The Role of Fintech in Making Art Collecting & Investing More Accessible

Trading Floor © MyArtBroker 2023

Trading Floor © MyArtBroker 2023Live TradingFloor

For centuries, art collecting and investing has been an exclusive and opaque world, accessible only to a wealthy inner circle. With the rise of fintech, the art market is undergoing a profound transformation. Fintech, or financial technology, refers to the innovative use of technology to enhance, digitalise and streamline financial services.

In the art market, fintech solutions are lowering the barriers to access for art collecting and investing, with certain applications of fintech helping to make the market more transparent. By addressing some of the key challenges and risks associated with art investing, these technologies are creating brighter and broader horizons for art collectors everywhere.

Fintech & The Art Market: An Overview

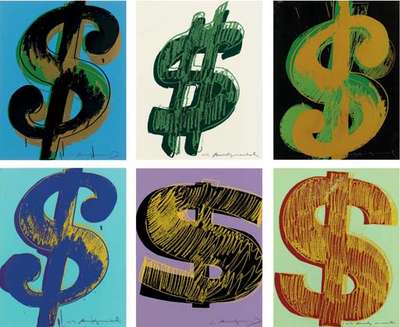

Fintech has brought significant changes to a market infamous for its traditional practices and lack of transparency. Most obviously, the emergence of online art platforms has transformed the way people buy and sell art. These platforms offer a vast range of artworks from around the world, giving collectors and investors access to a wider pool of art than ever before. Online platforms also aid investors in researching and purchasing art, with features such as virtual exhibitions, curated collections, and secure online transactions. Such expanded possibility explains why the online art market is set to reach over £9.3 billion in 2024, a three-fold increase on its value in 2014.

Investment apps are also making art investing more accessible to a wider audience. These apps provide users with a range of investment options such as fractional ownership, where investors can purchase a share of an artwork rather than the whole piece. This enables aspiring investors to get a stake in high-value artworks that may have previously been out of reach, as well as dispersing the burden of risk that is often associated with major art investments.

Aside from online marketplaces and communities, fintech solutions are providing valuable data analytics tools for art investors. Art data analytics tools use artificial intelligence and machine learning to analyse art market trends, prices, and patterns. These tools provide investors with insights and information based on millions of data points, which investors use to make smart decisions. Sophisticated tools can even identify undervalued artworks, predict future trends, and assess the potential risks and returns of an investment.

Online Art Platforms: The Future of Art Collecting & Investing

Online art platforms, like our own, have become an essential space for art collectors and investors, providing a range of benefits and conveniences unmatched by traditional galleries and auction houses. These platforms offer an extensive range of artworks from emerging artists to blue chip names. They also provide detailed information about each artwork including its provenance, condition, and history of ownership.

MyPortfolio: Industry-Defining Technology for Art Collectors & Investors

MyArtBroker is one of the spaces disrupting the status quo of art investment. Anyone interested in the print and multiples market can access our MyPortfolio tool, the only dedicated print market index in the world. Powered by repeat sales regression technology, MyPortfolio enables investors to track supply and demand based on real-time international auction results and thousands of public and private market histories. Seasoned investors can log their owned prints to get data-driven insights into the value growth of their collection, while those looking to buy can instantly acquire information on the performance of different artist markets to help make informed decisions.

Learn more about how to use MyPortfolio in our guide.

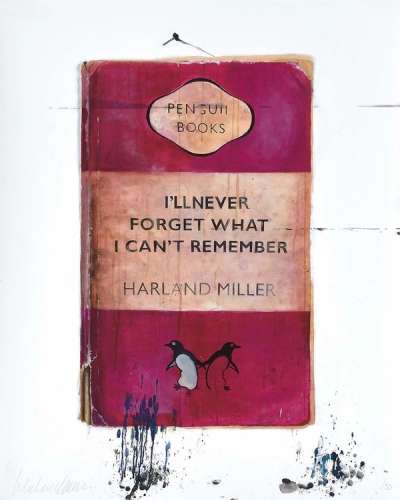

The MyArtBroker Trading Floor: Blue Chip Art Market Transparency Like You've Never Seen Before

Our platform also offers access to the art collector’s community via Trading Floor, providing accurate data on the activity of our private network in the prints and multiples marketplace. Prints for sale, wanted prints, and prints within the network are posted directly to the platform, giving investors real time information about the availability and demand for particular artworks. With the Trading Floor, we've picked up our network insight and put it on the front end of our site: it doesn't get more transparent than that.

MyArtBroker is just one example of the transformative impact online platforms are having on the art market, delivering key information to a wider audience. Even traditional auction houses report a surging number of online sales, with Phillips reporting that 75% of total bids are now made digitally. For Sotheby’s this figure is even higher, soaring to 91%. With newcomers relishing the higher degree of transparency, accessibility, and convenience offered by online marketplaces, they look to be an important fixture in the future of art collecting and investing.

