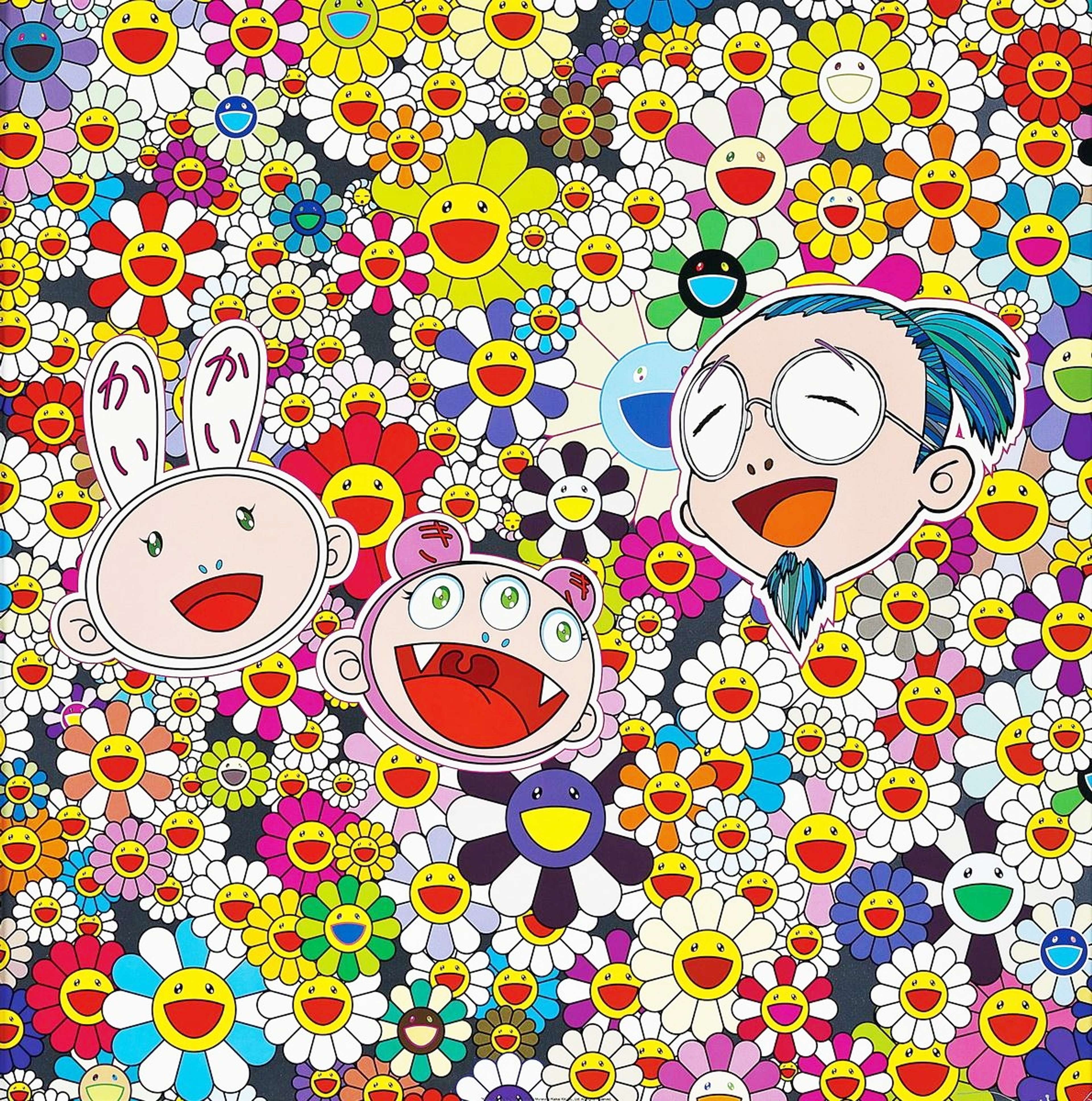

Kaikai Kiki And Me © Takashi Murakami, 2010

Kaikai Kiki And Me © Takashi Murakami, 2010Market Reports

If in 2021 it was hard to escape the buzz surrounding the boom of the NFT market, it seems that today it is hard to escape headlines referring to the crypto slump and NFT crash.

With the market cooling down in the second quarter of 2022, the question everyone seems to be asking is: what will happen to NFTs? Were they just a temporary fad or are they here to stay?

While predictions are hard to make, in this article we take a look at what is currently happening and offer you alternative investment options if you're looking for a safer bet.

A History of the NFT market

But first things first. While NFTs have had us addicted to Discord and Telegram groups, impatiently awaiting the next record sale or ground-breaking project, it may be worth brushing up on our crypto-knowledge.

