Everything We've Built

MAB100 © MyArtBroker 2023

MAB100 © MyArtBroker 2023Live TradingFloor

In 2023, MyArtBroker took significant strides in melding the worlds of art and technology, unveiling a suite of revolutionary products designed to empower art collectors and investors. This year we have introduced a trifecta of innovative art investment tools: MyPortfolio, Trading Floor, and the MAB100. Powered by the SingularityX algorithm, which we also launched this year, these tools represent a paradigm shift in the art market, offering unparalleled, data-driven insights. Redefining how art is collected, valued, and traded in the modern era, these advancements embody MyArtBroker’s commitment to access and transparency in the converging worlds of art and investment.

As we reflect on the past year, the intersection of art and technology has become more pronounced than ever before. MyArtBroker, at the forefront of this convergence, has introduced an array of technological innovations this year alone - with a view to fundamentally transform the secondary art market into a more accessible, transparent, and data-driven landscape for collectors and investors.

Our bespoke algorithm, SingularityX, stands as the cornerstone of these innovations: processing a wealth of public and private market data to provide unparalleled insights once exclusive to market insiders. Complementing this is MyPortfolio, a sophisticated platform that redefines art collection management by offering real-time value growth indication, and market trend analysis. We then proceeded to build the Trading Floor, a dynamic platform providing live insights into the supply and demand of our network. Bringing a new level of transparency and immediacy to art trading, the Trading Floor places the information we - as a business - have used for years, on the front-end of our website. More recently, the MAB100 has emerged as an entirely novel art market index - offering an in-depth overview of the prints and multiples marketplace. Integrating comprehensive data from auction houses and private sales, the MAB100 gives collectors an analytical perspective to discover liquidity within the art market.

In 2023, MyArtBroker not only embraces the future of art and technology - we are shaping it.

Art Tech & Algorithms with Charlotte Stewart © MyArtBroker 2023SingularityX: Harnessing Data to Revolutionise Art Investment

At its core, SingularityX is a testament to the transformative power of big data in the art market. By aggregating and analysing extensive market data, it provides a nuanced understanding of art valuation and market trends. The technology behind SingularityX is groundbreaking in an opaque art market. It processes information from over 300 auction houses, private sales and valuations over the last 15 years, unsold rates, series relationships and repeat regression technology, incorporating over 40 different data inputs affecting art valuations. This comprehensive approach ensures that every nuance of the market is captured and analysed, offering a level of market insight previously held by insiders alone.

Enhancing Art Investment Strategies

By harnessing the power of data, SingularityX offers a depth of market insight that redefines what it means to invest in art intelligently. The algorithm serves as the engine behind MyPortfolio and the MAB100, integrating data-first insights and extensive valuation metrics. The problems SingularityX aims to solve include the lack of transparency in the art market, the challenges in understanding the true market value of art, and the reliance on limited auction house data for valuations. It addresses these by incorporating a diverse range of data points, including private sales pricing, artist trends, and related print series.

The team behind SingularityX, includes ex-financial quants, python developers, and expertise from art dealerships, auction and traders. Our algorithm aims to reshape the art market into a more accessible, transparent, and credible space for all collectors.

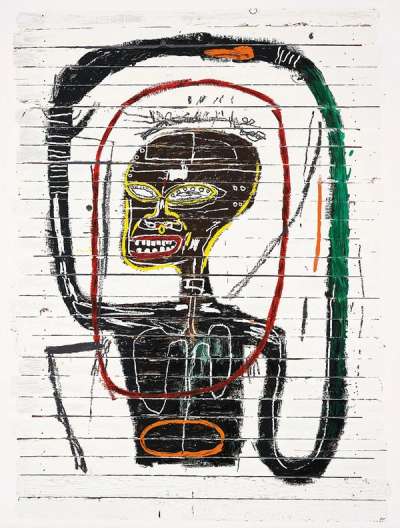

MyPortfolio: A New Era of Art Collection Management

In order to equip collectors with the data-driven prowess of SingularityX, we built MyPortfolio to redefine the dynamics of buying, selling, and valuing blue chip art. Using MyPortfolio, collectors can curate, manage, and understand their portfolios with newfound precision.

Comprehensive Collection Management

Central to MyPortfolio is its ability to offer a personalised dashboard where collectors can manage their prints and editions collection effectively. Users can add an unlimited number of artworks, closely monitoring market changes and understanding the value of their pieces in real time. This tool is essential in a market known for its volatility and rapid shifts, providing collectors with a tool that not only keeps them informed but also ahead of the curve.

Empowering Informed Decisions

MyPortfolio also provides a novel Growth Indicator, which displays an artwork’s Average Annual Growth Rate (AAGR) over the past five years. This tool, combined with the only dedicated print market index in the world, empowers users to make well-informed investment decisions, considering both historical performance and current market trends.

