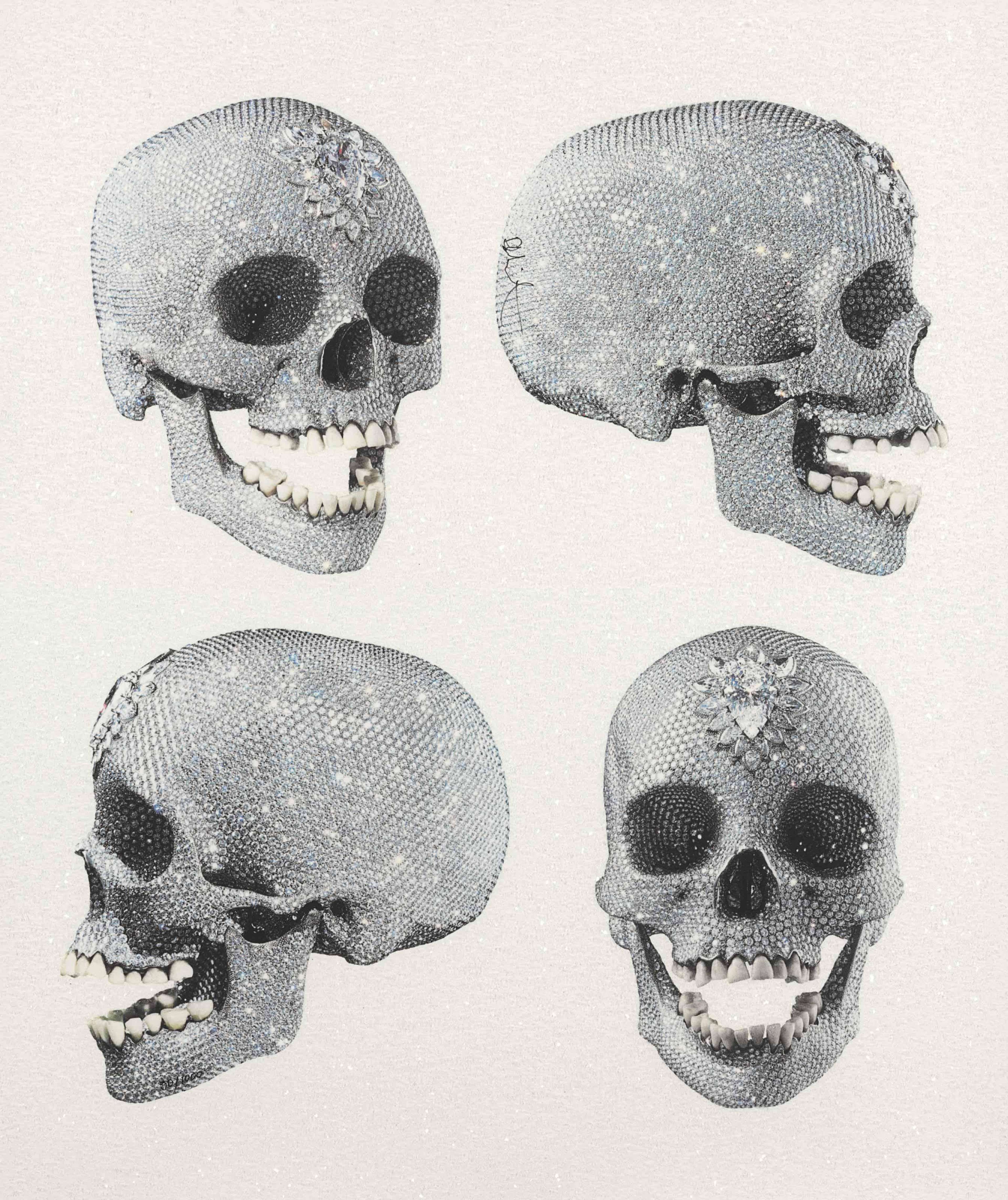

For The Love Of God (four, white) © Damien Hirst 2011

For The Love Of God (four, white) © Damien Hirst 2011Market Reports

Transparency has emerged as the watchword of the art market in recent times, as the traditionally opaque practices of the art world are being challenged. The call for greater openness and accountability has come from all sectors of the art world, including artists, collectors, and buyers. At MyArtBroker, we are proud to be championing this shift, and this article will explore why transparency is crucial in the art market in 2023, how it's evolving and how we have already contributed to the change.

