Auction Watch: Sotheby’s Sydell Miller Collection Achieves 100% Sell-Through Amid Mixed Modern Art Auction Results

Image © Sotheby's / Nymphéas © Calude Monet c.1914-17

Image © Sotheby's / Nymphéas © Calude Monet c.1914-17Live TradingFloor

This week, the art world's attention is firmly on New York. Sotheby’s took centre stage by securing the coveted Sydell Miller collection for this year’s November sales. Spread across three auctions, the first evening sale of the late Palm Beach cosmetics mogul’s collection launched marquee week with a remarkable white-glove performance, significantly surpassing the results of the Modern Evening Auction that followed.

A Legacy of Beauty

The Sydell Miller Collection is spread across four sales, continuing into December, with a total estimated value of $200 million (USD). This impressive evening sale alone, featuring just 25 lots, achieved remarkable results: every lot sold, with 8 exceeding estimates and another 8 selling within their expected range. The sale realised $189.5 million under the hammer, placing it near the upper echelon of its $205 million high estimate. To put this into perspective, Sotheby’s has already achieved approximately 95% of the collection’s total estimated value, effectively reaching its goal early in the series. Estimates were carefully calibrated for the Miller collection showcasing works across various mediums, reflecting the grace and femininity characteristic of the late beauty mogul’s refined taste.

Single Collector Sales at Sotheby’s

While this was a strong performance for Sotheby’s and a solid kickoff to marquee week, it stands in stark contrast to the previous year’s Emily Fisher Landau Collection. That evening sale alone achieved $351 million (hammer), with pre-sale estimates ranging from $319.5 million to $415.1 million–a significant difference in both hammer total and estimate range, despite the Landau auction featuring just six more lots.

A key distinction between the two sales lies in Sotheby’s approach to guarantees. In the Landau sale, every lot was backed by a minimum price guarantee, led by a standout $139.4 million (with fees) Pablo Picasso. By contrast, the Miller Collection sale carried more risk, with only 7 of its 25 lots supported by third-party guarantees. The price distribution further underscores the differences: the Landau collection included 9 high-value lots exceeding $10 million, with one surpassing $100 million, while the Miller collection achieved only 4 lots above $10 million, with the highest hammer price reaching $59 million.

Sotheby's Modern Evening Auction

Sotheby’s Modern Evening Auction achieved $79.1 million at the hammer from 31 lots–23% below the low presale estimate and 58% decrease from last year’s $190.3 million. Average estimates also showed a 40% decline, with 30 lots sold this year compared to 24 in the equivalent sale last year.

What explains this difference? Several factors are at play, including a softer market that has prompted auction houses and sellers to adjust estimates accordingly. Prestigious provenance continues to be a key driver, underscoring the fierce competition among auction houses for private collections.

Here are the highlights:

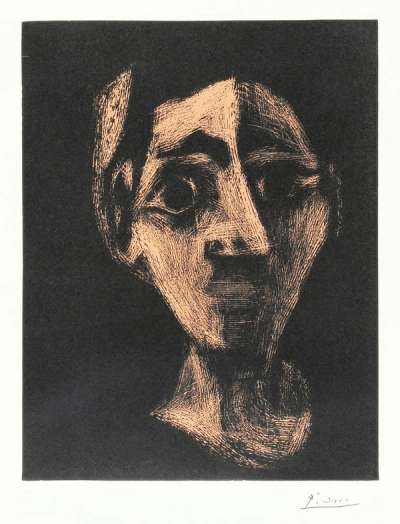

Image © Sotheby's / La Statuaire © Pablo Picasso 1925

Image © Sotheby's / La Statuaire © Pablo Picasso 1925Sydell Miller Collection

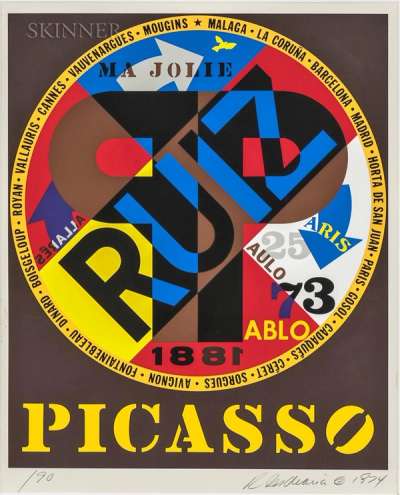

Looking To Buy Picasso Prints?

Browse Pablo Picasso on the Trading Floor and Sign Up to MyPortfolio Collection Management.

Star Lots: Claude Monet’s Nymphéas and Pablo Picasso

The Sydell Miller Collection featured two highly anticipated star lots. The highest-valued piece, Claude Monet's Nymphéas (1914), carried an undisclosed estimate of $60 million and hammered at $59 million ($65.5 million with fees), likely going to its third-party guarantor. Standing over five feet tall, this Impressionist masterpiece made its auction debut with a notable provenance tracing back to Monet’s son, Michel Monet.

