Investing in Blue Chip Art: How to Maximise Returns with Prints and Editions

Mick Jagger (F. & S. II.139) © Andy Warhol 1975

Mick Jagger (F. & S. II.139) © Andy Warhol 1975Market Reports

Starting an art investment journey can be challenging, but seeking professional guidance can be beneficial. A recommended approach is to begin by acquiring prints and editions by renowned artists with a track record of value appreciation. These blue chip artworks offer substantial investment potential, as they have an established presence in the secondary market with consistent sales and a mature market. Collectors are drawn to the market's patterns, investing in high-quality works with proven demand. Prints and editions provide accessible and lucrative entry points into the growing art market, offering exciting opportunities for passion asset investors.

This guide will provide practical tips and strategies to optimise returns on blue chip prints and editions, uncovering the expanding realm of alternative investments. We delve into investment strategies and valuation factors, equipping you with the confidence to embark on diversifying your asset portfolio. At MyArtBroker, we extend our expertise in bluechip prints and invite you to join our growing network of collectors and buyers. Our MyPortfolio platform helps to make informed decisions while tracking the value of your artwork collection against real-time auction data.

Understanding Blue Chip Art

Blue chip art refers to high-quality collectible works created by artists with a well-established market of repeat sales. The term originates from the financial sector, where "blue chip" signifies stable, reliable stocks from companies with a history of strong financial performance. Similarly, blue chip art has become a sought-after tangible asset for diversifying investment portfolios.

This art category is also associated with renowned blue chip artists recognised for their distinctive signatures, individual aesthetics, and subject matter. Paintings in this category are unique, while prints and editions are produced in limited quantities, making them rare finds, which creates demand and buzz within the artist's market. The inherent uniqueness of blue chip artworks contributes to their competitive investment value, with a track record of strong market performance and patterned appreciation in value over time.

While art investments have the potential for healthy returns, they are also considered passion investments. Artworks generally maintain and increase in value over time, demonstrating resilience even during economic downturns. When evaluating blue chip art as an investment option, factors such as liquidity, diversification, and risk tolerance should be considered. Nonetheless, for investors seeking portfolio diversification and a hedge against market fluctuations, blue chip art provides a tangible and historically stable investment choice that has consistently proven its long-term value.

Investing in Blue Chip Art

Investing in blue chip art presents an attractive proposition for those looking to diversify their investment portfolios and capitalise on the art market's potential for substantial returns. However, as with any investment, it is crucial to consider several factors and understand the associated risks. Often, one of the biggest deterrents for those looking to invest in blue chip art can be the hefty price tags that seemingly require astronomical budgets. Prints and editions, however, offer a great alternative to this as they come at many different price points. Nevertheless, you should also consider other costs apart from just the acquisition price. Associated fees include insurance, adequate storage, and proper maintenance.

One of the most important aspects to consider when investing in blue chip art is the expertise needed to make informed decisions. You should endeavour to develop a strong understanding of the art world, its trends, and the artists you're interested in. This can be achieved by conducting thorough research, attending art fairs and auctions, and seeking advice from knowledgeable professionals such as MyArtBroker. Professionals can also help you protect your investment by ensuring the authenticity and provenance of a piece through proper documentation and provenance research, minimising the risk of forgery or any legal disputes.

Despite the fact that blue chip art tends to hold its value in comparison to other assets during economic downturns, fluctuations in the art market and an artist's individual market are common and can still impact investment values. You should be prepared for potential shifts in buyer preference which can influence prices, and keep abreast of market trends. Another risk to consider, which comparatively to stocks or bonds, blue chip art is not rapidly liquid. Finding a buyer for a unique work of art can take time, and a flexible approach to various price points is recommended if you require immediate capital. Because art is a passion-asset, it is considered a long-term investment, an aspect worthy of serious consideration when purchasing blue chip art.