What is transparency in the art market?

Transparency is a crucial element of a healthy and sustainable art market. Here is how we define transparency as it relates to the art market, divided into six key aspects:

- Clear and complete documentation of a work's provenance, ownership, and condition.

- Accessible and explicable pricing information for works sold at auction on the secondary market or through galleries on the primary market, and a clear understanding of buyer/seller fees.

- Clarity around present market trends, supply and demand, relating to unique one-of-a-kind works and how these inform fair market value and availability.

- Disclosure of any conflicts of interest such as resale agreements on certain artworks or potential ethical concerns regarding restitution or looted artworks that may affect a sale or transaction

- Consistent and fair treatment of all buyers and sellers, regardless of their status or influence while also respecting artistic innovation and cultural heritage

- Use of trusted and reputable experts, platforms, and consultation services to ensure the authenticity and legality of works sold or acquired.

Why is transparency important to the health of the art market?

Collectors are not only motivated by the financial potential of their art purchases, but also by a desire to preserve and share cultural heritage. In order for collectors to trust art market professionals with their collection, transparency is key. Not only this, but transparency prevents the art market from harbouring unethical or destabilising practices, maintaining the health of the market overall in the future.

Ownership of art has historically entailed more than just status and investment returns; it has also implied stewardship and ensuring the longevity of artworks for the inheritance of future generations. Patronage of the arts has always been driven by this impulse, as individuals and institutions sought to support artists and preserve their works for posterity.

Part and parcel of this will always be maintaining a healthy art market, moreover most collectors still prioritise the cultural significance of the art they purchase, viewing themselves as custodians of the important works that will be enjoyed and appreciated by future generations. By investing in art with a long-term perspective and a commitment to stewardship, collectors can help ensure that the art world remains a vibrant and meaningful part of our cultural heritage.

Globalisation, the pandemic and a new demographic: how the art market is changing

Historically, the art market has often been shrouded in secrecy and ambiguity, with transactions conducted behind closed doors and information concerning availability and pricing closely guarded by insiders. While some degree of confidentiality is understandable and necessary to protect the privacy and interests of clients, much of this opacity has been the result of the art market's entrenched traditions, which favour elitism and purchasing power.

Auction houses have been particularly opaque, providing limited information about the works for sale and bidding is commonly conducted and on behalf of anonymous individuals. Meanwhile, in the world of private galleries, there is a sense that clients must court dealers in order to have a chance to acquire a work, perpetuating the exclusivity and hierarchy of the art world. This lack of transparency has made the market vulnerable to abuses from fraud and forgery, to conflicts of interest and insider trading. As the art market evolves and becomes more global and accessible, there is a growing recognition of the importance of greater transparency and accountability, not only to protect buyers and sellers, but also to ensure the long-term health and sustainability of the art world as a whole.

One of the most significant changes in the art market in recent years has been the shift towards online marketplaces and online auctions. While traditional galleries and auction houses still play an important role, more and more collectors are turning to digital platforms to buy and sell art.

This trend has been accelerated by both the globalisation of the art market and the pandemic, which made it difficult or impossible for many collectors to visit physical galleries or attend live auctions. In 2020 online global art sales reached their highest recorded level with $12.4 billion, doubling in value from 2019, and continuing to grow through 2021 to reach $13.3 billion (according to statistics from the 2022 Art Basel and UBS Global Art Market Report). As certain annual art fairs were forced to move online, many galleries (including major player David Zwirner at Frieze London) posted price tags alongside their artworks, a tactic previously unheard of at in-person events.

Read more in our The Online Global Art Market Around The World article, here.

Another factor generating the growing debate around transparency is that the new and younger generation of collectors has contributed to the broadening wealth category. Studies suggest that differences between how millennials and their predecessors spend centre on a desire for transparency and instantaneous information, as is available through various online platforms and digital marketplaces, including MyArtBroker.

While studies show that most collector’s still enjoy in-person experience and viewing of works, there is evidence of greater acceptance and use of online sales and exhibitions. Online marketplaces offer several advantages, including greater convenience and access to a wider range of artists and works. However, they also present a new set of challenges when it comes to transparency. Buyers must be able to trust that the information received is credible, and that the provenance, condition, and authenticity has been thoroughly checked and vetted by market specialists. Buyers and collectors also need to be confident that the platform they are using is secure and reliable for monetary and privacy purposes

Read A Concise History of the Art Market to learn more about how the art market has evolved.