An NFT is a Non Fungible Token, a unique, digital-only asset that has a set of distinctive characteristics that make it unlike any other asset. This means that, unlike Fungible tokens like cash, bonds or shares of a company, Non-fungible tokens cannot be exchanged or traded for an equivalent token.

NFTs are stored on a blockchain, a digital ledger that allows keeping track of sales, and are sold in cryptocurrencies - Ethereum or Solana being the most common. Their presence on the blockchain entails that NFTs are easily traceable and provenance and authenticity are more easily ascertained - two thorny issues that haunt the business of auction houses.

Some other characteristics that make NFTs different to other alternative assets like art are that they offer the possibility of fractional ownership, meaning you can buy even just a portion of an NFT, and that they can also work as entry tickets to exclusive members-only events.

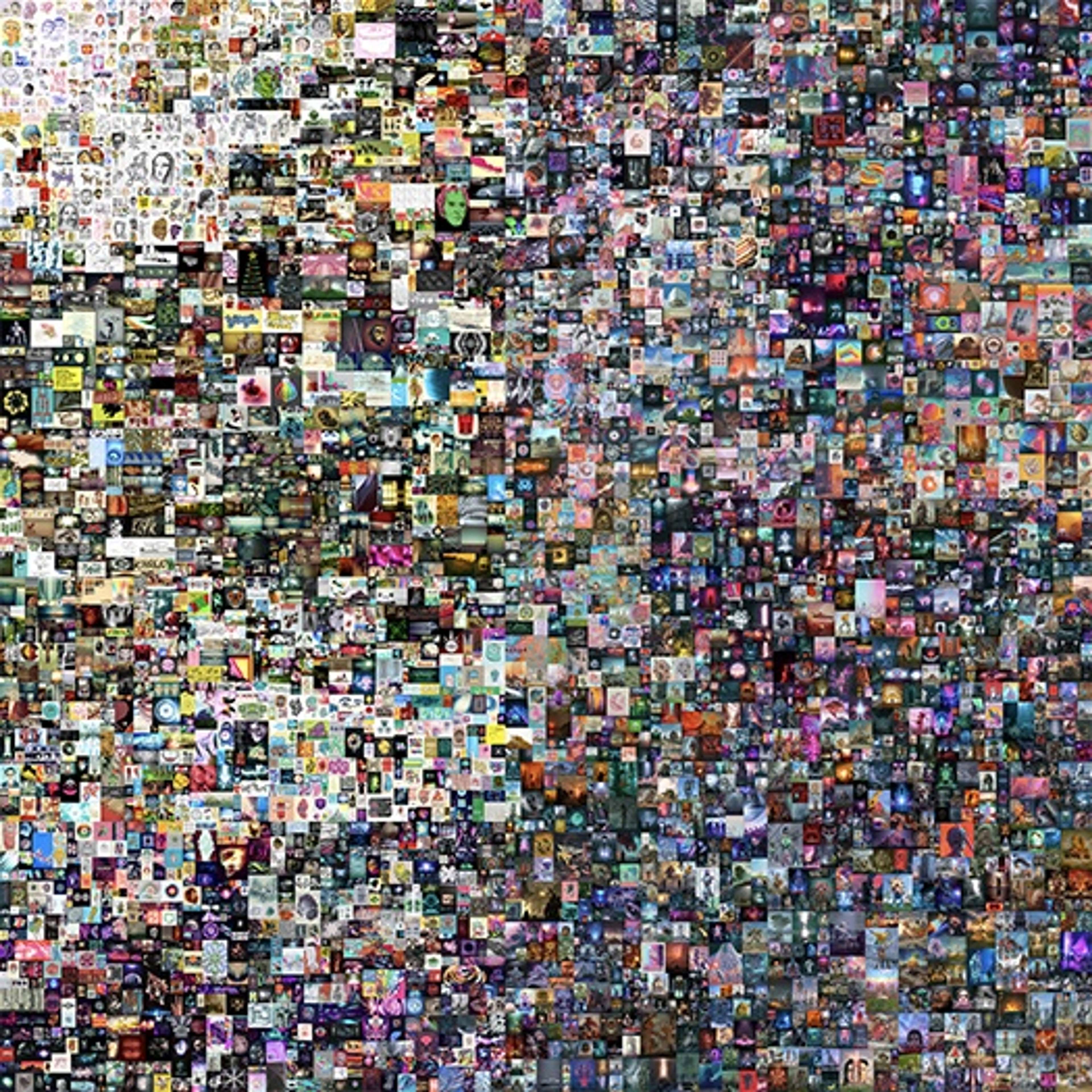

Image © Christie's / Everydays: The First 5000 Days © Beeple, 2021

Image © Christie's / Everydays: The First 5000 Days © Beeple, 2021First appearing on the international scene in the mid-2010s, NFTs gathered momentum in 2017, when the online video game CryptoKitties allowed users to collect, “breed” and buy virtual cartoon cats with cryptocurrency. After CryptoKitties, Christie's sale of Beeple's Everydays: The First 5000 Days for $69.3million catalysed the art world's attention to the metaverse, prompting innumerable debates around the authority of digital art.