Art Data Analytics: Tools For Informed Decision-Making

In the art market, financial technology is also transpiring as art data analytics. With the ability to analyse vast amounts of relevant information on market trends and historical data, art data analytics tools can crunch the numbers that investors need to make more informed decisions.

While the art market has often been dominated by investments borne of personal connections and insider knowledge, art data analytics are now providing collectors with objective, evidence-backed insights into the market. Data points such as auction results, exhibition attendance, and social media engagement are just some of the factors that can be used to gauge the value and potential of a print or collection.

Big Data & The Art Market

Leveraging these kinds of big data insights helps investors to make the call about buying or selling art. By tracking the performance of their art collections over time, art owners can make strategic decisions about the optimal time and price at which to sell. A buyer might use big data to trace market trends for a particular artist or identify avenues of potential.

The big data approach is the basis of our MyPortfolio tool. Using over 55 different data points, 30,000+ auction histories and real time data for 350 auction houses, our technology can track fluctuations in value to help investors make informed, intelligent buying decisions.

Today, art data analytics tools are an essential part of the modern art market, providing investors with the information they need to make informed decisions. As the art market continues to evolve, utilising data analytics will be a critical component of successful investing, as well as securing a more accessible, transparent industry future.

Challenges and Risks in Art Investing: Mitigating Risk with Fintech

Fintech & Art Authentication: Ensuring Trust

While art investing can be a lucrative and rewarding experience, it has always presented a range of challenges and risks. Art investors need to consider issues such as authenticity, provenance, and condition when making investment decisions. In addition, the tangibility of prints and passion assets exposes them to the risk of fraud, theft, or damage.

