Market Watch: Market Editor Report November 2023

Marilyn (F. & S. II.26) © Andy Warhol 1967

Marilyn (F. & S. II.26) © Andy Warhol 1967MyPortfolio

November heralds the most eagerly anticipated period in the art market. While the spring auctions carry their own significance, it is the autumn sales that showcase the most prized and valuable artworks. As we transition from the buzz of fairs and auctions in London and Paris, the global epicentre of artistic innovation, New York City, takes centre stage. In this November edition of our newsletter, we present a slightly altered format. First, we delve into the latest MyArtBroker updates and developments. We offer an exclusive exploration of the profound impact of Andy Warhol's Marilyn on the art market. Additionally, we introduce a groundbreaking technological advancement, the MAB100 Print Index, which holds deep personal significance. Finally, we delve into the New York auctions and their implications for the art market in the year ahead.

MyArtBroker is excited to announce the upcoming release of our year-end Market Report, providing an in-depth analysis of Q4 auctions and yearly art market trends. To access our Market Reports visit our website here.

MyArtBroker Market News

The Legacy and Value of Andy Warhol’s Marilyn

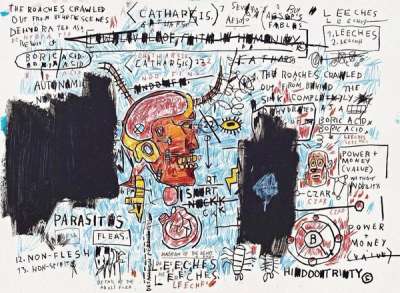

This month, our Managing Director, Charlotte Stewart, engaged in a captivating conversation with Richard Polsky, friend of MyArtBroker, as well as an accomplished author and art authentication expert. They delved into the profound influence and enduring legacy of Marilyn Monroe, Andy Warhol's most iconic muse. Their discussion revolved around the transformative impact that Warhol's screenprinted portraits of Marilyn Monroe had on the art world and the broader cultural perspective during the 1960s.

At the outset, Warhol's art was perceived as unconventional and somewhat distant from the mainstream art community. However, this perception underwent a remarkable shift when his work was prominently featured in an exhibition at the Stable Gallery in New York, exhibiting none other than his Marilyn portraits. This exhibition served as a pivotal moment in Warhol's career, as it showcased his transition from the advertising industry to a significant and influential figure in contemporary art.

To explore other conversations with Charlotte and Richard, read their take on the perils of pricing and how to invest in art like an insider.

Browse Andy Warhol prints on the Trading Floor and find out more about the Marilyn print market growth on the MAB100 Print Index.

With a free MyArtBroker account, you will have access to all our EDITION premium content, plus access to MyPortfolio, add your collection and track value in real-time.

MAB100 Print Market Index © MyArtBroker 2023

MAB100 Print Market Index © MyArtBroker 2023The MAB100 Print Index

MyArtBroker is constantly exploring inventive ways to enhance our technological standing in the art world, with a primary goal of providing the utmost transparency in art collection, purchase, and sale. At the beginning of this month, we proudly introduced the MAB100 Print Market Index, a groundbreaking tool that not only improves transparency but also significantly aids in art valuations.

The MAB100, introduced by MyArtBroker, is a revolutionary tool specifically designed for the prints and multiples segment of the art market. Its primary purpose is to bring clarity and data-driven insights to an area often clouded by subjectivity. Utilising the sophisticated algorithm known as SingularityX, the MAB100 evaluates the top 100 prints based on historical auction sales and other pertinent market data. This comprehensive analysis offers valuable insights into market trends, emphasising liquidity and significance within the art market. It also provides collectors and investors with a powerful tool to better assess the value of art pieces.

MAB100 Print Market Index © MyArtBroker 2023

MAB100 Print Market Index © MyArtBroker 2023 One of the key ways the MAB100 aids in art valuations is by offering a clear and data-backed perspective on the worth of individual artworks. Unlike traditional indices that often focus solely on artists, MAB100 shines a spotlight on the intrinsic value and demand of each artwork. It does this by harnessing advanced Repeat-Sales-Regression technology, which not only considers public auction sales but also incorporates data from private sales. This unique feature allows for a more comprehensive and accurate assessment of an artwork's value.

Furthermore, the MAB100's emphasis on equal-weighted calculations ensures that market representation remains unbiased. This is crucial for art valuations, as it eliminates potential distortions that may arise from overemphasising certain artists or segments of the market.

MyArtBroker has proudly made the MAB100 accessible to the public, simplifying the art investment process and making valuable market insights freely available to all users. This accessibility is a significant advantage, especially when compared to other platforms that often involve fees and complex trend analyses, making it an invaluable resource for anyone seeking to assess the value of artworks accurately in the ever-evolving art market.

To discover more about the differences of art indices available read our insightful article here and explore the value of prints and editions on the MAB100.

November Marquee Sales © MyArtBroker 2023

November Marquee Sales © MyArtBroker 2023The November New York Auctions

What Happened in New York?

Christie's launched the marquee auction week on November 8th with their 21st-century sale, followed by Phillips' 20th Century & Contemporary Art evening sale, and Sotheby's concluded the action-packed two weeks with The Now sale and their Contemporary evening sale on November 16th. In our auction reports, we covered the Post War and Contemporary Evening and Day auctions, which collectively yielded $1.4 billion in hammer prices across 11 sales, including two private collections hosted at Sotheby's and Phillips. To sum up, this figure represents a $1 billion decrease compared to the combined hammer prices of the November 2022 auctions, and it also shows a slight dip from the November 2021 auctions, which totalled $1.95 billion, signifying a -28% difference. However, it's important to acknowledge that the November 2022 auctions received substantial support from the Paul G. Allen sales, contributing $1.3 billion in part one of the two-part sale. This indicates that the November 2023 auctions have performed relatively well, reflecting a moderate market adjustment amidst the economic backdrop.