Scandal in the Art Market?

The art market has experienced its fair share of scandals in recent years, underscoring the need for greater transparency and accountability in the industry. Given the number of instances that have surfaced, it is unsurprising that people feel the need for a reaffirmation of trust within the art market.

One of the most high-profile scandals in recent memory was the case of the "Salvator Mundi", or ‘The Lost Leonardo’ (after which a Sony Pictures documentary was titled and released in 2021), attributed to Italian master Leonardo da Vinci. This series of surreal events serves as a cautionary tale for art market collectors and investors, reinforcing the importance of integrity and due diligence in the authentication of artworks, transparency surrounding pricing, and accountability when it comes to exponentially inflating prices.

The sale of the 'Salvator Mundi' sparked controversy when the painting, attributed to the 1500s sold by Christie's in 2017 for a record-breaking $450 million, making it the most expensive work of art ever sold.Causing tension from the outset, many experts questioned the attribution of the painting to da Vinci and its condition. Since the sale, the painting has not been seen in public and its whereabouts remain unknown, causing upset among those who would like to look into the work’s authenticity and galleries such as the Louvre with dreams of displaying the work.

The speculation surrounding the sale of "Salvator Mundi" has highlighted the need for greater transparency and due diligence within the art market, particularly when it comes to high-value works with disputed provenance and attributions. This event has also raised concerns about the role of auction houses in the art market and their responsibility to ensure the authenticity and condition of the works they sell.

Responding to these scandals, and longstanding concerns about money laundering via the art market, has seen increased (although by no means comprehensive) efforts to increase regulation within the historically unregulated art market with a greater focus on regulatory compliance. The EU's fifth Anti-Money Laundering Directive (5AMLD), which came into force in 2020, introduced new regulations and organisations such as the Association of Art Museum Directors (AAMD) and the International Council of Museums (ICOM) have introduced guidelines and best practices for ethical conduct in the art world. These guidelines include recommendations for transparency in the acquisition and deaccessioning of artworks, as well as the management of conflicts of interest.

Image © Christie's 2017 (Salvator Mundi attr. Leonardo da Vinci)

