How To Sell Art

For The Love Of God, Wonder © Damien Hirst 2009

For The Love Of God, Wonder © Damien Hirst 2009Market Reports

Fine art is not only the top-performing collectible asset, but one of the most enjoyable passion assets to collect. By diversifying your portfolio and collecting across a range of established, blue chip artist markets, an art collection can prove a lucrative investment. Should you decide to sell art from your collection, research and due diligence is essential.

Though selling art can - at times - seem a daunting feat, at MyArtBroker we're passionate about making it a straightforward and enjoyable process. By using MyPortfolio and our Trading Floor, maximising the value of your collection has never been easier.

The Art Of Selling Art

Though today's art market is a highly competitive landscape, there are various approaches that will maximise the value of your collection. With careful planning, thorough research, and an efficient strategy, selling art can be a fruitful way to harness your investments. This requires a deep understanding of the market, as well as the ability to navigate the complex world of art sales and marketing.

From pricing your artworks to promoting your collection to the right audience, there are many factors to consider when it comes to selling art successfully. However, by using a reputable industry expert - like our specialist brokers - this process can be streamlined: allowing you to enjoy the rewards of your sale without the burden of going alone.

Read our cohesive report to navigate the art market as a seller: A Guide to Selling Prints in the Current Market.

Valuing Your Artwork: Factors To Consider

Valuing your art collection can be complex process, with several factors at play that can influence its value.

