Dollar (F. & S. II.277) © Andy Warhol 1982

Dollar (F. & S. II.277) © Andy Warhol 1982 Market Reports

Arguably the most awaited month in the art market calendar, May is pivotal in setting the tone for the rest of the year with the highly anticipated New York sales. We’ll discuss financial matters from the previous months that have continued to permeate throughout the first half of the auction year. Sotheby’s continues to make waves with large scale redundancies and the announcement of a $700 million securitisation backed by art-secured loans. I provide context of this move, what it means for Sotheby’s and how it speaks to art market confidence that we have seen in the first half of the 2024 art market calendar.

The addition of a new series from MyArtBroker: The Week In Prints: News From The Prints & Editions Market will be published weekly, and provide you with exclusive insights on the prints and editions market and news from the most lucrative blue chip artist’s markets.

Art Market Confidence

Christie’s Cancels June Sales And Sotheby’s Enters Consultation Period

Confidence is a key driver in any market, influencing investor behaviour and overall market dynamics. While defining confidence in the art market can be challenging, there are certain indicators that suggest a thriving market. One of the most obvious indicators is sales figures. Investors and market participants typically look for significant numbers, reflecting growth and sustained performance. In the recent May sales, although the numbers were down, they were steady. The sales still boasted healthy sell-through rates, albeit carefully orchestrated by auction houses with a significant number of buyer guarantees. Privacy and confidentiality are also highly valued, which makes Christie’s recent technology breach concerning, at the very least.

Investors also pay close attention to market dynamics, which may not be as immediately apparent as sales figures but play a crucial role in shaping the art market. Geopolitical and macroeconomic events, such as pending elections in the United Kingdom and the United States, are significant factors. Elections can lead to regulatory changes that affect various aspects of the art market, including the import and export of artworks and antiquities. This creates intense competition among countries vying for cultural influence. For example, when Donald Trump became the president in 2017, he imposed a 25% import duty on printed works in the United States. Similarly, Brexit has had profound effects in the UK since its implementation in 2020. Art and antiques entering the UK from the EU are now subject to a 5% import VAT and extensive bureaucratic procedures, leading to a slight decline in cross-border trade.

A whole article could be dedicated to exploring how elections influence markets and the art trade, but for now, the focus will remain on the latest developments shaking up the art market: news from the auction houses. Christie's recently made headlines by announcing the cancellation of its prestigious June sales in London. Instead, they plan to concentrate on showcasing quality works in two main seasons: March and October. Meanwhile, Sotheby's has also made waves with reports of impending layoffs affecting dozens of employees in the UK, with further cuts anticipated in other locations as part of a consultation period. These developments coincide with French-Israeli telecoms billionaire Patrick Drahi's foray into slightly unconventional business ventures. Drahi’s leveraging Sotheby's Financial Services (SFS) loan portfolio to secure a $700 million securitisation bond. Here, we’ll delve into the intricacies of loan securitisation, its implications for the art market, and how it reflects on the concept of market confidence, before providing a recap of the May New York auctions.

Sotheby’s $700 Million Loan Securitisation

Sotheby’s stands firm in the art market, evident in Drahi's move to secure confidence through a reported $700 million art-backed loan securitisation, making waves in financial circles. This innovative initiative targets investors, many of whom may not possess art themselves but are seasoned financiers and wealth managers, a common trend in the art-backed loan sector. Since 1988, SFS has been facilitating loans for clients using art collections and collectibles as collateral for up front cash: a way to unlock liquidity in their assets. Drahi has orchestrated what is akin to a bond–a $700 million bond, merging 89 smaller loans into a combined portfolio, forming the basis for the bond securitisation, known as loan pooling.

Enter, Sotheby’s ArtFi Master Trust, Series 2024-1, (the issuer), which acts as a special purpose vehicle (SPV) to receive the a transfer from SFS of the combined loan portfolio along with their corresponding cash flows. In the process of operations, Sotheby’s ArtFi Master Trust was formed to represent various level of investment options, referred to as 'tranches', which simply means a portion of the securitised investment. Morningstar DBRS, a credit rating agency, has classified Sotheby’s ArtFi Master Trust's combined loan portfolio into five categories of 'tranches': A-1, A-2, B, C, and D. Each category corresponds to a different credit rating, ranging from AAA (highest) to BBB (lowest), which simply validates the credit quality and level of risk associated with that 'tranche'. As you descend the rating scale, the level of risk increases. For example, investors who purchase securities from the AAA-rated tranche are attracted to the higher credit quality and lower risk associated with these securities. They expect a higher level of safety and reliability in terms of receiving payments compared to investors in lower-rated tranches.