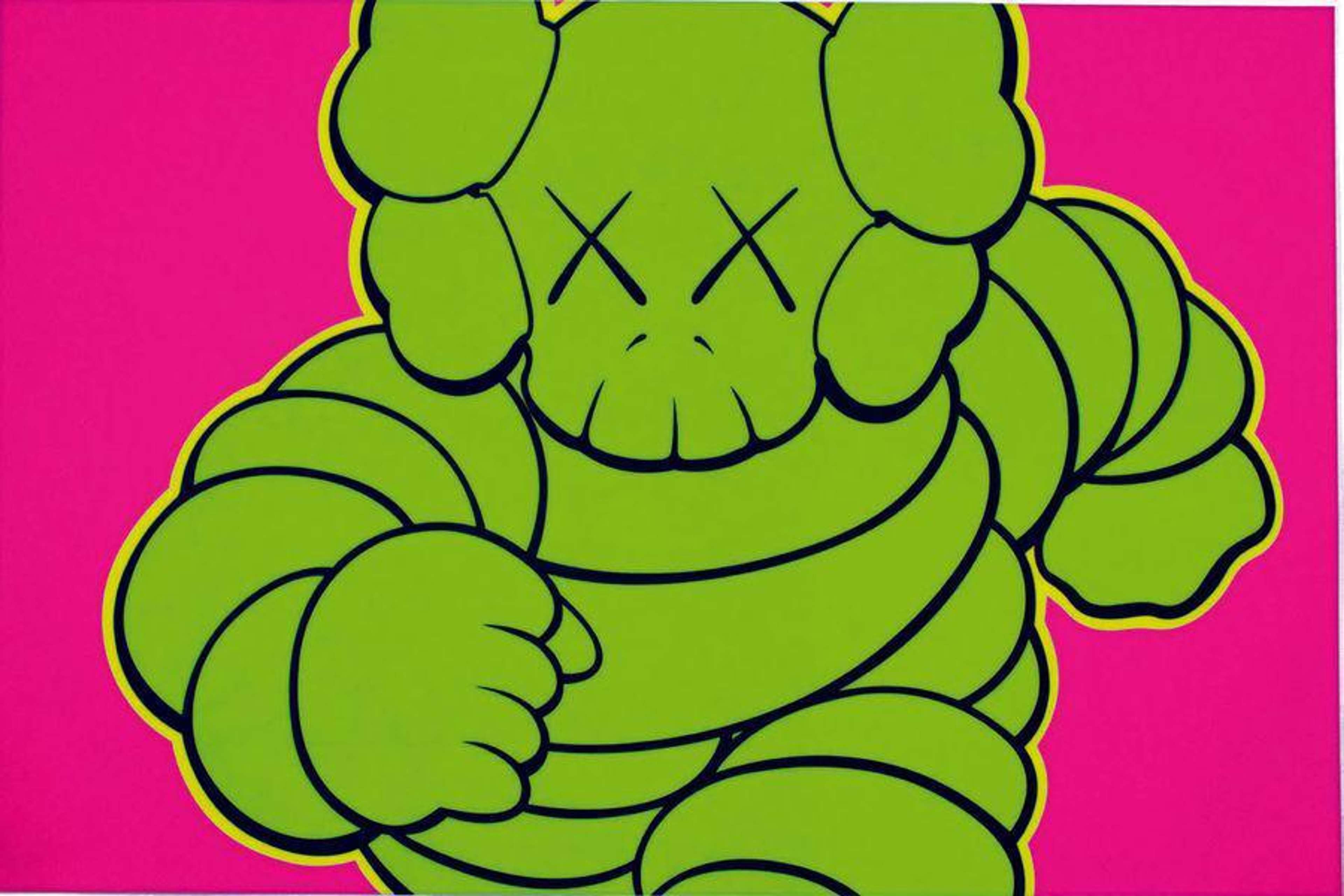

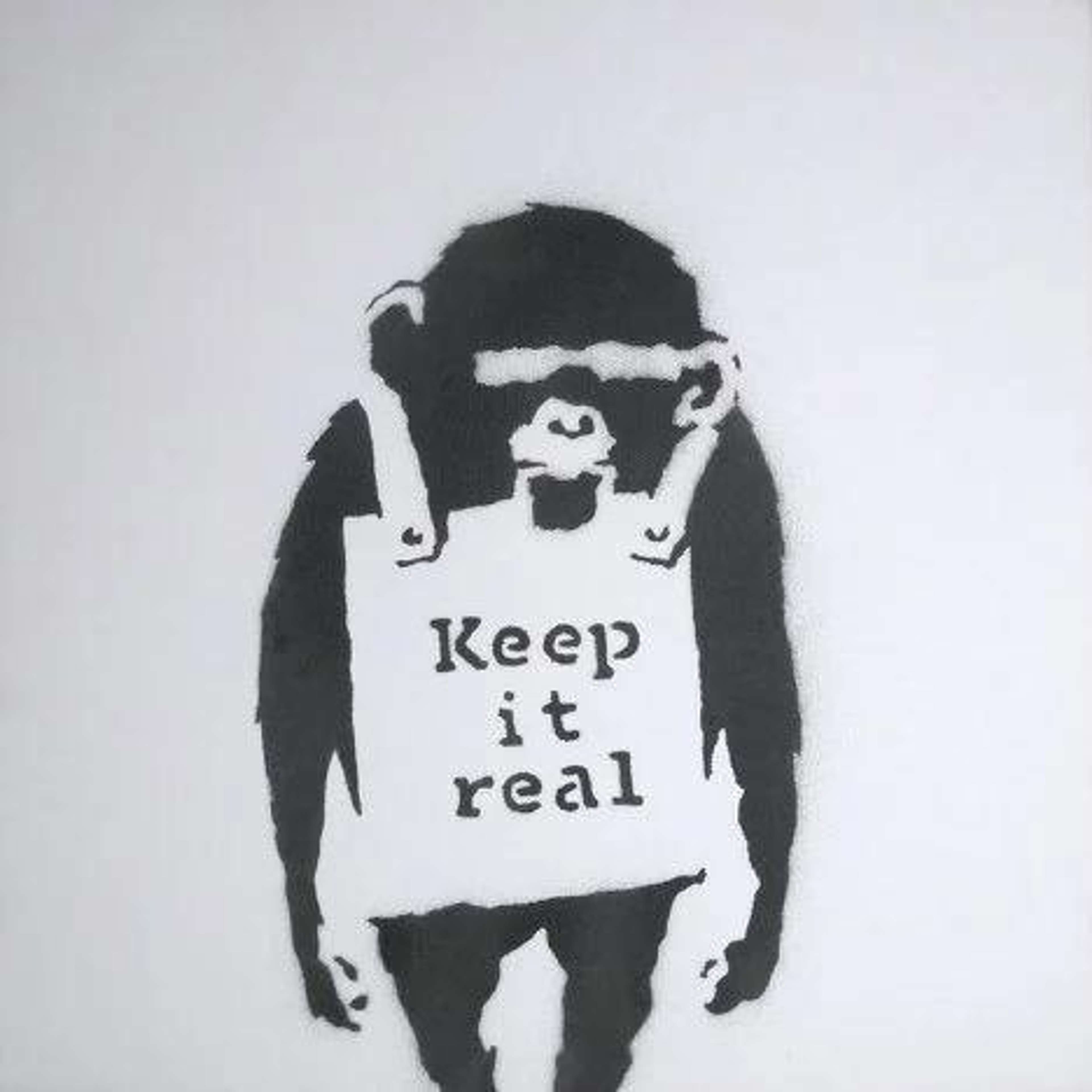

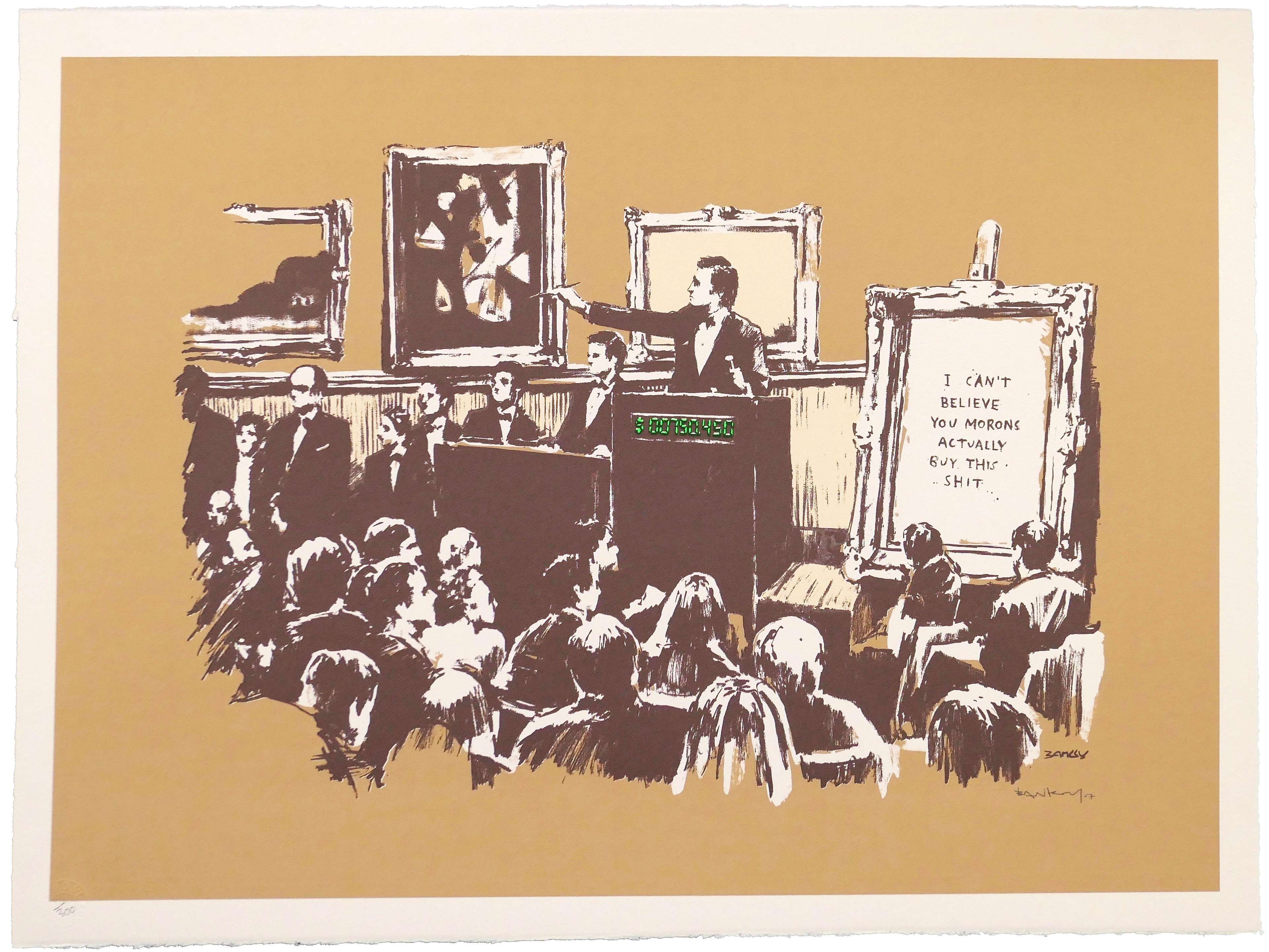

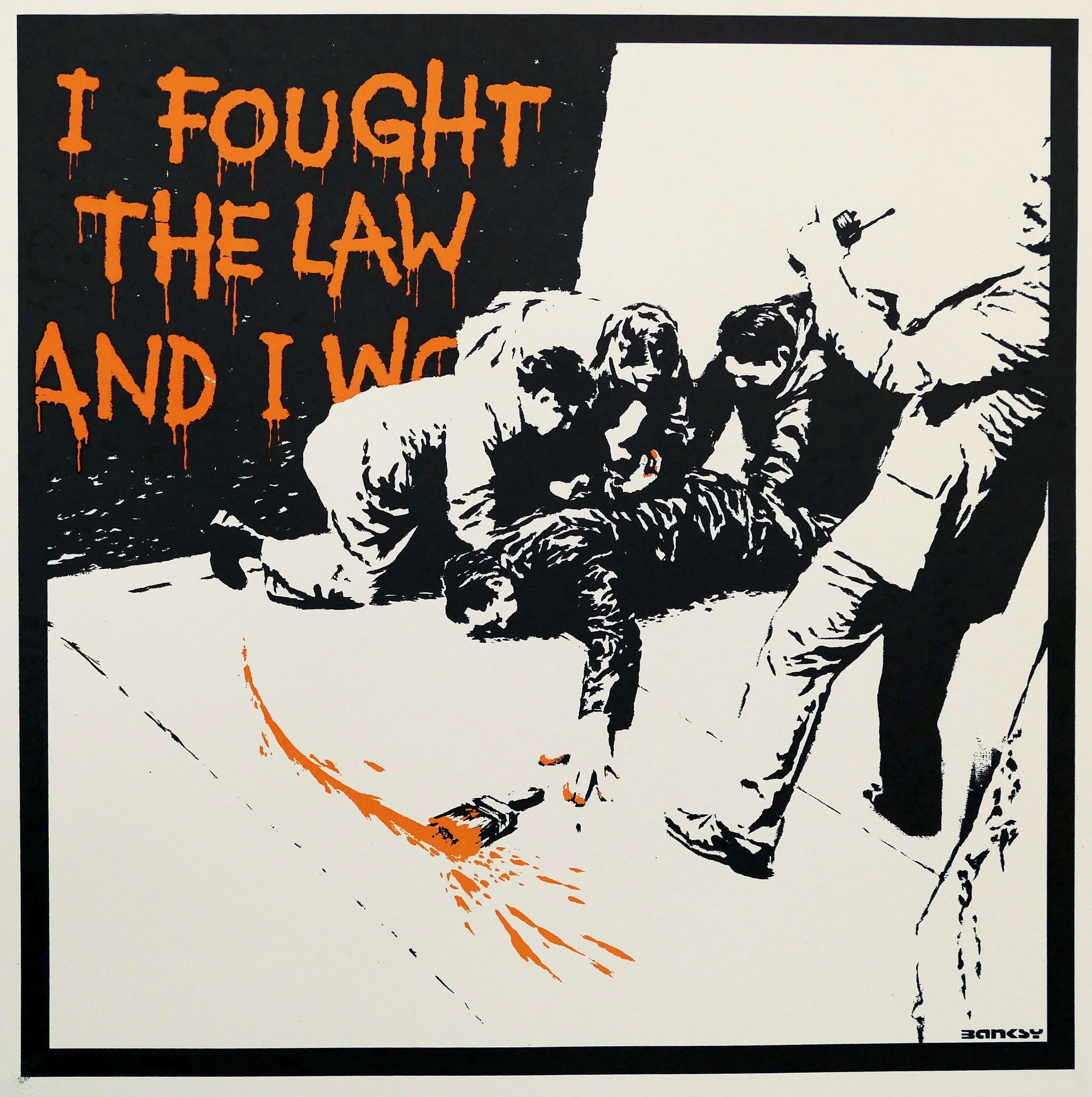

Image © Christie's 2017 (Salvator Mundi attr. Leonardo da Vinci)In terms of reaction from within the art world: many were shocked in 2018 when a painting by the artist Banksy had self-destructed after being sold at auction for over a million pounds. The stunt, which involved a shredder hidden inside the frame of the work, has been seen by some as Banksy’s own commentary, from inside the art world on the commodification of art and the excesses of the auction market. Banksy has been one of the most vocal artists of his generation regarding the immoderacy of the art market, as can be seen, also, in his print Morons.

Where does transparency come into a technologically advanced art market?

Digital technologies, such as blockchain, offer potential solutions for increasing transparency and accountability in the art market. Blockchain-based systems can provide a decentralised and transparent ledger of ownership and transaction history, making it easier to track the provenance and ownership of artworks over time. This system helps to ensure that buyers can be confident in the authenticity and legality of the works they are purchasing.