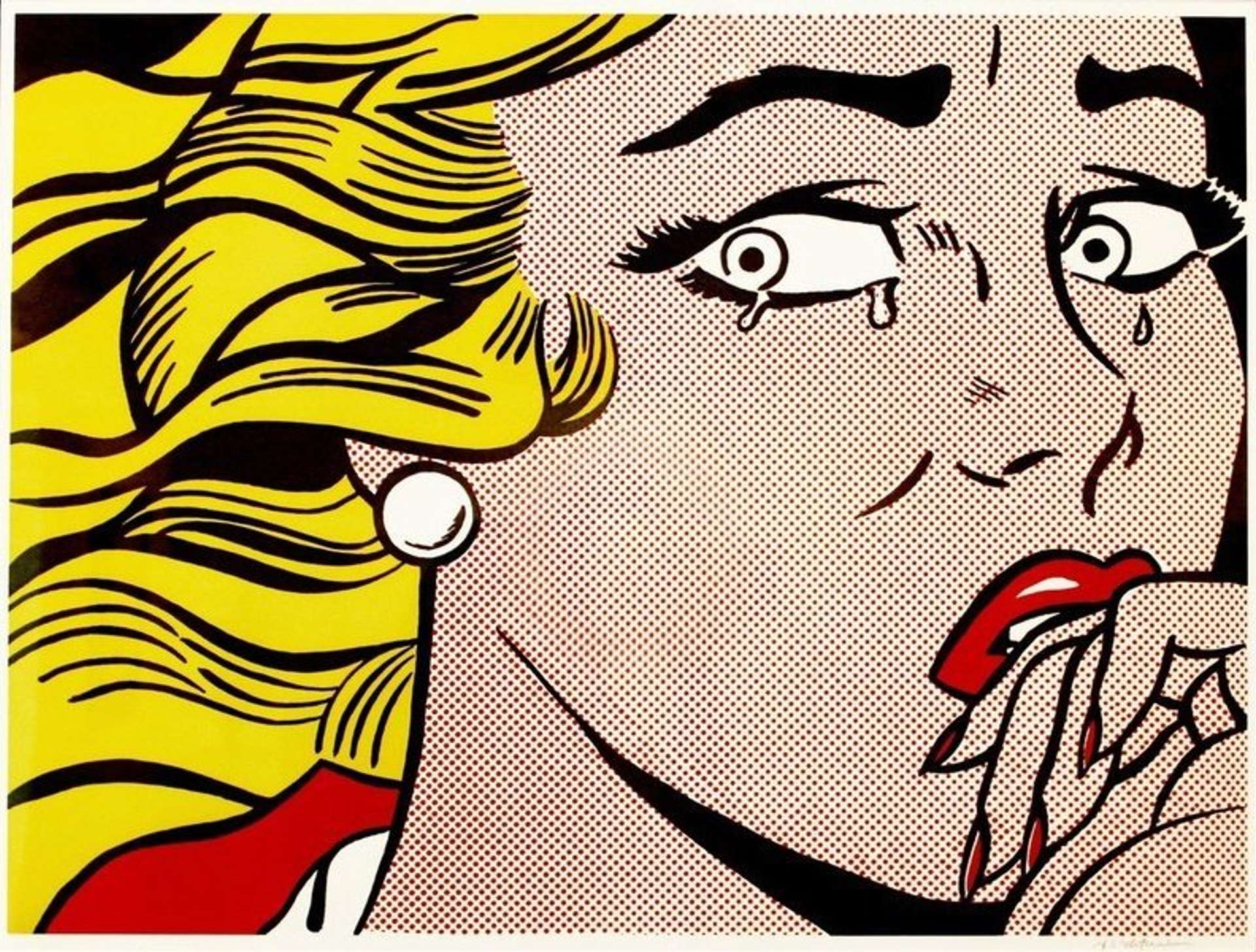

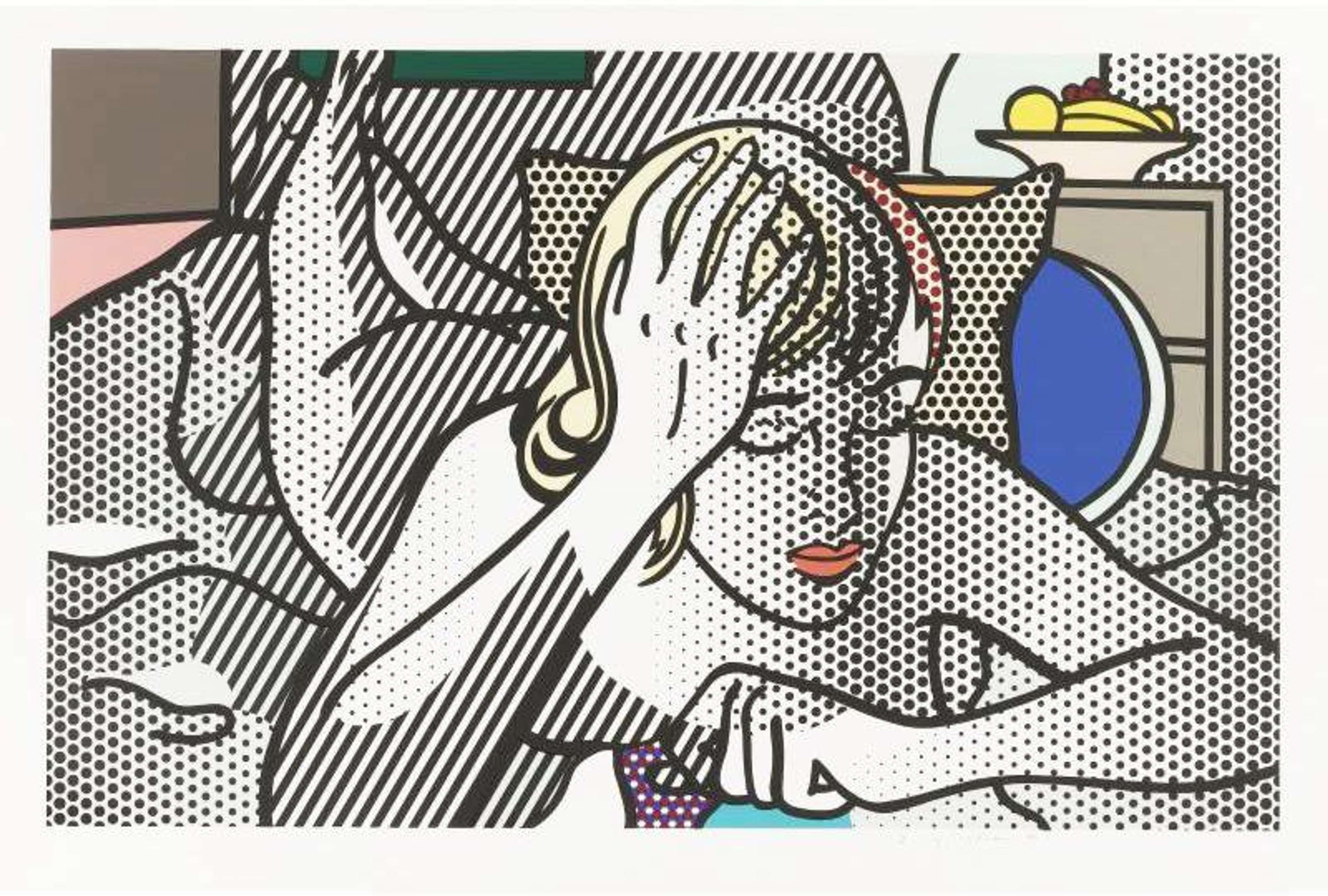

Artist Reputation

An artist's reputation and demand for their work are among the key factors that determine the worth of an artwork. The condition of an artwork is also essential in determining its value. Artworks that are well-preserved and maintained over time over time will have a higher value than those that are damaged or in poor condition.

When you come to sell an artwork through MyArtBroker, we handle everything: from initial condition reports to the logistics of the sale. We work with external industry experts, who will supervise in the creation of a condition report for your artwork. We also work with conservators who can address any issues with your artwork, before it is presented for sale among our private network. Condition is of the utmost importance when valuing and selling your artwork, and our expert-driven service does all the hard work for you.

Find out more from Andy Warhol Authenticator Richard Polsky.