By understanding the factors and risks involved and applying well-informed strategies, investors and enthusiasts can tap into the lucrative and enticing world of collecting blue chip art and building a diverse and profitable portfolio.

Prints and Editions: A Viable Option for Building a Collection

Prints and editions have gained significant popularity among collectors and investors, serving as an accessible entry point into the art market. These artworks are carefully crafted under the direct supervision of the artist or with their copyright approval. They are created as a series of identical impressions or multiples, utilising versatile printing techniques such as lithography, etching, screenprinting, and digital printing. Compared to one-of-a-kind artworks, prints and editions are more widely available in terms of volume, streamlining the acquisition process for high-calibre works by renowned artists at a fraction of the cost.

The diverse range of mediums and availability of prints offer a price distribution that caters to different spending budgets, allowing collectors the freedom to explore various artists, styles, or themes, fostering a diverse and dynamic collection. Despite being priced lower than paintings, editioned prints embody the original artwork's creative intent and aesthetic appeal, making them attractive investment options. The prints and editions market has exhibited remarkable resilience, showing a growth of 64% since 2019, even during challenging times such as the pandemic, when other markets experienced significant downturns.

Our comprehensive Ultimate Print Market Report highlights the enduring value of blue-chip editioned prints as investment assets. Over time, these prints, created by renowned artists like Andy Warhol, Roy Lichtenstein, and Keith Haring, often appreciate in value. It is important, however, to carefully choose artwork for investment purposes. Generally, smaller edition sizes command higher prices due to their rarity and exclusivity within the market. By investing in prints, collectors gain a piece of art history and have the opportunity to own significant works by iconic artists.

Pop Artists and Printmaking

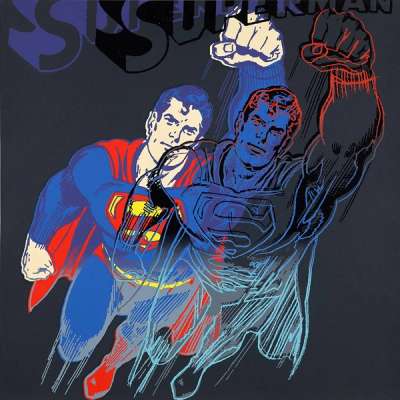

Andy Warhol, known for his profound impact on printmaking, is widely regarded as one of the most renowned artists in this medium. His art captures the intersection of consumerism and fine art, and his fame continues to skyrocket. In a groundbreaking auction in 2022, the sale of his iconic work, Shot Sage Blue Marilyn, shattered records and became the most expensive artwork ever offered. This monumental sale had a cascading effect on the value and demand for Warhol's paintings, making it unsurprising that his print market has also experienced substantial growth.

Our comprehensive analysis in the Ultimate Five Years in the Print Market Report reveals compelling insights into Warhol's print market. Over the past five years, starting from 2017, the average selling price of Warhol's prints has shown a compounded annual growth rate of 27%. Moreover, the sales value of his complete print sets alone witnessed a remarkable 175% growth between 2020 and 2021. Notably, investable prints by Warhol include the iconic Campbell's Soup series, Ladies And Gentlemen, and Queen Elizabeth II (F. & S. II.336), all of which have seen their value increase by at least 200% in recent years.