The value estimates generated by MyPortfolio take into account a myriad of factors, including the condition of the print and the average price at auction houses and in the private market, providing a comprehensive and transparent picture of the artwork’s value. This level of detail serves to help collectors understand precisely what to expect in the market, enhancing their decision-making process.

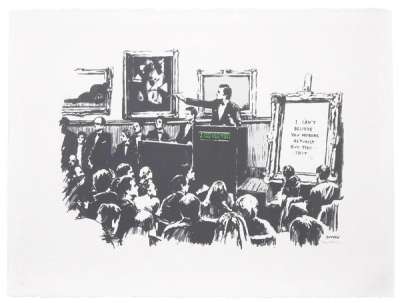

Trading Floor: Redefining Access to the Art Market

Our Trading Floor offers real time insights into the prints and multiples marketplace. By placing the intel of our brokers on the frontend of our website, this tool provides direct access to the pulse of the art market: showcasing live supply and demand data. Bringing an unprecedented level of transparency and immediacy to art trading, the Trading Floor represents a significant shift in how art collectors and investors engage with the market.

Live Supply & Demand

With our Trading Floor, we embrace the capacity of tech to encourage a more active and engaged collector community. With transparent and real time data, it has democratised access to market information - also once in the realm of a select few insiders. This openness fosters a more dynamic and competitive market, where informed decisions can be made rapidly, reflecting the true nature of supply and demand.

This platform is a direct window into our private network of collectors and investors. Displaying prints which are for sale, wanted, and currently held by collectors within the network, the Trading Floor offers immediate access to market demand: providing users with a critical edge in making informed decisions.

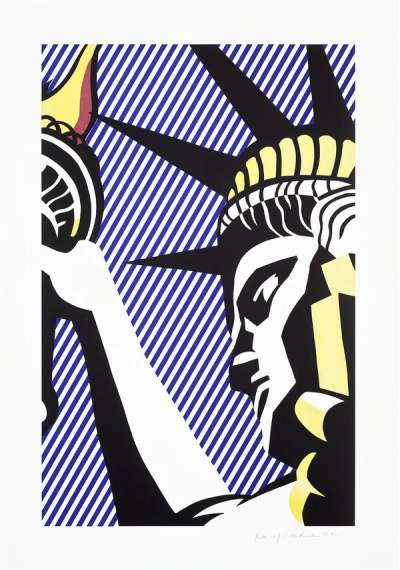

MAB100: The FTSE100 of the Secondary Print Market

Developed with the SingularityX algorithm, the MAB100 marks a significant innovation in the realm of art market analysis. Our comprehensive index offers an overview of the prints and multiples marketplace, showing the top 100 prints ranked by value and demand.

Finding Liquidity in the Blue Chip Art Market

The MAB100 is distinguished by its robust and multifaceted approach to data collection and analysis. It encompasses 100 index constituents, each ranked by their cumulative spending, derived from historical auction sales across more than 300 auction houses, private sales, and the 40 other data points which inform the SingularityX algorithm.

Unlike traditional art market indices that may rely on limited data sets or subjective interpretations, the MAB100’s algorithmic approach delivers an objective and data-driven perspective. This level of detail and precision enables investors to gain a deeper understanding of market movements and trends, making it an invaluable resource for collectors and investors seeking liquidity in their prints and multiples portfolios.

Auto Value Indicator © MyArtBroker 2023

Auto Value Indicator © MyArtBroker 2023Integrating AI into our Valuations Service

AI technology is now deeply implemented into our product, leveraging a sophisticated algorithm connected to a live database. This system meticulously tracks auction sales of blue chip artists, drawing from extensive data across international auction houses and historical private sales records.

Driven by our dedication to innovation, we have embraced the power of AI to augment our algorithm, enabling it to produce not just insightful, but crucially accurate “value trends’’ for each artwork. This enhancement stems from an in-depth analysis of data history, encompassing aspects including hammer prices, average selling prices, and seller returns. We rigorously verify and cross check this data for precision, bolstered by AI’s analytical strength. As a result, our users gain access to current and reliable valuations for the most sought-after prints showcased on our website.

For precision in valuation, we employ a time-based framework, analysing data over periods of 12-months, 5-years, and total sales history. This approach ensures that our value statistics are always relevant and accurate. Each artwork is categorised based on the number of sales it has accumulated within these time frames, offering a detailed and current view of its sales value.

Looking Forward: Art & Tech in 2024

The past year has been transformative in the convergence of tech and the art market; something which we at MyArtBroker have embraced. The pioneering tools we have introduced in the past year alone set to redefine the parameters of art collection and investment. They represent a synthesis of data, insight, and accessibility that empowers seasoned investors and newcomers alike - always on, and for now, free of charge.

Since its genesis, MyArtBroker has prioritised perpetual innovation and fostering transparency in the art market. As we move into 2024, the objective is to remain committed to providing our clients and the broader community with the tools and insights needed to navigate the ever-changing art market with confidence and foresight.