The AAA rating is reported to cover approximately 59% of the $2.85 billion value of the collateral. This rating system is crucial for categorising when dealing with billions of dollars with of assets.

Why Securitise $700 million?

Well, it hinges on repayment from the borrowers of the 89 smaller loans, where SFS is generating revenue through interest. In the event of borrower default, Sotheby’s can recoup losses by auctioning the artworks and collectibles, a process they undertake approximately 500 times annually. Simply put, loan securitisation involves combining smaller loans into a larger bundle, a ‘bond.' Each investor, whether a financier or wealth manager, that SFS has secured owns a share of that bundle. Why would each investor want a slice of this bundle? Essentially, each investor sees the potential for substantial returns, particularly as more than half of the deal received AAA ratings (the highest credit rating), which promises potentially higher yields compared to the other investment securitised categories based off the credit rating system. This stems from various factors including the distinctiveness of the collateral and the scarcity of investment opportunities backed by art.

However, with more than half of the investors securing AAA ratings, which signify a low risk of default, this presents an interesting dynamic for Drahi. The deal must prioritise and cover payments within these securities first. Although, with nearly $3 billion worth of art to sell compared to the $700 million securitisation, I'm sure Drahi is resting somewhat easier. There are also broader risks involved, particularly if one of the smaller loans defaults.

Other risks to consider include fluctuations in the value of the collateral, which is evaluated in-house, by Sotheby’s team of experts, and likely by an additional external party. The value of collectibles can be influenced by market conditions, and a significant decrease in value may not be sufficient to cover the outstanding loan balance. Liquidity risk is also a concern, as art and collectibles are generally considered illiquid assets. Moreover, there is a concentration risk, where the performance of the securitisation may be impacted if the collateral is not sufficiently diversified. However, these risks were carefully assessed by Barclays Plc, BNP Paribas SA and Morgan Stanley who, according to Bloomberg, serve as joint leads on the transaction and are well-equipped to make informed decisions.

Overall, this securitisation illustrates a significant level of investor confidence in SFS. With this influx of funds ($700 million), SFS can continue to expand its lending activities and bolster its business. This strategy seems logical for several reasons. Firstly, Sotheby’s stands to gain irrespective of the outcome. If borrowers repay their loans, SFS earns interest income. In the event of a default, Sotheby’s can sell the artwork, earning favourable fees off the top and safeguarding the security backing the bond.

This approach represents a traditional method for Sotheby’s to diversify its portfolio, especially during uncertain market activity. In theory, consolidating numerous smaller loans into a single securitisation makes it less vulnerable to volatility compared to managing 89 smaller loans individually. The primary concern for investors would arise if all 89 smaller loans defaulted simultaneously, similar to the financial crisis of 2008. However, the likelihood of such a scenario is minimal, resulting in strong profit margins and reduced risk for SFS.

What is Sotheby’s Collateral In the $700 million Securitisation?