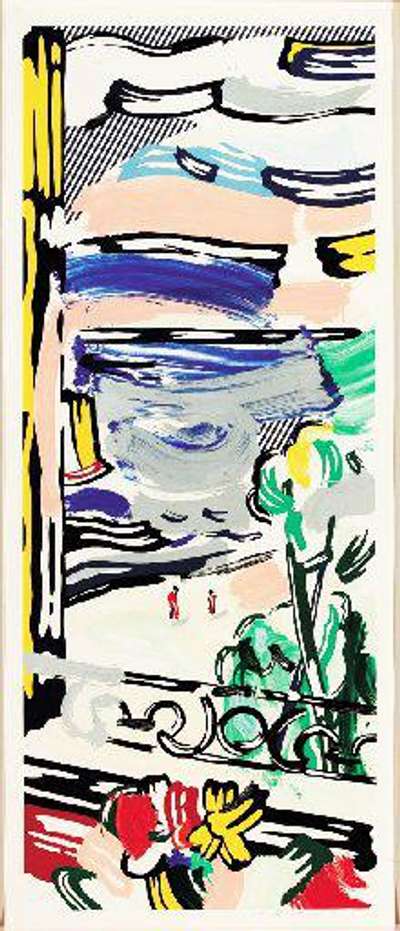

Another influential figure in Pop Art, Roy Lichtenstein, is instantly recognisable for his comic book-inspired style that translates brilliantly into prints. Throughout his career, Lichtenstein created over 300 original prints, many of which have become seminal pieces in 20th-century art history. While his market may not be as stable as Warhol's, there is significant potential for long-term investment. Lichtenstein demonstrates a compounded annual growth rate (CAGR) 5.7%. Notably, his top-selling prints stem from his Nude series, and Waterlily works.

Printmaking was enthusiastically embraced by Pop artists as a means of mass-producing artworks that captured their distinct aesthetic. This medium has garnered immense enthusiasm and desire among collectors, as evidenced by the remarkable growth of the overall Pop Art Prints Market.

Download our Print Market Reports Now!

The Ultimate Print Market Report: 5 Years in The Print Market and The American Pop Print Market Report

Contemporary Artists and Printmaking

Printmaking has retained its popular status among contemporary artists, prized for its ease and accessibility. When renowned artists issue prints, they tend to attract significant attention.

David Hockney is one of the most famous contemporary British artists, having had a long career since his beginnings as a pop artist in the 1960s. Hockney's works carry an enduring appeal, and his ability to adapt to evolving tastes has made him a highly collectable artist who, according to our Ultimate Print Market Report, boasts the second-largest market, coming second to Andy Warhol. Because of his artwork's enduring appeal, they are considered a safe investment. Hockney's most investable prints include Untitled No.516 (2016), The Arrival Of Spring In Woldgate East Yorkshire 17th April 2011 (2011), and Four Part Splinge (1993), all of which have seen a value growth of over 605%.