Rarity & Provenance

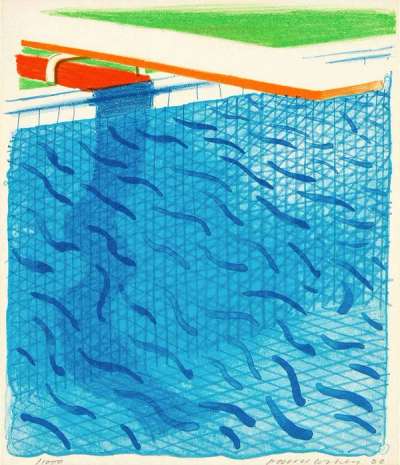

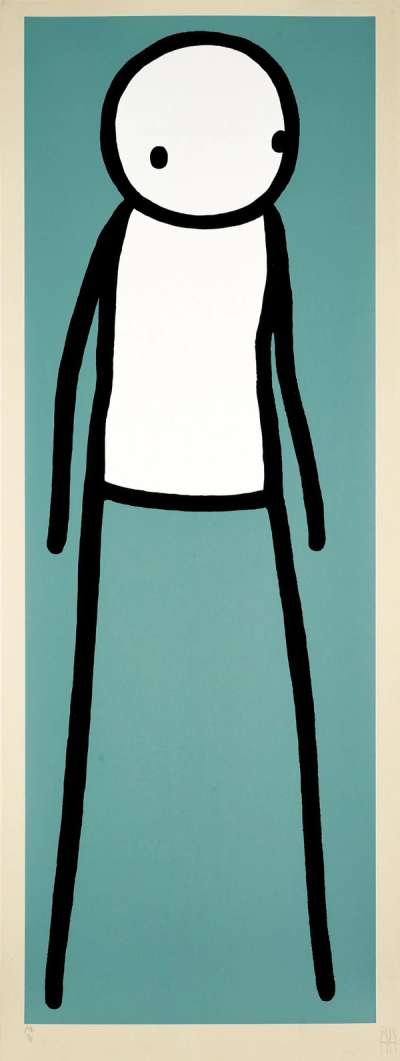

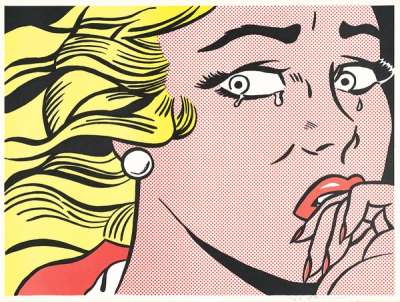

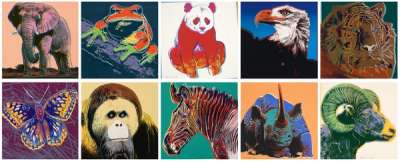

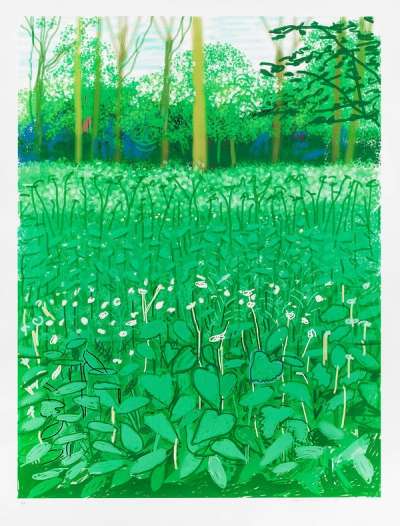

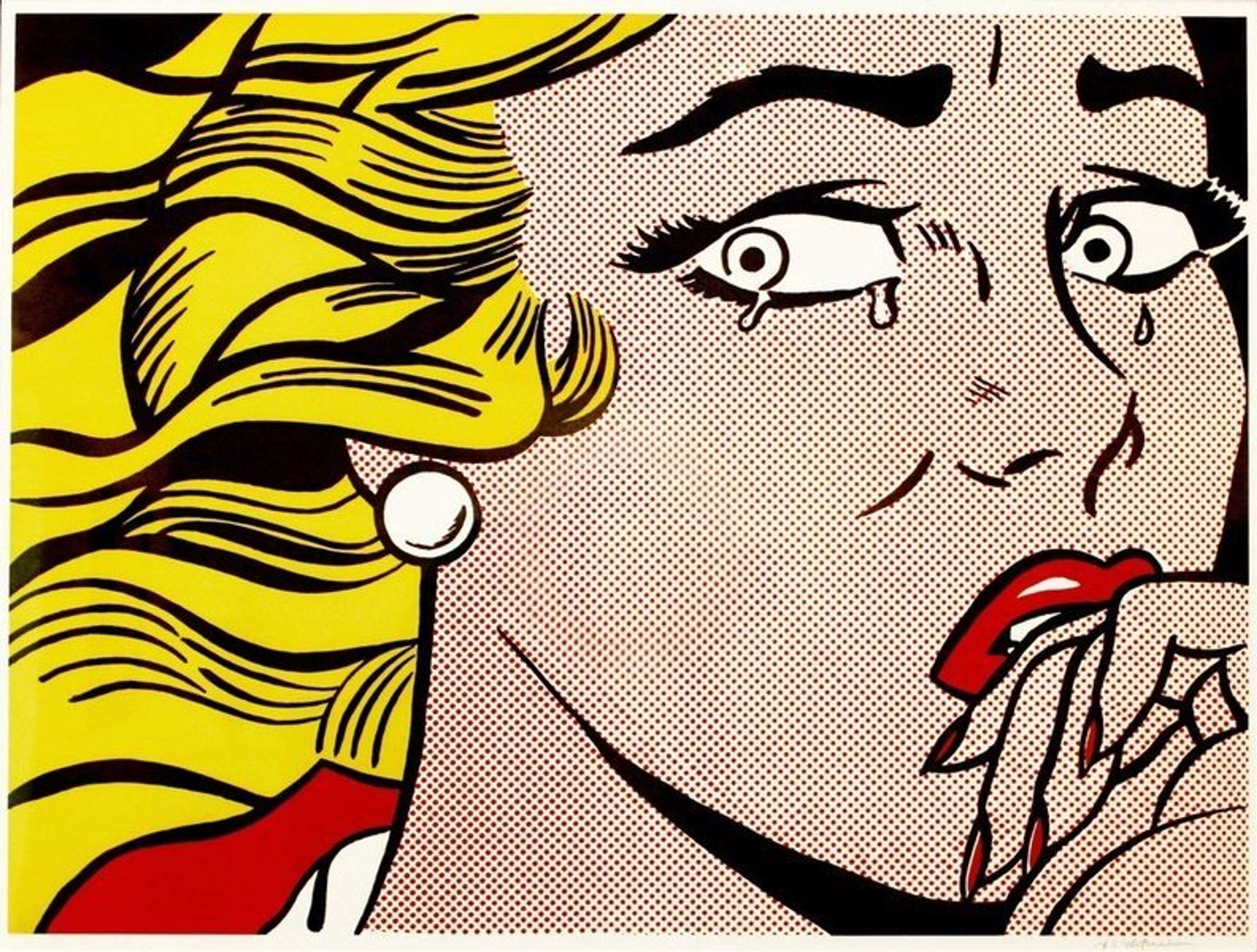

Another factor to consider when valuing your art collection is rarity. Limited edition or rare artworks typically have higher value, since they are not readily available in the market. Artworks by era-defining artists like Andy Warhol, David Hockney, and Banksy have become some of the most highly valued artists of our age - and their rarer works often carry further value. Likewise, signed prints and editions will offer command higher sale prices than unsigned works. The rarity of an artwork gives it a noteworthy status in the history of art itself, which directly contributes to the distribution of value in the artist's market.