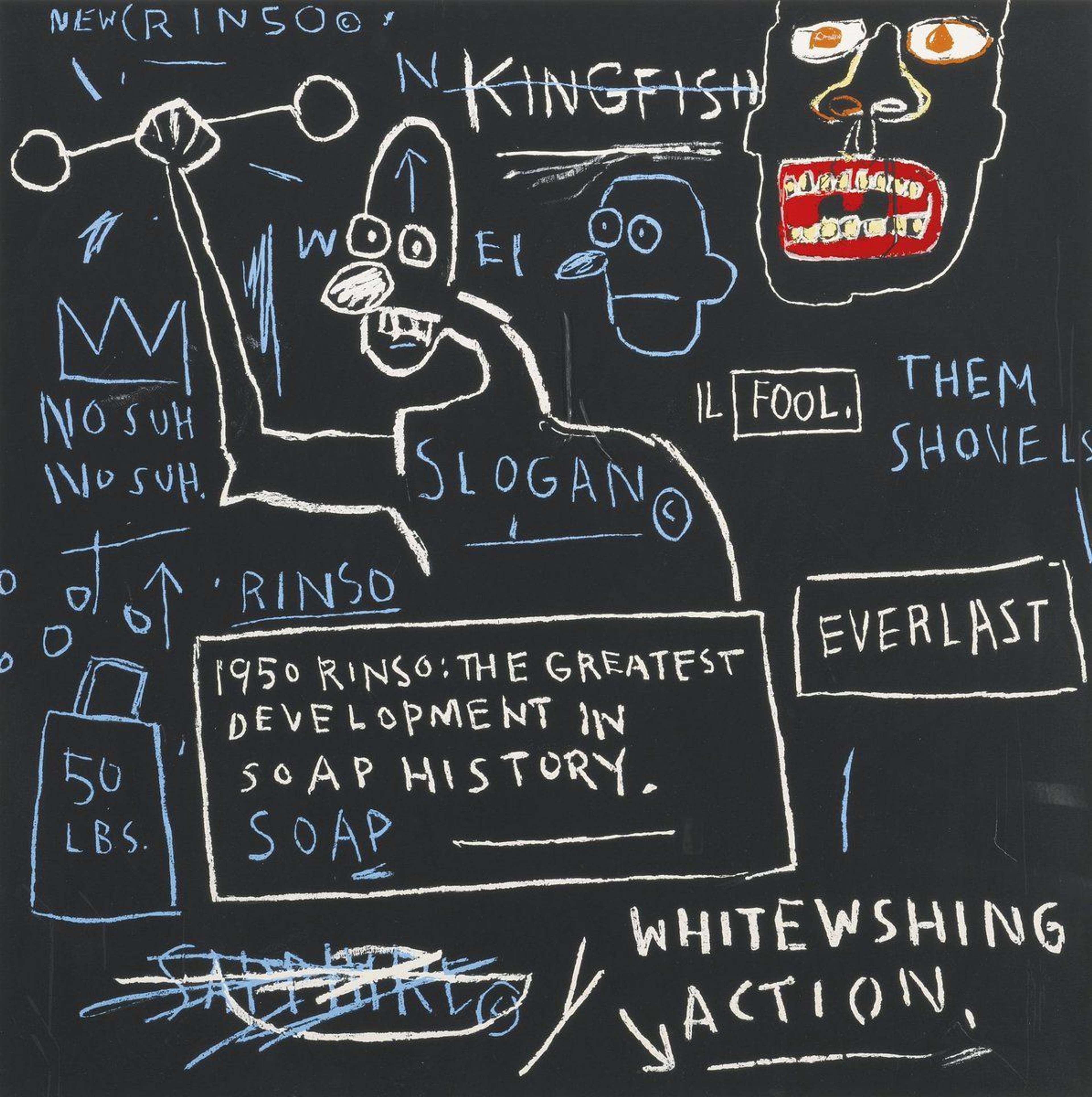

In this securitisation deal, Sotheby’s is leveraging the 89 'smaller loans' as collateral, backed by 2,484 works of fine art and collectibles. According to Bloomberg, it was revealed that the top five painters whose art will serve as collateral for the debt primarily belong to the modern and contemporary art categories. These include renowned names such as Pablo Picasso, Frida Kahlo, Andy Warhol, and Basquiat. However, the identities of the individuals who own these works within one of the smaller loans remain confidential.

To grasp the liquidity of these artists, let’s look to the resale values in the latest May auctions. Sotheby’s offered a collaborative untitled piece by Warhol and Basquiat which sold for $19.3 million, a notable surge from its previous record of $2.6 million. Other strong resale values were set by these artists individually. You can explore our auction reports–Sotheby's, Christie's and Phillips– offering a comprehensive analysis of their individual works' resale values.

So, is Sotheby’s displaying confidence in the art market? Investors in the securitisation seem to think so, evident from the reported surge in demand for participation in this bond. Initially set at $500 million, the request escalated to $700 million. Also worth noting, while the majority is secured by art, the $2.85 billion value does include other collectibles too. Our Commissioning Editor, Erin Atlanta-Argun gives her take on collectibles and luxury assets in the 2024 art market in Old Masters are Out, Luxury Collectibles & Editions are In.

Yet, SFS must act swiftly, with the $700 million reportedly due back by March 2027 and the interest by December 2031. Putting this into perspective, in the May auctions alone, Sotheby’s raked in nearly $530 million, roughly 75% of the total sum.

What Does Sotheby’s Securitisation Mean For The Art Market?