However, it was only in 2021 that the market for NFTs properly exploded. Through projects like Bored Ape Yacht Club or Crypto Punks, NFTs took over the world, leading established auction houses and galleries like Sotheby's and Pace to open their own digital NFT marketplaces. Soon, celebrities and artists of the calibre of Jeff Koons, Takashi Murakami, Paris Hilton and Bella Hadid had joined the ranks of crypto-enthusiasts and launched their own NFT projects.

Where we're at now: Q2 2022 and the Bear Market

After experiencing a peak in sales in January and February 2022, the NFT market has seen a sharp decline in the total volume of NFT sales and the number of buyers and sellers on the market.

June 2022 in particular saw a 12-month low, with sales plummeting to $1 billion - the worst performance of the market since June 2021 (when sales were at $648 million). Data from Chainanalysis shows that while the market was worth $3 trillion in November 2021, it is now worth less than $1 trillion.

In the second quarter of 2022, things got even worse. A recent Q2 market report published by Non Fungible shows that since Q1 2022, the volume of sales is down 20.05%, from 12,639,781 to 10,105967. The number of sellers is down 35.88% and the number of buyers saw a decrease of 25.41%.

Even more strikingly, the total profit at resell went down 46%, from $3,502,706,752 to $1,888,762, 534, a drop of almost 50%. The main metric to have increased in the last three months has been the Average Duration of Ownership, which has increased by 55%.

The total number of sales remains equal between the primary and the secondary markets, although the total number of sales in US dollars is remarkably higher in the secondary market, which accounts for almost 80% of the total sales of Q2 2022.

This data suggests that collectors are currently not interested in taking great risks when investing in new and upcoming projects surfacing on NFT platforms, and prefer to trade in the secondary market, where prices remain higher.

The numbers suggest that the NFT market is now currently a "bear market", defined as a market that experiences a 20% decline in pricing from its recent highs.

Why Did the NFT Market Crash?

The crash of the NFT market can be seen in relation to the concurring downturn of the cryptocurrency market. Since November 2021, Bitcoin is down more than 56%, and Ethereum more than 63%.

While there are many factors that can account for the collapse of these markets, the most important determinant has been the rising inflation and interest rates. With inflation through the roof in a post-pandemic world, interest rates have been raised significantly, making the highly volatile and risky NFT and crypto markets less appealing as investment assets.

Globally, inflationary pressure, rising interest rates and a deteriorating macro-economic outlook have weighed on the prices of almost all investment classes.

However, while the market for assets on the riskier end of the investment spectrum has taken a hit globally, this situation is most pronounced in Europe, due to the outsized impact of the Russia-Ukraine crisis and the cost of living crisis.

Will The Market Recover?

The Debate

As always, making predictions about the future performance of a certain asset can be tricky. Since their appearance on the market, NFTs have caused dividing debates. Their current performance on the market has been no less polarising. On the one hand, NFT sceptics maintain that the lack of any inherent value of NFTs will determine their doom.

On the other hand, defenders of NFTs and crypto claim that the NFT market is normalising, meaning that the downturn of the market should be read as a sign of cyclicality and that the market will recover.

An example often quoted in this context harks back to the early days of the Internet, to the so-called dot-com bubble. Attracting wide speculation and hype, the Internet bubble that dominated the late 1990s burst in March 2000, only to eventually recover. Between March 1997 and March 2000, the NASDAQ 100 rose by over 450%.

However, within one year it had fallen by over 65%. The market bottomed around 2002 and then began a steady recovery. It is clear now that the Internet and the technology that ran off it was not just a fad. Will something similar happen to NFTs? Only time will tell.

Image © Christie's / CryptoPunks © Larva Labs, 2021

Image © Christie's / CryptoPunks © Larva Labs, 2021Alternative Investment Opportunities

In the meantime, it might be worth looking towards different alternative assets that offer a more stable investment, like traditional art and the contemporary prints and multiples Market.

Data from our latest Q2 Contemporary Report suggests that in times of economic uncertainty and volatile markets, the contemporary prints and multiples market has demonstrated its resilience and stability, performing even better than traditional art during the pandemic. While sales have begun to stabilise following the boom of 2021, the print market has continued to grow steadily.

Prints are easily manageable and offer both a less risky venue for investing and a way of diversifying your portfolios.