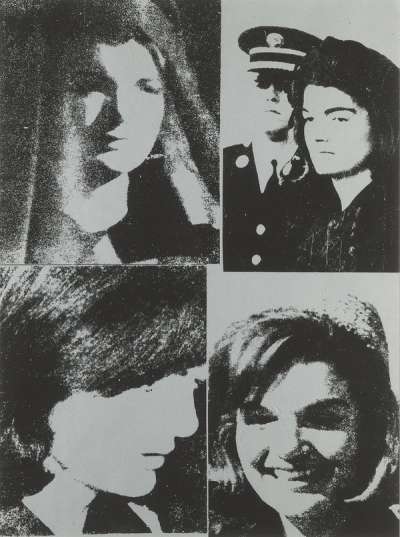

Image © Sotheby's / Emily Fisher Landau © Andy Warhol 1982

Image © Sotheby's / Emily Fisher Landau © Andy Warhol 1982November Art Market Trends

Securing Single-Owner Collections

Auction houses, focusing on art resale, highlight the significance of the three D's in the art market: Death, Debt, and Divorce. It's vital to note that these occurrences can be unforeseeable and not necessarily tied to economic hardships. Auction houses, despite their efforts, have a limited ability to predict when and which works will be included in their sales. This underscores the necessity of a well-thought-out strategy.

In the realm of art auctions, it's frequently disregarded that competition extends beyond bidders, as auction houses themselves vie to acquire artworks from their respective owners. The major players, namely Christie’s, Sotheby’s, and Phillips, engage in constant competition, each employing their unique strategies to secure artworks while also providing collectors with assurances of their collections' value. This is where single-owner collections come into play. For the November sales, Sotheby's acquired the Emily Fisher Landau Collection, and Phillips acquired the Triton Collection Foundation, both significant collections divided into evening and day sales. The Emily Fisher Landau sale contributed 58% to Sotheby's $627 million hammer, while the Triton Foundation Collection contributed 48% to Phillips' $143 million hammer.

Third-Party Guarantees

Once an auction house secures a collection, their strategy becomes apparent, especially during periods of heightened market activity. Sotheby's and Phillips made significant commitments to these collectors by ensuring that the works from their single-owner collections were guaranteed to sell. Phillips and Sotheby's ensured minimum price guarantees for all 30 Triton Foundation Collection lots and 31 Emily Fisher Landau collection lots, often with both third-party and auction house backing. This approach essentially ensures that the works will find buyers, a notable observation indicating that auction houses recognised market uncertainties and were willing to bid on themselves to secure sales.

Christie's, on the other hand, took a different but equally intriguing approach. Despite not securing a prominent single-owner collection, they augmented their 20th-century sale with Impressionistic works by renowned 20th-century masters such as Cezanne and Monet. Interestingly, these works outperformed their 21st-century blue chip counterparts, which had dominated auction sales throughout the year.

Browse Contemporary prints on MyArtBroker's Trading Floor and browse their current value and performance on the MAB 100 Print Index.

Wet Paint Artists Versus Blue Chip Names

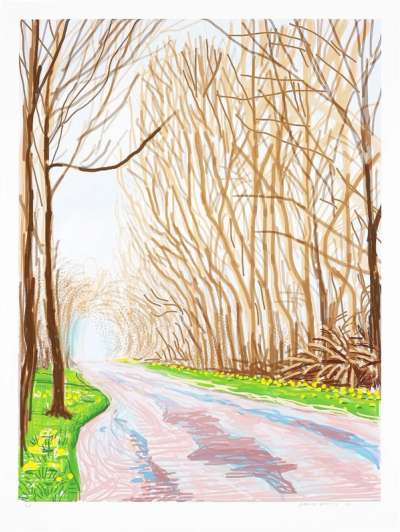

This year, auction figures declined noticeably, highlighting the need for consignors and auction houses to adjust estimated values to match the economic climate. Despite a trend of auction houses featuring artworks from highly sought-after blue chip artists, recent November sales in New York didn't yield record-breaking prices. While still producing seven to eight figure sales, artists like Warhol, Basquiat and Hockney saw their works sell at or below estimated values.

Surprisingly, emerging artists, predicted to decline in value in late 2022 and early 2023, exceeded expectations in November. Jadé Fadojutimi, linked with Gagosian, consistently exceeded high estimates across all three auction houses.

November Marquee Auctions Top Sales

Jean-Michel Basquiat, Untitled (1981) sold for $11.9 million (with fees) at Christie’s 21st Century evening sale.

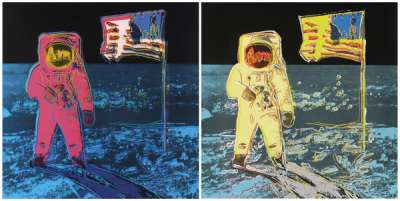

Andy Warhol’s Sixteen Jackie’s (1964) sold for $25.9 million (with fees) at Christie’s 20th Century evening sale.

Andy Warhol’s Endangered Species (1983) sold for $3.4 million at Christie’s Post-war and Contemporary day sale.

Kaws’ UNTITLED (DBZ2) (2007) sold for $1.9 million (with fees) at Phillips Evening Sale Part II.

Andy Warhol’s Kimiko Powers (1972) sold for $952,500 at Phillips 20th Century & Contemporary Art day sale.

Jean-Michel Basquiat’s Self-Portrait as a Heel (Part Two) (1982) sold for $42 million (with fees) at Sotheby’s Contemporary evening sale.

David Hockney’s View From Terrace III (2003) sold for $7.2 million (with fees) at Sotheby’s Contemporary evening sale.