However, it's important to note that not all new digital technologies are equally reliable or trustworthy. NFTs, for example, are a highly speculative area of the art market and should be approached with caution. Purchasing NFTs through the various blockchains available eliminates intermediaries and direct communication between consumers and producers. Studies show that the impact of this new way of purchasing has been relatively weak and that many prefer to conduct sales with intermediaries including dealers and galleries to obtain specialist insight and clarity. Similarly, new tech startups that offer art fractionalisation services may not always be as transparent or profitable as claimed.

To learn more about NFTs in the artworld, read The True Value of NFTs in the Art World.

Transparency in the prints and multiples segment of the art market

If transparency and accountability are crucial in maintaining the integrity of the art market, then this is especially true for editioned prints and multiples. Buyers need to be able to trust that the works they are purchasing are authentic, legally owned, and accurately represented in terms of their condition, provenance, and other key details. Similarly, sellers need to be able to demonstrate that the works they are offering are legitimate and of high quality.

Print editions and physical multiples, in particular modern and contemporary prints, are an established segment of the art market by now, and thus less speculative, but also an area that lends itself to the application of new financial transparency. Prints are more easily sold and distributed in an online-only environment, as prospective buyers may only need to see one example of an editioned work to know what they are purchasing. Moreover, at MyArtBroker, we only deal with blue-chip artists: buying and selling artworks of high quality, and that are widely considered to be a reliable investment.

TradingFloor © MyArtBroker 2023 / Pulp Fiction © Banksy 2004

TradingFloor © MyArtBroker 2023 / Pulp Fiction © Banksy 2004What is MyArtBroker’s Trading Floor and how is it revolutionising transparency in the prints market?

It was with transparency in mind that MyArtBroker recently launched our new Trading Floor. The Trading Floor is a completely unique platform that provides collectors with access to real-time data on the activity of our network in the prints marketplace. We have always believed that transparency is essential in the art market, releasing regular Print Market Reports (the latest Print Market Report is here), and our new platform is designed to provide integrated, instantly accessible, and accurate information on the latest trends in supply and demand.

Our platform is user-friendly and allows you to navigate by artist, artwork, estimated value, and average annual growth rate. You can view print series that are for sale, owned, or wanted in our network, in real time. Our algorithm tracks up-to-date value data across 3,500 artworks spanning 30 years, including signed, unsigned, APs, PPs, TPs, and sets of prints and editions.

In addition to providing access to real-time data, our platform also invites you into our private community of buyers and sellers of blue chip prints. If our network doesn't currently have what you're interested in, you can register your interest, and we'll work to source it for you.

To foster the growth and stability of the art market, transparency is essential. It serves to promote ethical and fair transactions, build trust and confidence, and combat issues such as fraud and money laundering. Advancements in technology and regulations are driving a shift towards greater transparency and accountability in the art market. Although there is still work to be done, these changes represent an important step towards creating a more sustainable and transparent art market.

MyArtBroker is proud to be nurturing this new transparency: helping collectors to attain the art they love with an informed perspective of how works have performed historically, enables them to invest in the long-term view of preserving our cultural heritage. Using trusted platforms and technologies that prioritise transparency and security, like our Trading Floor, contributes to a vibrant and valuable art market for years to come.

Learn more about MyArtBroker’s Trading Floor.