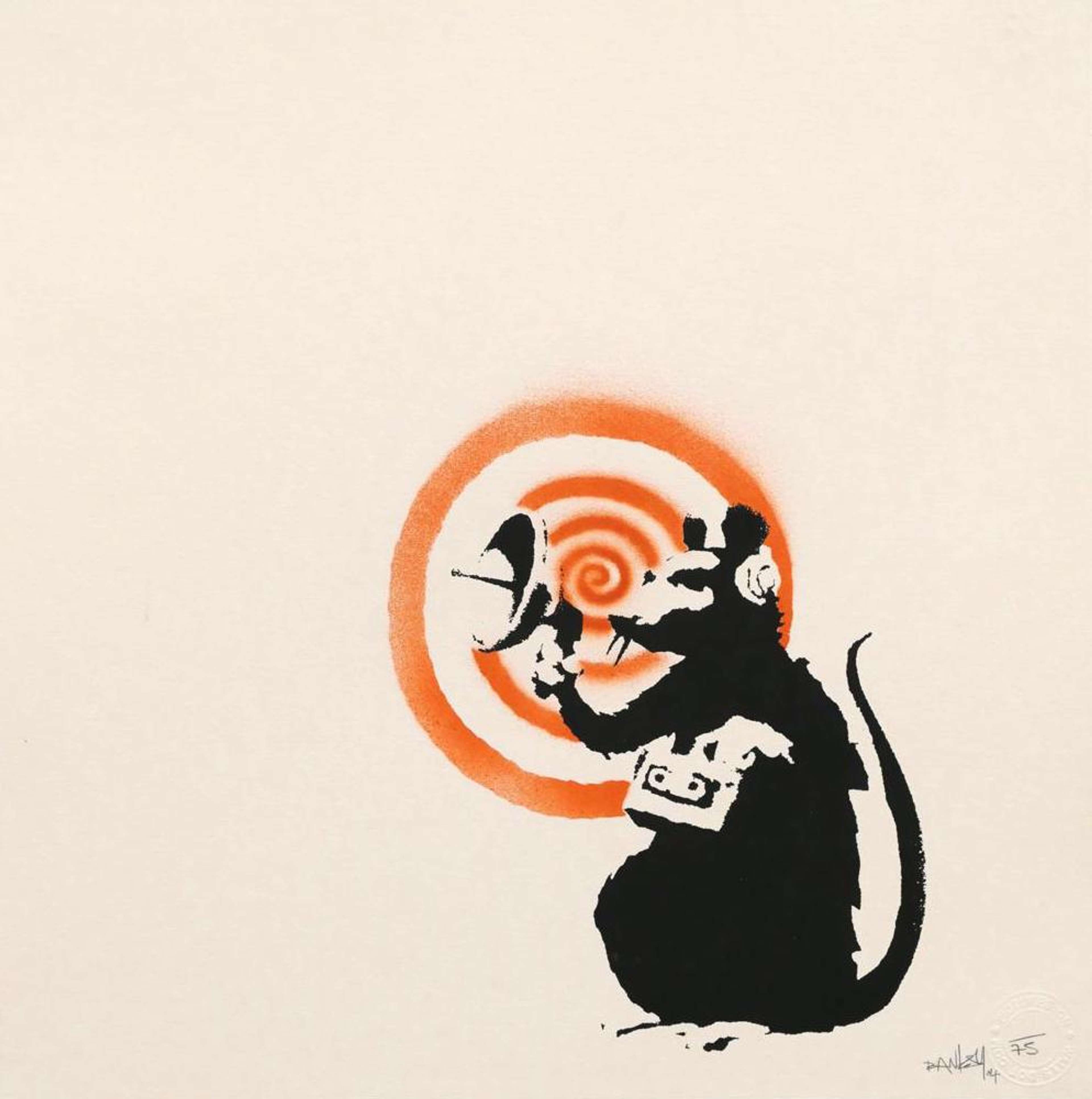

Fintech solutions are addressing some of these challenges and risks, making art investing a more secure and transparent experience. While blockchain technology has typically been used by alternative banks and cryptocurrencies, it is now making it easier to verify the authenticity of artworks and track their provenance, reducing the risk of buying fake or stolen artwork.

Fintech & Art Insurance: Providing Security

Financial technology has also expanded the availability and accessibility of art insurance, providing investors with protection against loss, damage, and theft of their artworks. In the past, art insurance was often a complex and time-consuming process that involved multiple insurers and brokers. However, fintech solutions are now providing new and innovative ways to insure artwork. Digital insurance platforms are making it easier to purchase art insurance online and manage policies in real time. Insurance apps are also becoming popular, providing collectors with quick and easy access to insurance coverage for their artworks.

Fintech is also addressing some of the challenges associated with the valuation of artworks. Accurately valuing an artwork is important for insurance purposes, as well as for making informed investment decisions. MyArtBroker's MyPortfolio tool, for example, uses repeat sales regression technology to provide accurate and real time valuations of artworks in the print market.

Sharing The Burden of Risk: Fractional Ownership

Fractional ownership is another solution powered by fintech that is addressing some of the challenges and risks associated with art investing. Fractional ownership allows multiple investors to own a share of a piece of art, reducing the financial risk and allowing investors to diversify their portfolios. The maintenance costs of an artwork are usually divided amongst all owners, lowering the level of risk undertaken by each investor.

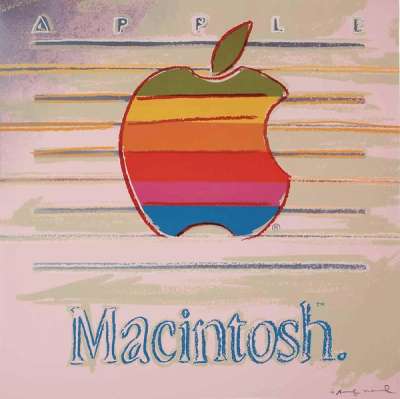

Another clear benefit of fractional ownership is that it provides opportunities to low-net-worth investors who have historically been kept out of the art market. The tech-powered model of fractional ownership offers aspiring collectors access to blue-chip artworks that were previously only available to a select few. This is particularly significant in the Asian art market, where the growth of the middle class and renewed appetite for investment has made fractional ownership an attractive option.

Fintech is playing an important role in mitigating the risks and challenges associated with art investing. With the adoption of technology, investors can now make more informed decisions, protect their investments, and access new investment opportunities.

The Rise of Digital Art and NFTs: A New Frontier in Art Investment

The art world has seen a recent surge in the popularity of digital art and Non-Fungible Tokens (NFTs), which are unique digital assets that are stored on a blockchain. These new forms of art are changing the way investors think about art investments, and fintech is playing a critical role in facilitating this shift.

One of the primary advantages of NFTs is that they allow for greater art market transparency and security. With NFTs, ownership of digital artwork is recorded on a blockchain, providing an immutable record of ownership that cannot be tampered with. For many, this transparency is a welcome break from traditional art investments, where the ownership history of a piece of art can be difficult to track and verify.

Fintech is also facilitating the rise of digital art and NFTs by providing new platforms for buying and selling these assets. Online marketplaces like Nifty Gateway, SuperRare, and OpenSea have emerged as leading platforms for buying and selling NFTs and digital art. These platforms make it easier for investors to discover new artists and invest in the growing market for digital art and NFTs.

Another area where fintech is playing a significant role is in the creation of new investment products. Some companies are now creating investment funds that specialise in ‘alternative investments’ such as NFTs and digital art, offering specialised advice on investing in these emerging markets.

With greater transparency and security, new platforms for buying and selling, and the creation of new investment products, the future of art investing will be largely dependent on financial technology. As the art market becomes more democratic, transparent and diversified, fintech looks set to continue pushing the boundaries of what is possible.

Reframing The Art Market with Fintech

Financial technology is revolutionising the art market. While the pace and possibilities of these kinds of technology are hard to comprehend, they are making art collecting and investing more accessible. With the advent of online art platforms, art data analytics tools, new models of investment and insurance and, of course, NFTs, collectors and investors have more information at their fingertips today than ever before.

For art collectors and investors who are interested in using technology to improve their art collecting and investment experiences, the opportunities are endless. Utilising technology and art analytics is key to making informed decisions that will help collectors and investors succeed in the ever-changing world of art investment.