Ponte Sant'Angelo, Wrapped © Christo 2011

Ponte Sant'Angelo, Wrapped © Christo 2011

Christo

17 works

Key Takeaways

Christo's prints, often preparatory drawings for his large-scale installations, range from several thousand to tens of thousands of pounds. Following his death in 2020, the market has surged, with top prices achieved, such as £146,345 for Running Fence (1975). Authentication requires verifying provenance, examining signatures, and consulting the catalogue raisonné Christo and Jeanne-Claude: Prints and Objects. Condition is crucial; store prints in stable environments, avoiding sunlight and humidity. Major exhibitions and anniversaries can boost market interest, such as Christo and Jeanne-Claude: Paris! at Centre Pompidou.

Christo Vladimirov Javacheff, known simply as Christo, was a Bulgarian-born American artist renowned for his monumental environmental installations. Christo's work continues to inspire discussions about art, environment, and impermanence, and sustains a thriving print market - if you’re looking to sell a print, this guide will talk you through the process.

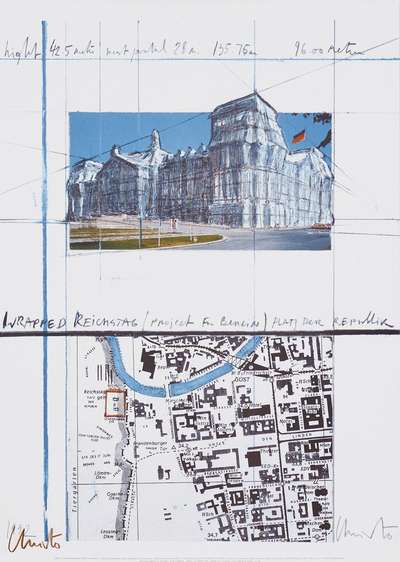

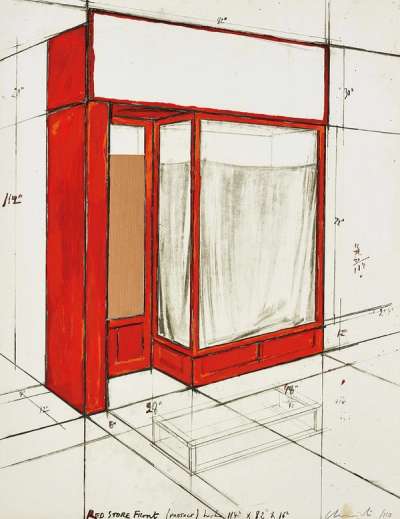

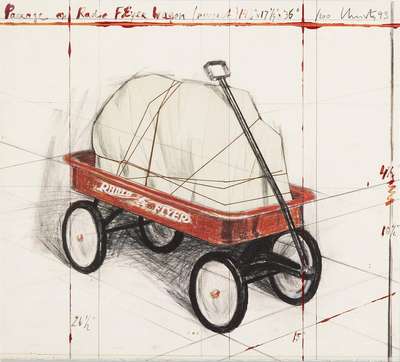

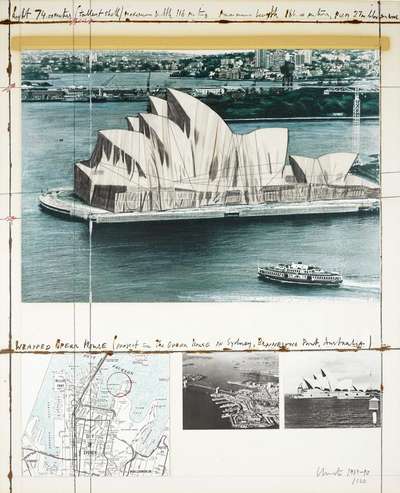

Christo worked with his wife Jeanne-Claude until her passing in 2009, together gaining international acclaim for wrapping landmarks and landscapes in fabric. Their projects, often years in the making, temporarily transformed familiar sites into surreal, thought-provoking artworks. Christo produced and sold prints to prepare for and fund their projects, subsequently giving the art world an opportunity to preserve part of these temporary masterpieces.

How Much Do Christo Prints Sell For?

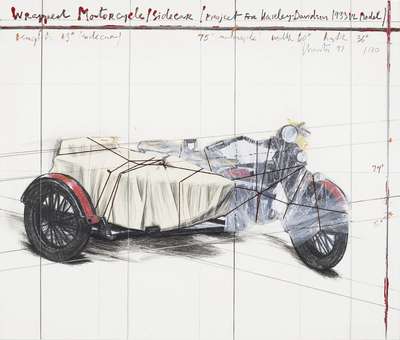

Initially, the only way to own a piece of Christo and Jeanne-Claude’s work was through their donation of used materials to participants after project competition. In the 1960s, however, Christo began printmaking as a means to fund his larger environmental projects and offer more accessible works to collectors. Over several decades, he produced a diverse range of prints, including lithographs, etchings, and screenprints. These works often featured preparatory drawings, collages, or visual documentation of his monumental installations, providing insights into his creative process and allowing collectors to own tangible pieces of his otherwise fleeting art.