In his recent piece for The Art Newspaper, Tim Schneider presents an intriguing perspective on SFS’s strategic approach to art lending, shedding light on how auction houses like Sotheby’s influence the flow of art within the market and pointing out, that they are not the first company to securitise a bond. Building upon Schneider’s insights, I'd like to expand on this notion, suggesting that this dynamic leads to a curious kind of market saturation orchestrated by both the ultra-wealthy and auction houses, who are both buyers in the art market. When a select few wealthy collectors consistently acquire a large volume of artworks, they essentially take these pieces out of circulation, reducing accessibility for other potential buyers. What happens is a concentration of ownership, which creates bottlenecks in the market driving prices upward, making it increasingly difficult for new collectors to enter or participate in certain segments of the art market.

This trend is reflected in the rising number of third-party guarantees in auction sales, which ArtTactic reports to have increased by 19% in the recent May sales compared to the previous year. Keep in mind that among those who secure works for auction houses as third-party buyers, some may indeed have art collections. However, it's worth considering that these art collections might not be displayed on the walls of their homes. Instead, they are likely stored in freeports and could potentially be used as collateral for an art-backed loan (enter SFS), where they will remain in the freeport facility. Citing Barron’s and referring to Sotheby’s $700 million securitisation, it is revealed that over 80% of the artworks are held in storage, with 18.2% located in a collector’s residence or office, and a mere 1% displayed in a museum or exhibition.

I agree with Schneider's analysis, emphasising the significant control exerted over the top segment of the market, with SFS playing a pivotal role. This influence is widely recognised, particularly in curating the high-end market for specific buyers. However, recent reports have found that the upper segment of the market is contracting. The consensus reflecting on the 2023 art market indicated an expansion in the core sector of the market, marked by an increase in the number of lots sold at lower price points. Rather than being a cause for concern, this trend underscores the growth observed in the luxury collectibles segment of 2023, where items like jewels and watches accounted for 16% of sales. Similarly, there was a notable uptick in prints and limited editions, reflecting an 18% increase from the previous year.

Marilyn (complete set) real-time value / Andy Warhol © MyArtBroker

Marilyn (complete set) real-time value / Andy Warhol © MyArtBroker While prints often reside in the shadow of high-value originals in marquee auctions, they offer accessible entry points into the art market, typically priced between $100,000 and $1 million. This heightened interest is exemplified by recent successes, such as the complete set of Warhol's Marilyn prints sold at Christie's day sale for $3.6 million with fees, surpassing its 2023 sale of $2.9 million. Such restricted access to the upper tier of the market has spurred significant growth and interest in prints, providing avenues for portfolio diversification. Furthermore, the million dollar valuations of certain prints also enters consideration for art-backed loans, indicating the growing value in prints as a medium.

Explore the real-time value of Andy Warhol's Marilyn with MyPortfolio. Get a Valuation Today.

Looking Ahead

As we bid farewell to the excitement and flurry of May, encompassing groundbreaking announcements by the auction houses and the spectacle of the May auctions, we now turn our attention to June. While the outcomes of Sotheby's and Christie's financial strategies remain uncertain, we lack a crystal ball to foresee them; only time will reveal their impact. Looking ahead to June, Phillips Prints & Editions sale looms on the horizon in the early part of the month. With a plethora of offerings from blue chip artists, we anticipate the possibility of new auction records. Stay tuned for our forthcoming auction report and follow us on X, @MyArtBroker for real-time updates on the outcomes.

The May New York Sales

The highlight of May is always the New York sales. As is customary, auction houses including Christie’s, Sotheby’s, Phillips–and let’s not forget Bonhams–conducted their May New York sales, starting on Monday the 13th and concluding on Saturday the 18th. While attention is typically drawn to the lots themselves and the numbers produced, this year’s marquee spectacle saw an unsettling shift in focus to an unexpected issue: Christie’s cyberattack.

The Numbers

First, let’s start with the numbers. This year, the auction houses adhered to their traditional formats. Sotheby’s combined The Now and Contemporary Evening auction, followed by the Modern evening and day auctions. Phillips conducted its Modern & Contemporary art evening sale, followed by the day sale in two sessions. Meanwhile, Christie’s stood out as the only house to secure a single-owner collection. They began with the Rosa De La Cruz sale, immediately followed by its 21st century evening sale and its 20th century evening sale, with the day sales hosted in between.

