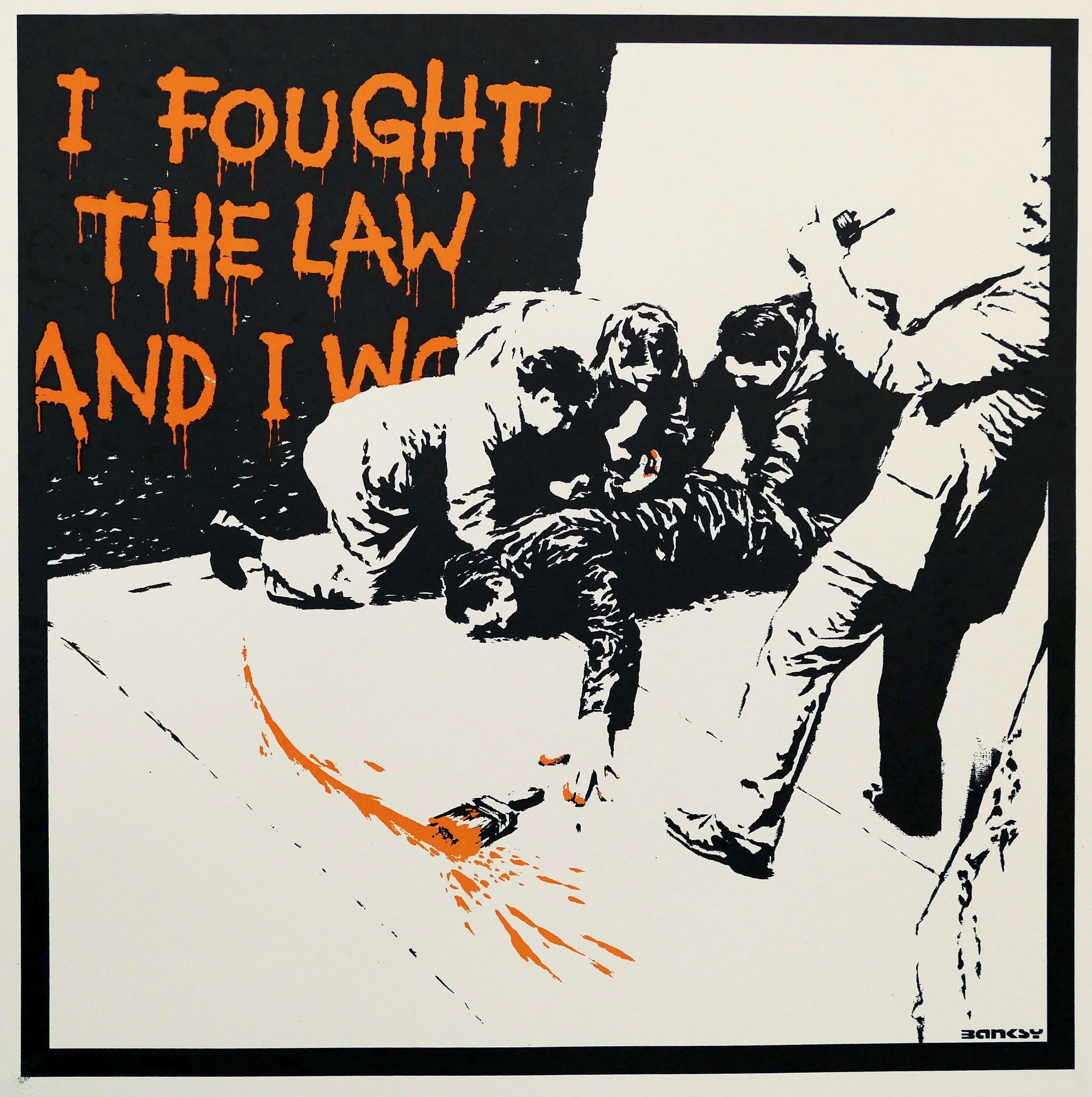

Red Flowers And Green Leaves, Separate, May 1988 © David Hockney 1988

Red Flowers And Green Leaves, Separate, May 1988 © David Hockney 1988Market Reports

Key Takeaways

Overstone, led by Harco van den Oever, is pioneering the transformation of art into a structured asset class using data science and financial tools. The company addresses the opacity in the art market by combining advanced algorithms with expert insights to assess the liquidity and value of art as collateral. Overstone's innovative approach has attracted institutional clients, such as private banks and insurers, enabling art to be leveraged with confidence and reduced risk. As the market grows, new financial tools like art-backed bonds and credit default swaps are set to expand art’s role as a financial asset. Van den Oever predicts that art leveraged as collateral could rise from 3% to 10% or more. By integrating data analytics with traditional valuation methods, Overstone is bridging the gap between art and finance, reshaping the art market, and supporting the development of a more sophisticated financial ecosystem.