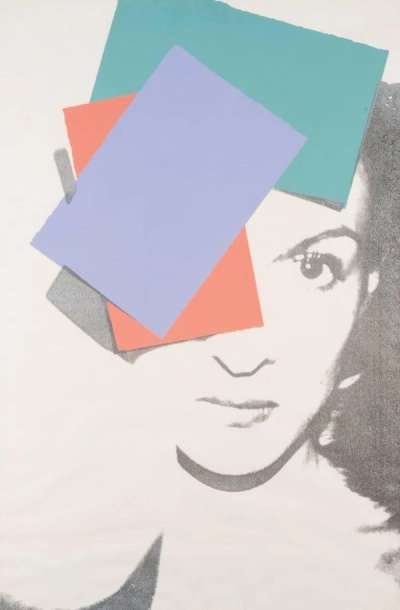

Another standout was Picasso’s La Statuaire (1925), also carrying an undisclosed estimate expected to be in the region of $30 million. This painting, inspired by his Parisian residence, showcases Picasso’s unparalleled artistic versatility–blending elements of Surrealism, Neoclassicism, and Cubism, as seen in the tonal hues, the composition of the setting, and the intentional construction of the woman’s face. Avant-garde yet unmistakably Picasso, the piece hammered at $22 million, achieving $24.8 million with fees. Remarkably, this work had no guarantees and was previously sold in 1999 for $11.8 million.

Image © Sotheby's / Relief Éponge bleu sans titre, (RE 28) © Yves Klein1961

Image © Sotheby's / Relief Éponge bleu sans titre, (RE 28) © Yves Klein1961Yves Klein’s Éponge bleu

Another highly anticipated lot that outperformed estimates was Yves Klein’s Relief Éponge bleu sans titre (RE 28) (1961). Similar works from the late 1950s usually only appear at auction once a year, with the last comparable piece coming to market in October 2023. Backed by both an auction house and a third-party guarantee, this work exceeded its $12 million estimate, hammering at $13.4 million and achieving $14.2 million with fees in it’s first time auction appearance.

Image © Sotheby's / Jeune fille en robe rose © Henri Matisse 1942

Image © Sotheby's / Jeune fille en robe rose © Henri Matisse 1942Modern Masters: Henri Matisse and Edgar Degas Doubles Estimate

A rare work by Henri Matisse, Jeune fille en robe rose (1942), demonstrates the modern masters’ astute understanding of form and colour. Small in scale and making its auction debut, the piece achieved $8.3 million at the hammer and $9.7 million with fees, far exceeding its $5 million high estimate. Also, Edgar Degas’s bronze sculpture, Grande arabesque, troisième temps (circa 1882–95), delivered an exceptional hammer-to-estimate performance. Initially valued at a modest $600,000 high estimate and supported by house and third-party guarantees, the piece significantly outperformed expectations, hammering at $1.4 million and achieving $1.6 million with fees.

Françoise-Xavier Lalanne’s Animals Are In Hot Demand

Lastly, Françoise-Xavier Lalanne is also trending in the market coming off of strong results from a dedicated sale at Christie’s in October. Sotheby’s offered an ornate centre table that surpassed its $6 million estimate, hammering at $10 million and achieving $11.6 million with fees, highlighting the growing demand for diversified luxury assets in the market.

Image © Sotheby's / The Cat Woman © Lenora Carrington 1951

Image © Sotheby's / The Cat Woman © Lenora Carrington 1951Modern Evening Auction

Top Sales from Sotheby’s Modern Evening Auction: Giacometti, Carrington, Signac, and Tiffany Studios

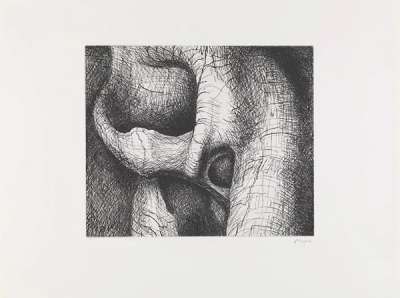

Sotheby’s Modern Evening Auction followed the Sydell Miller Collection and, despite overall lacklustre figures, showcased several notable sales. The highlight was Alberto Giacometti’s Buste (Tête tranchante) (Diego) (circa 1953, cast in 1954), which sold for $11.5 million at the hammer and $13.2 million with fees, aligning with its $15 million high estimate.

Among the standout performers, Leonora Carrington’s highly anticipated La Grande Dame (The Cat Women) set an auction record for her sculptural works, hammering at $9.8 million ($11.3 million with fees). Impressionist Paul Signac’s work exceeded expectations, hammering at $6.7 million and achieving $9.9 million with fees, placing it among his top 10 sales. Additionally, another success for luxury assets, a Tiffany Studios’ Danner Memorial Window (1913) highlighted strong collector interest, hammering at $10.8 million ($12.4 million with fees).

Image © Sotheby's / The Danner Memorial Window © Tiffany Studios 1913

Image © Sotheby's / The Danner Memorial Window © Tiffany Studios 1913High Value Lots Fall Below Expectations

Not all high-profile works met expectations. Matisse’s Young Girl Torso (1921–22), estimated at $12–18 million, failed to sell, while Picasso’s Buste de femme (1949) hammered below its $8.5 million low estimate, achieving $9.9 million with fees. Another Picasso piece, Femme au chat assise (1964), was withdrawn from the auction.

Overall, both auctions experienced a 50% decline compared to last year’s equivalent sales, with a combined hammer total of $268.7 million. Despite this, demand remained evident, as fewer guaranteed lots and fewer unsold works reflected a cautious yet engaged market demonstrating resilience amid current challenges. Buyer preferences favoured diverse mediums and pieces with prestigious provenance.