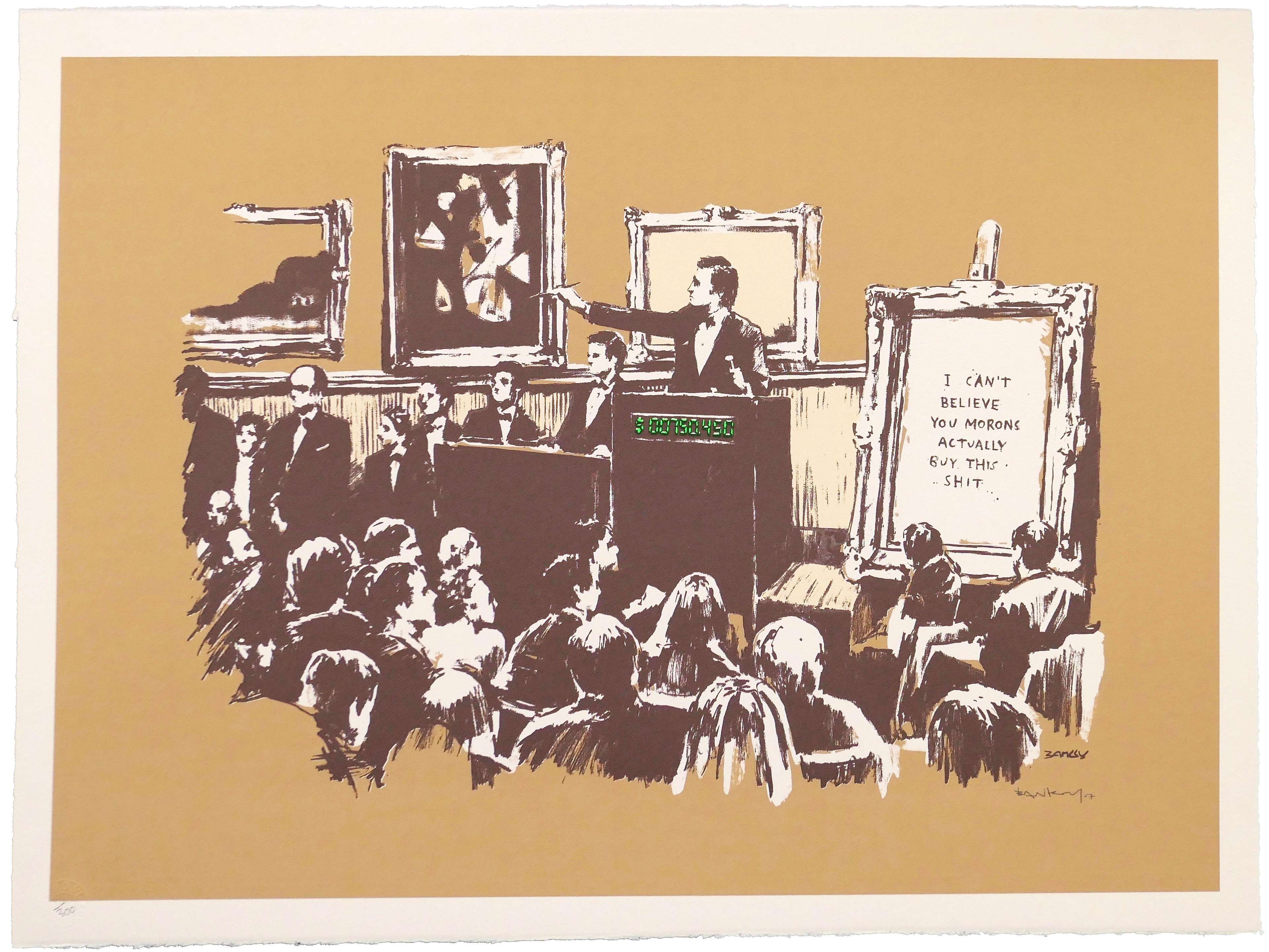

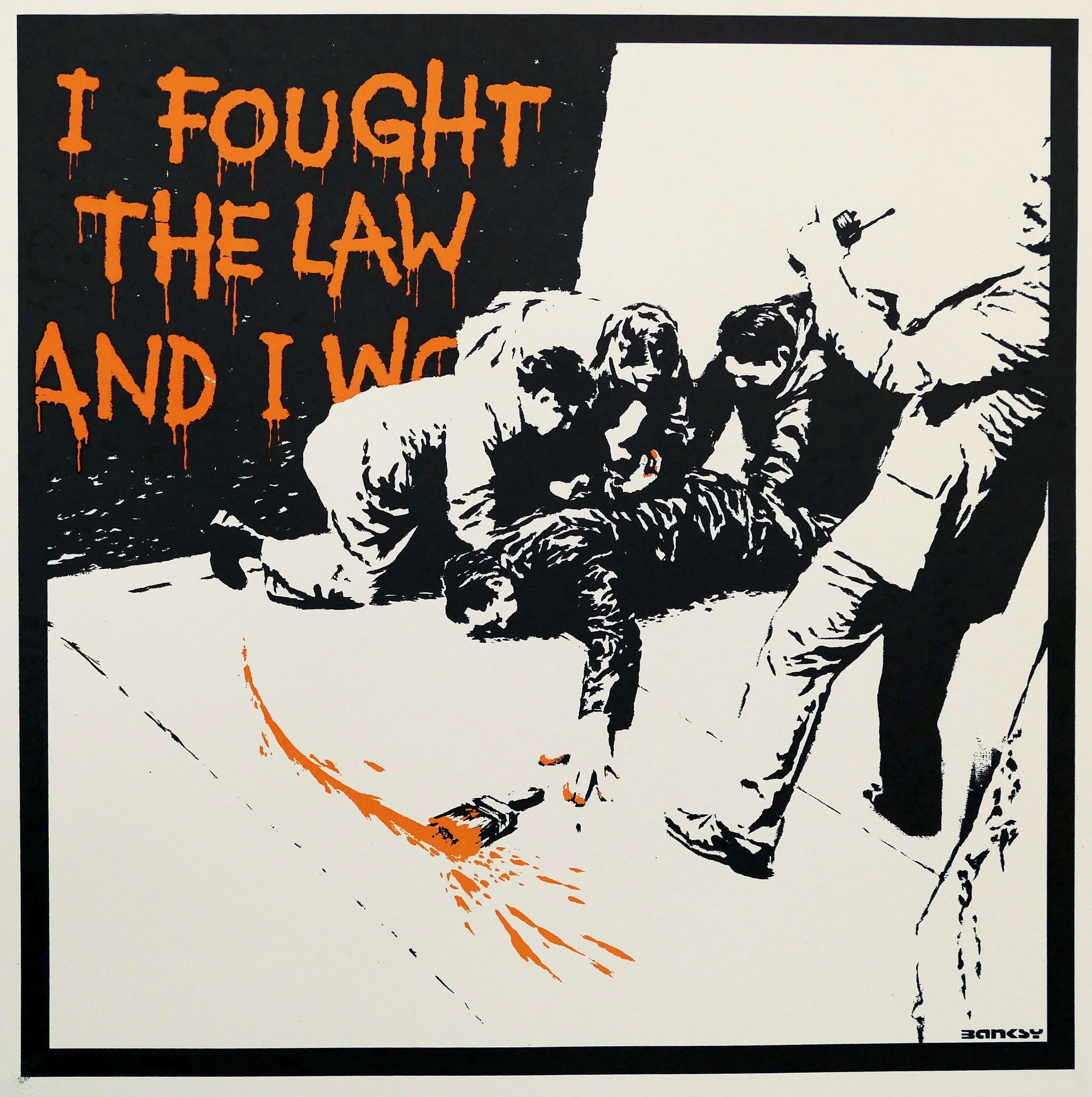

Banksy's limited edition prints have solidified his reputation as an iconic artist, and although the market has experienced a recent downturn, the enduring influence of his work remains undeniable. As the market for Banksy's prints enters a phase of maturity following its peak in 2021, they continue to present compelling long-term investment opportunities. It is increasingly vital for investors to stay informed about market trends as Banksy's career shows no signs of decline. Notable prints such as Jack & Jill, Love Is In The Air (Flower Thrower) (AP), and Girl With Balloon have demonstrated remarkable appreciation, with value increases of at least 380%.

Prints and editions are attractive for building a diverse and dynamic art collection. By understanding the nuances of the medium and relying on the expertise of people such as the team at MyArtBroker, collectors can make informed decisions.

Get In Touch With Us Today to Discuss Art Investments.

Building A Blue Chip Art Collection with MyPortfolio

At MyArtBroker, we aim to simplify collecting, buying and selling prints. Managing your collection is one of the most crucial aspects of owning art, and having all your data in one place is key to efficiently keeping tabs on what matters. Our unique service MyPortfolio is the only print market index providing insights into the latest art market trends by tracking auction data against our private sales data and also acts as a collection management service. MyPortfolio, can help to make informed decisions when selecting prints and editions for your collection and identify those with the most potential for long-term growth.