In the ever-evolving landscape of the art market, the concept of art as an asset class is often met with skepticism by traditional art enthusiasts. We sat down with Harco van den Oever, CEO of Overstone to discuss the area that is at the very center of their mission. Here’s what we learnt:

The reluctance stems from the fear that viewing art through a financial lens may diminish its intrinsic cultural and emotional value. However, as the market becomes increasingly sophisticated, there’s a growing need for a structured approach to art valuation, lending, and insurance. This is where Overstone, led by founder and CEO Harco van den Oever, comes in.

Van den Oever sheds light on Overstone’s innovative approach to transforming art into a more structured and viable asset class through the use of advanced data science and financial tools. From his background as an investment banker to his tenure at Christie's, van den Oever has carved a unique niche, bridging the gap between the financial and art worlds.

Here’s a glimpse into our conversation, where we discuss the inception of Overstone, the challenges faced in the art finance market, and the future of art as a collateral asset.

Watch the complete podcast here:

The Birth of Overstone

Overstone was conceived from van den Oever’s frustration with the lack of financial sophistication in the art market during his time at Christie’s. Recognising the need for a structured approach to assessing art as collateral, van den Oever left Christie’s to establish Overstone. His goal was clear: to introduce structure and transparency to an otherwise opaque market.

“At Overstone, our mission is to provide the tools and data needed to enable institutional participation in the art market,” van den Oever explains. The company's innovative use of data analytics allows for a more nuanced understanding of art as a financial asset, bridging the gap between traditional art valuation and modern financial practices.

Navigating the Complexities of Art Valuation

One of the most significant challenges in the art market is its inherent unpredictability. Unlike other asset classes such as real estate or even luxury cars, art values can fluctuate dramatically based on a multitude of factors, including artist popularity, provenance, and market trends. Much like MyArtBroker, van den Oever believes that “the truth and efficiency in art valuation lies somewhere between human expertise and data-driven analysis”.

Overstone employs a combination of advanced algorithms and expert insights to assess the liquidity and value of artworks. Their focus is on understanding the depth of the market for specific pieces and providing a probability assessment of whether an artwork will sell at a particular price. This hybrid approach allows Overstone to cater to the needs of both traditional collectors and financial institutions looking to leverage art as collateral.

In parallel, MyArtBroker’s algorithm for prints leverages a comprehensive array of data points, far beyond traditional auction results, to produce a precise valuation of artworks. By acting as a market maker and bridging the gap between buyers and sellers, the algorithm aims to dispel the opacity that has long plagued the art market, offering a data-driven approach that empowers collectors and transforms the way art is bought and sold.

Transforming the Art Finance Market

Overstone’s data-driven approach has been instrumental in attracting institutional clients, particularly banks and insurers. “When we started, the average lot value of collateral we dealt with was around a million dollars,” van den Oever shares. Today, Overstone’s client base includes some of the largest global private banks, enabling them to lend against art with more confidence and less risk.

For insurers, Overstone offers a way to navigate the complexities of valuing high-value collections accurately. “When you’re insuring a collection worth half a billion dollars, even a 10 percent change in value is a significant number,” he explains. The company’s regulatory framework, including oversight from the Financial Conduct Authority and adherence to strict data security standards, provides the necessary infrastructure to support these high-stakes transactions.

The Future of Art as an Asset Class

Looking ahead, van den Oever sees immense potential for growth in the art finance market. “Today, only about 3 percent of art in private hands is leveraged. There’s no reason this figure shouldn’t be 10 or even 20 percent,” he asserts. With the introduction of new financial tools, such as art-backed bonds and credit default swaps, the market is poised for significant expansion.

Van den Oever also highlights the need for transparency and structure in the art insurance market, where underwriters often struggle with concentration risks due to a lack of reliable data. By providing sophisticated tools and analytics, Overstone aims to fill this gap, making art a more manageable and appealing asset class for both lenders and insurers.

As the art market continues to evolve, the integration of data science and financial expertise is becoming increasingly essential. Overstone, under van den Oever’s leadership, is at the forefront of this transformation, offering a structured, data-driven approach to art valuation that empowers both collectors and institutions. By redefining how art is perceived and managed as an asset, Overstone is not just reshaping the art market but also paving the way for a more sophisticated and inclusive financial ecosystem.

With the rise of tools like Overstone, the future of art finance looks promising, where art can be appreciated not just for its beauty and cultural significance, but also as a reliable and valuable component of a diversified investment portfolio.