Likewise, provenance is another critical consideration when it comes to valuation. The history of ownership, exhibition, and past sales can impact value significantly. One of the risks involved with sale through auction, for example, is that your artwork might be ‘burned’ if the sale is successful. With auction, there is a lot riding on the night of the auction. If the sale is unsuccessful, the provenance of your artwork might be hindered: putting the reputation of your artwork in jeopardy.

At MyArtBroker, we never ‘wait to see what happens on the night’. We post live supply and demand indication from our private network directly onto our Trading Floor. This way, you can see where opportunity lies in the prints and editions market place - in real time, and for free. Likewise, our print market index affords you a bespoke glimpse into the value growth of your artwork and entire portfolio. With MyPortfolio, you can input the date you bought you artwork and the price you purchased it for. Our algorithm does the rest, calculating the value growth since you bought it and showing you the compound annual growth rate of your collection. With us, you can take your time to sell your artwork and enter the deal with industry expertise and cutting-edge technology by your side.

Art Market Trends

Trends in the art market are another vital role when determining value. Changes in the art market, such as demand for certain genres or artists, can influence the worth of your collection thanks to its popularity. Blue chip artists like Keith Haring and Bridget Riley have a stronger position in the art market than emerging artists sold via the primary market. Trends in these established artist market tend to be easier to predict, though we don't have a crystal ball. However, with MyPortfolio you can track the live supply and demand across blue chip artist markets in real time.

Find out more in our article: How To Value Art.

Maximising The Value Of Your Art Collection

As the top-performing collectible asset, investing in art can be a great way to diversify your portfolio with an asset class that is enjoyable to collect and inherently valuable. However, the preservation and conservation of your art collection is essential to maximise value. You might consider working with experienced conservators to address any issues with your art, such as fading, discolouration, and damage. Our brokers can provide you with further information about conservation services near you, who can help you maintain the condition - and therefore the value - of your art collection.

To increase the value of the collection, you might also choose to expand your collection over time. By staying up-to-date with the latest trends in the art market - using our live trading floor - you can discover new pieces which could add value to your overall portfolio. From the Trading Floor, you can add works that you want to your MyPortfolio dashboard and enquire to buy through our brokers. Within the prints and editions market, you have greater scope to invest across a range of artists, genres, and styles - bringing rich value to your portfolio.

Ultimately, increasing the value of your art collection requires a combination of careful planning, ongoing conservation, and strategic investments in new artworks. Of course, by owning more, you have more to play with when it comes to selling art.

Navigating The Art Market: How To Be Successful

The art market is a traditionally murky space, long faced with a lack of access and transparency. MyArtBroker are leading the change: providing collectors with the data and industry expertise they need to become successful decision makers.

Our Trading Floor brings blue chip market transparency like you've never seen before. You can see exactly where supply and demand is among our network in real time - completely free of charge. Access to our private network is free, giving you the opportunity to sell your artwork to a community of collectors. By removing the element of chance from the sale process, we enable you to make the most informed decisions when it comes to selling your art collection.

We offer 0% seller's fees as standard. When you choose to sell through MyArtBroker, we remove many of the burdens involved in selling art. We market your artworks to our entire network and available platforms.

Trading Floor © MyArtBroker 2023

Trading Floor © MyArtBroker 2023How To Sell Art With MyArtBroker

MyArtBroker is powered by cutting-edge technology, and the personal relationship between brokers and collectors. Our team of industry experts, working across American Pop, Modern British, Post-War & Contemporary, and Street & Urban Art, can help you make the most informed decisions when it comes to selling your art collection.

To start selling your art through MyArtBroker, visit our Trading Floor to view current market demand. With this live platform, you can filter by artist and artwork title to find the works you would like to sell. From here, you can add works you want to sell to your MyPortfolio dashboard. You can request a free and zero obligation valuation anytime, and our specialist brokers will support your sale and work to get you the best deal possible.

It has never been easier to sell your art and maximise value at MyArtBroker. Indeed, selling art is an art itself. It's not just about putting a price tag on an artwork and waiting for the highest bidder. Though there are a myriad of factors to consider, MyArtBroker can streamline this process and help you get the best deal possible.