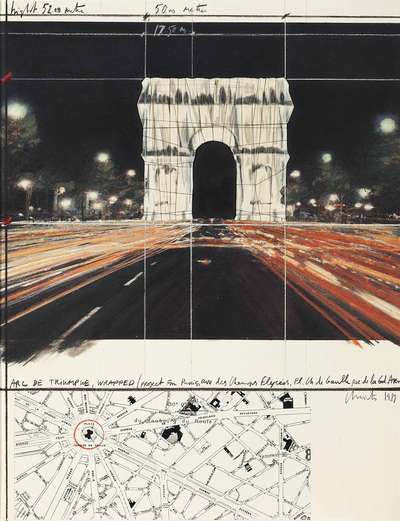

The value of Christo's prints can vary significantly based on several factors, including rarity, size, edition number, and the popularity of the project they depict. Generally, smaller prints or those from less famous projects might sell for a few thousand pounds, while larger, more sought-after pieces can command tens of thousands. Limited edition prints from iconic projects like the Arc de Triomphe, Wrapped (1989) in Paris tend to be particularly valuable.

Despite a generally steady increase in value, one lithograph achieved a standout record at auction in Munich, Germany, in 2022. Running Fence, Project For Sonoma County And Marin County (1975) sold for £146,345. This particularly high value could be attributed to several factors - from rarity of the print to the scale and mythical nature of the original project as one of Christo and Jeanne-Claude’s most ambitious. Standing 5.5m tall and running 39.5km long, and taking 42 months of preparation, the Running Fence stood for only two weeks in September 1976. It left no mark on the landscape north of San Francisco, and was funded entirely by sales of prints, collages, preparatory drawings, and models. As such, it is revered as one of Christo’s most impressive and original projects.

For context, Christo’s Floating Piers (2016) sold at auction in 2020 for £21,855, and the Arc De Triomphe, Wrapped (1989) sold in 2023 for £16,208. Other sought-after high-value prints include Wrapped Globe (Eurasian Hemisphere) (2019) and Wrapped Opera House, Project for Sydney (1991). As with all art, prices can fluctuate based on broader market conditions, individual sales, and changing collector preferences. For the most accurate and up-to-date valuation, it's advisable to consult recent auction results, reputable galleries specialising in Christo's work, or professional art appraisers who have expertise in contemporary prints.

How Do You Authenticate a Christo Print?

The first step, and most crucial part of determining a print’s authenticity, involves examining the print's provenance and tracing its history of ownership and exhibition. Documentation such as certificates of authenticity, gallery receipts, or inclusion in exhibition catalogues can provide valuable supporting evidence, enabling experts to trace and validate a print’s exact position in an edition.

Physical examination of the print is also important. Christo’s projects were well-documented; however, even with such recognisable works, forgeries can still exist, particularly as the artist’s method of laying out and presenting his prints varied so much from project to project. Experts will look for consistency in line quality, use of colour, and compositional elements characteristic of Christo's work. The paper quality, printing technique, and any embossments or stamps should align with known examples from the same period and series. For definitive authentication, consulting with the Christo and Jeanne-Claude Foundation or one of the artist’s catalogue raisonnés is advisable. One such catalogue is Christo and Jeanne-Claude: Prints and Objects by Jörg Schellmann (updated in 2021).

Edition and Signature

Most of Christo’s prints are signed, and many are numbered. However, the method lacks consistency, and some of his prints do not have traceable edition sizes. Where this information is available, it will be presented in pencil in either the top or lower margin, often accompanied by the project’s title, notes, contact details, measurements and angles, and grid lines. Christo’s signature usually appears simply as “Christo.”

Browse Christo prints on the Trading Floor and find out more about the print market growth on the MAB100 Print Index.

Looking to Sell Your Christo Prints?

Request a free and zero obligation valuation with our team without hesitation. Track your prints & editions with MyPortfolio.

Has Your Christo Print Been Kept in Good Condition?

A print that is in excellent condition will command a higher price and be more appealing to collectors. If you own a Christo print, it is advisable to store it in a stable environment, away from direct sunlight and extreme temperatures and humidity. Prints should ideally be stored in flat, acid-free portfolios or folders; however, if your print is on display, make sure the framing is archival-quality, with UV resistant glass, appropriate spacing or matting, and glue or tape that will not damage the paper. If you must handle your print, do so while wearing clean, cotton gloves to prevent oils, moisture, or dirt transferring to the paper.

When you come to sell your print, there are several key signs of damage that may affect the sale price. Fading and discolouration, either of the paper or the printing inks, can indicate sun damage or acid damage. Creases, tears, or punctures can indicate damage from poor handling. Foxing (small, brownish spots) can be the result of insects or mould. Prints made using unconventional materials, that have a complicated exhibition history, or that are larger in size are likely to show more signs of wear and tear.

If you notice that your print has sustained damage, it is possible to consult a conservator about restoration. Although restoration may not entirely restore the original value of the print, it will help you preserve the piece and achieve the best possible sale. MyArtBroker can help you begin the restoration process.