MyPortfolio © MyArtBroker 2023

MyPortfolio © MyArtBroker 2023Art Stocks: A Convenient Way to Invest in Art

Art stocks are a relatively new way to invest in the market without owning the physical artwork, and are a great way for investors to expose themselves to the industry. They work similarly to traditional stocks, where investors can buy and sell shares of publicly traded art companies on stock exchanges. These stocks represent fractional ownership of a work of art, and investors can profit from any future sales. Investing in art stocks has several benefits, such as lower transaction costs, greater liquidity and greater potential for diversification. It is also a less stressful way to own a piece of art history, given that you do not have to worry about conservation, storage or security measures.

However, investing in art stocks also comes with its own set of risks. Art stocks are still relatively new and unregulated. Their value can be influenced by several factors, such as market volatility, inflation, and economic uncertainty. It is also important to note that art stocks, like regular stocks, can be susceptible to fraud – one notable example is the scandal of Inigo Philbrick, who swindled investors and sold more shares in a single artwork than were available. Phillbrick was recently sentenced to seven years in a US jail.

Investing in art stocks requires careful consideration and analysis. Investors should carefully research the artwork’s credentials, its management team’s qualifications, the competitive economic landscape and growth prospects and if ever in doubt, always seek the expertise of art advisories.

Maximising Investment

There are strategies you can employ to maximise your return in blue chip prints and editions. One of the main ones is being selective when purchasing art: you should focus on acquiring pieces that represent the artist’s best work or are considered rare, as these are likely to retain or increase in value, but also choose something that personally resonates with you. Remember that blue chip art is a long-term investment, and fluctuations within the market are common. Given that art is a passion asset, your collection should be a source of joy and inspiration. Carefully researching blue chip artists and following the art market helps to make informed decisions.

The most important consideration when buying is to ensure that the artwork you are purchasing is authentic, with a well-established provenance and is in good condition. You should seek the expertise of a specialist to authenticate your work and request all available documentation in order to conduct appropriate provenance research, including invoices, photographs of the work in situ and certificates of authenticity. A professionally conducted condition report is also recommended. Lastly, depending on the value of your print, you might want to consider investing in proper storage solutions such as climate-controlled facilities to safeguard from harmful environmental influences.

Diversifying your collection is also a good investment practice. Spreading your spending across different artists, styles, and periods helps mitigate risks and capture potential gains from various market segments. As with any investment, you should periodically evaluate and analyse the performance of your collection, making necessary adjustments to maximise your investment portfolio according to the latest market trends. Stay updated to make informed choices, safeguard yourself from potential losses, and invest in what you love.

The Role of Art in a Diversified Portfolio

Art is recognised as an alternative asset class and a valuable component in a well-rounded investment portfolio. As conventional diversification methods relying solely on stocks and bonds prove less effective, alternative assets like real estate, commodities, and collectables have gained popularity. These assets offer low or negative correlation with traditional classes, reducing systemic risks. Art, being a tangible asset, has the potential to bring diversification benefits to a portfolio. Moreover, the inherent illiquidity of art investments can act as a hedge against sudden stock market price declines. The inclusion of art within an investment portfolio can potentially enhance the risk-return profile over the long term.

Moreover, blue chip artworks, prints, and editions have demonstrated a consistent trend of appreciating in value, making them a potential safeguard against inflation. The existing disparity between projected art investments and available opportunities presents a promising prospect for new investments poised for growth. Investing in art is not only expected to yield favourable outcomes but also contribute to the development of various sectors of the economy, nurturing a thriving culture, fostering knowledge, and stimulating creativity.

Final Thoughts

Investing in blue chip art – specifically prints and editions – can provide a lucrative and accessible opportunity for collectors and investors to diversify their portfolios. You can maximise your investment returns by understanding the nuances of the art market, focusing on high-quality pieces from established artists, relying on expert knowledge, and employing informed strategies. Remember to exercise patience, embrace diversification, and seek professional guidance when navigating the world of blue chip art. With the right approach, you can create a dynamic, resilient collection that brings aesthetic pleasure and generates financial success.