Overall, across the three auction houses' evening and day sales (including impressionists sales), a total of 1,671 lots were sold, excluding any post sale transactions. These artworks garnered a combined hammer price of $1.15 billion. This figure fell 3% below the low presale estimate across 14 sales. Including Bonhams' two sales, there were an additional 77 lots sold, bringing in an extra $8.9 million (hammer).

In comparison to the same set of sales in 2023, Christie’s, Sotheby’s, and Phillips faltered by 22%, collectively. However, it's worth noting that the 2023 totals were bolstered by three additional single-owner collections: Mo Ostin, Si Newhouse, and the Gerald Fineberg collections.

The Artworks

In 2023, the art market faced challenges, prompting art enthusiasts and industry players to anticipate similar road bumps ahead. A prevailing sentiment emphasised that in tight or stagnant markets, the emphasis on quality becomes paramount. While quality and condition are always critical in the print market, for Ultra-High-Net-Worth (UHNW) collectors and investors in the originals market, it's not just any blue chip artwork they seek—it's the one in pristine condition with impeccable provenance.

Among the heavyweight blue chip artists we expect to see in the sales—Keith Haring, Roy Lichtenstein, Andy Warhol, Yayoi Kusama, David Hockney, Gerhard Richter, among others—one artist stood out by a significant margin: Jean-Michel Basquiat. Reflecting on the 2023 sales, Basquiat's influence was tangible, with Christie’s and Sotheby’s showcasing “The Battle of the Basquiats,” ranking in $95.6 million across two works, El Gran Espectaculo (The Nile) and Now’s The Time. While these works performed favourably, this year's sales demonstrated a more pronounced impact, with an arguably strategic tactic, featuring more works with prestigious exhibition histories and provenance from private collections—precisely what matters in a discerning, yet bullish market.

Also within the sales, there were notable achievements by various Post War and Modern artists. Artsy highlighted the establishment of ten new auction records, with a particularly impressive showing by Leonora Carrington. However, what stood out as particularly intriguing was the presence (or absence) of Hockney's works, which were notably rare and departed from the usual Hockney pieces frequently encountered in major sales. We have been observing this trend closely since the March London auctions and remains one we will continue to monitor closely. In our latest podcast on MyArtBrokerTalks, I engage in conversation with Jasper Tordoff and Louis Denizett as we delve into the remarkable performance of Basquiat and the perplexing subdued presence of Hockney. For a comprehensive analysis, subscribe to our podcast, MyArtBrokerTalks and share your feedback by leaving us a rating.

Read Sotheby’s Auction Report

Read Christie’s Auction Report

Read Phillips Auction Report

The Incident and It’s Broader Implications

As expected, the art world continues to grapple with and closely monitor the aftermath of Christie's cyberattack. As the issue was observed, Christie’s decided to continue with their sales making the decision to leave their website offline, and for good reason at the risk of compromising the privacy and data of the buyer pool. While Christie's acknowledged a “technology security issue” via email, the auctions proceeded as planned with a healthy level of bidding activity. However, the breach has broader implications, particularly concerning the breach of sensitive information for Christie's UHNWI client base.

Throughout the sales, Christie's remained tight-lipped, understandable given the significant value of art at stake, which exceeded $800 million. It wasn't until Tuesday, May 28th, that The Art Newspaper broke the news of the hackers, known as RansomHub, claiming responsibility for the attack and threatening to release private data. Details remain scarce, but it's reported that the group now possesses full names, document numbers, nationalities, and birthdates of the auction house's clients and are threatening to release this information. We can only assume that Christie's is taking the necessary steps to limit the amount of private data exposed, though the specifics of their actions remain undisclosed.

The unfolding of this story raises significant concerns, not just for Christie's but for the art market as a whole. Confidence and trust are essential elements in any market, and incidents like these can seriously undermine that confidence barometer among market participants. However, Christie’s is not the sole player in this arena; Sotheby’s has also embarked on significant financial manoeuvres, the consequences (or rewards) of which remain uncertain. Ultimately, figures like Christie's, Guillaume Cerutti and Sotheby's, Patrick Drahi are key figures in the art market, participating as much as reporters and collectors, dealers and gallerists. The first half of the year in the art market has unfolded in an unexpected manner, defying predictions. All we can do now is observe and track the outcomes, all the while enjoying artworks by our favourite renowned artists along the journey.