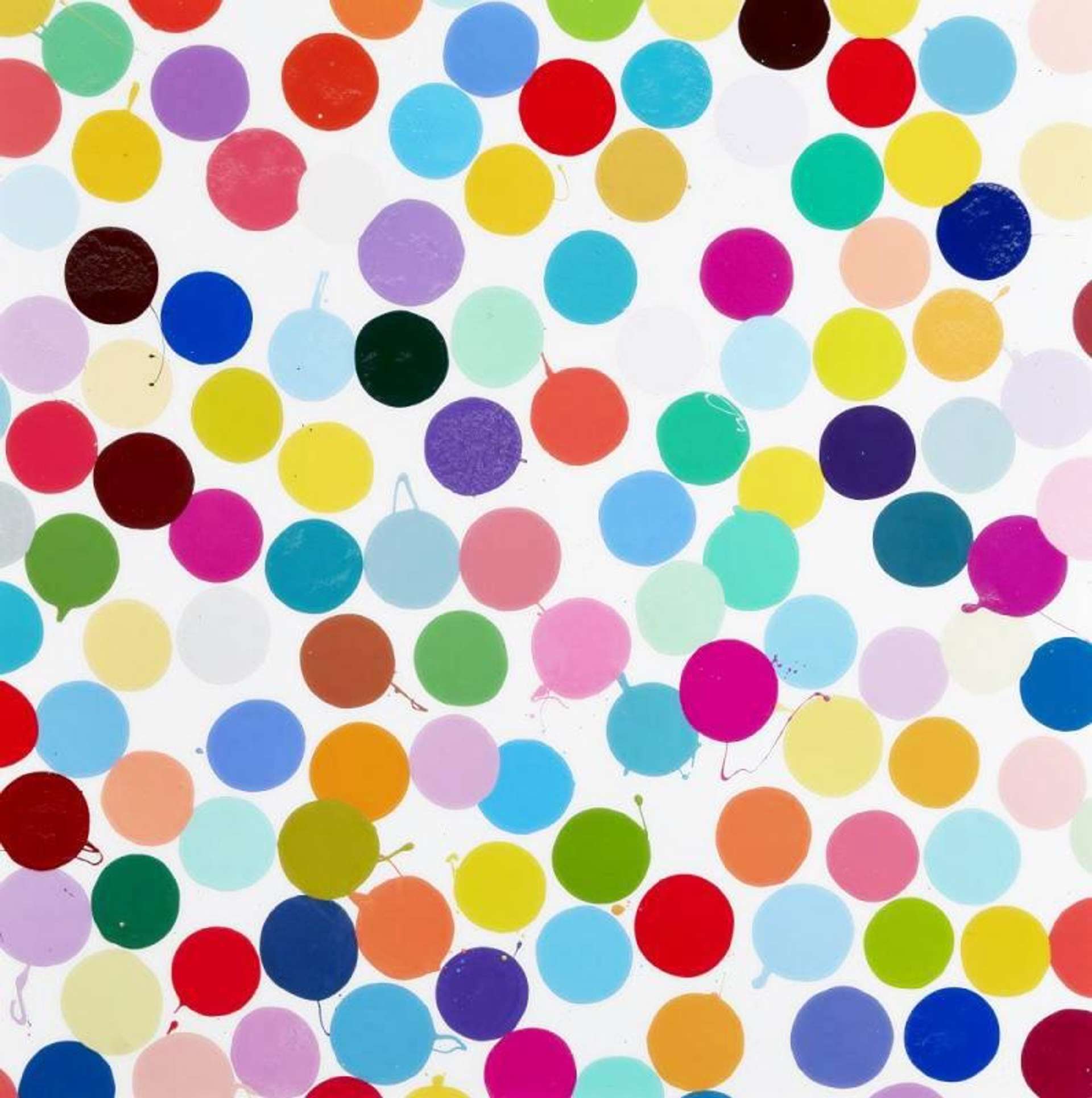

Image © Sotheby's / You Don't Have To Say It Today © Damien Hirst, 2016

Image © Sotheby's / You Don't Have To Say It Today © Damien Hirst, 2016Damien Hirst's The Currency

A trailblazer of contemporary art, Damien Hirst was among the first to jump on the NFT trend. His project The Currency, announced in July 2021, offered buyers the opportunity of buying an NFT version of one of 10,000 Spot paintings. For each NFT Spot painting, Hirst also created an equivalent work on paper.

Buyers had then the chance to decide whether to keep and resell the NFT or to exchange it with a physical work. The project drew attention to the difference between traditional and digital art and asked buyers to decide whether to invest in digital or physical art.

A year later, the results are in. On 27 July 2022, Hirst announced that 4851 people had decided to keep their NFT, while 5149 had traded it for the physical version. Accordingly, Hirst claimed that on 9 September 2022, he will be burning 4851 works on paper.

The outcome of the project, which Hirst described as an experiment in belief, is but one re-affirmation of collectors' trust in traditional, physical art over the digital.