When is the Best Time to Sell My Christo Print?

Timing is crucial when selling a Christo print, and success often hinges on patience, market awareness, and strategic decision-making. While Christo's work has consistently held value, his passing in 2020 marked a renewed interest in his work, and therefore a market and value boom. Nine out of the top 10 highest-value print sales have happened since this date.

Major exhibitions can significantly impact market interest. For instance, the comprehensive Christo and Jeanne-Claude: Paris! exhibition at the Centre Pompidou in 2020 reignited enthusiasm for their work. Keep an eye out for upcoming retrospectives or sales of contemporary art, typically held in spring or autumn, as these events often attract serious collectors. For example, Christo and Jeanne-Claude: Ocean Front. 50 Years Later, running from July to December 2024 in Newport, and Christo und Jeanne-Claude: Sammlung Würth, running from November 2024 to November 2025 in Germany.

Auction houses like Christie's, Sotheby's, and Phillips regularly publish market reports and auction results on their websites. These resources can help you gauge whether the current climate is suitable for starting the sales process. Additionally, pay attention to anniversaries of Christo's iconic projects, as these can stir up discussion about his work and encourage buyers to seek out valuable pieces.

MyArtBroker offers advanced art tech tools to help you determine the optimal time to sell. Our MyPortfolio service features an AI-powered value indicator that provides real-time valuations of individual prints based on both public and private sales data. Combined with our complimentary valuations, we can help ensure your print achieves maximum value by selling at the perfect moment.

Ways to Sell with MyArtBroker

At MyArtBroker, our specialists provide a free market valuation for your artwork, offering a level of transparency unmatched in today’s market. In addition to our valuations, through our online Trading Floor, you can access real-time insights into works by the artist you’re looking to sell, including pieces that are most in demand, wanted, or currently for sale: allowing sellers to trust the valuation that they are provided.

Additionally, the MyPortfolio collection management service grants you free access to our comprehensive print market database. This resource allows you to review auction histories for the specific work you’re looking to sell, including hammer prices, values paid, and seller returns. In a fluctuating market, this historical data is invaluable - and often comes at a cost elsewhere - offering insights into past and current values to further inform decisions based on market timing and conditions. In addition to our specialists guidance, you have concrete data.

Our approach is tailored to align with the unique attributes of each artwork, and offer optimal results:

How a Private Sale Works

Unlike peer-to-peer platforms, which lack specialised expertise, authenticity guarantees, and legal infrastructure for high-value sales, MyArtBroker operates through private sales ensuring a secure and seamless transaction process. We charge sellers 0% to sell, and take a small commission from our buyers, absorbing essential aspects including insurance, shipping, and marketing - at no extra cost to the seller. There is no magic to it, we’re a lean specialised business with less overheads than traditional models meaning we can do better for our clients.

Our revenue is derived from buyer commissions only, which are individually negotiated upon offer, and we aim to give the client the best return in the market place. By focusing on high-value artworks in excess of £10,000, we provide specialised care and expertise, ensuring each piece receives the attention it deserves, while simultaneously maximising returns with our clients. For works that fall below this threshold speak to the team about a recommendation, we offer market advisory free of charge. Our goal at MyArtBroker is to offer a seamless solution, setting us apart in the art market.

Advisory and Recommendations

In cases for artists and artworks, where our existing network of collectors isn’t the best fit due to value, medium or condition we collaborate with reputable partners to facilitate its sale. Carefully tailoring your artwork to the right party. This tailored approach is especially important as it considers the unique attributes of each artwork, providing sellers with the best possible outcome in today’s shifting art market. You can discuss this approach with us without charge as part of our advisory service.

Such recommendations are on a case-by-case basis, and ensures broader exposure and takes advantage of our knowledge of where a work will do best.

Christo Collection Management with MyPortfolio

In addition to our live trading floor, MyArtBroker's MyPortfolio serves as a collection management system, empowering collectors to curate and oversee their prints and editions collection. This feature grants users access to our print market database, uniquely tied to our proprietary algorithm, SingularityX. This algorithm scans and analyses both public auction and private sales data to determine real time valuations of individual print works, factoring in various aspects such as condition, colour, and other factors affecting value.

Read What Powers MyArtBroker's Technology? In Conversation With Stuart Jamieson, Financial Quant to learn more about our algorithm.

Emerging art tech tools are vital in navigating the current, and evolving, digital art market landscape. For instance, by adding Christo prints from our website to the MyPortfolio dashboard, users gain insight into unique sale opportunities and observe market performance and fluctuations as they happen, streamlining the sales process effortlessly. Our pioneering technology has revolutionised art portfolio management, making it more accessible and equipping users with data-driven insights for informed decisions. MyArtBroker harnesses cutting-edge technology driven by data, coupled with a team of industry experts, to deliver an exceptional experience. Our professionals work closely with clients, utilising the MyPortfolio dashboard, to provide personalised guidance for creating a profitable art collection. By merging technology and expertise, we are committed to offering unparalleled curation and customer service.