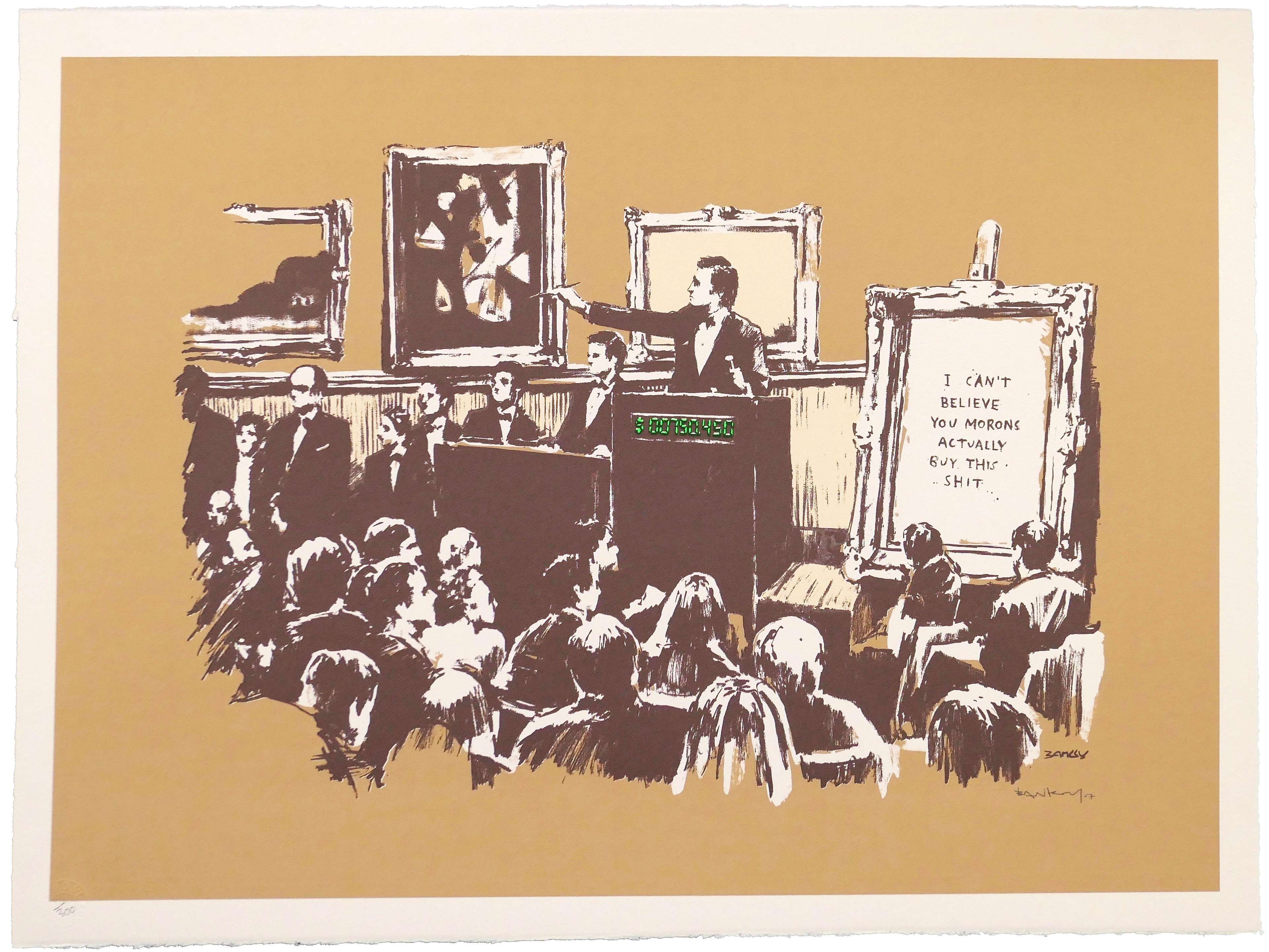

Morons © Banksy 2006

Morons © Banksy 2006

Banksy

266 works

Key Takeaways

- Auction houses are no longer the best route for Banksy prints: Sell-through rates for Banksy auctions have dropped significantly, with Sotheby’s Banksy-only sale seeing a decline from 85% in 2023 to 52% in 2024.

- Auction fees reduce seller returns: Sellers face commissions of around 15%, while buyers pay a premium of up to 25%, making auctions an expensive and unpredictable way to sell Banksy prints.

- Banksy prints are vulnerable to being “burnt” at auction: If a print fails to sell publicly, it risks reputational damage, lowering its future value.

- Pest Control authentication is essential: Only Banksy artworks with a Pest Control Certificate of Authenticity (COA) are accepted by most auction houses and reputable dealers.

- MyArtBroker offers greater transparency, flexibility, and 0% seller’s fees: Providing clear insights into past auction results, current market trends, and demand for specific works, allowing sellers to make informed decisions. No hidden costs if you decide to sell, ensuring sellers return the full price agreed upon consignment.

For those looking to buy or sell a Banksy artwork, auctions are a trusted and reputable platform for unique pieces. However, when it comes to prints and editions, do private sales offer an advantage over auctions - and if so, why?

Banksy’s most expensive works are wonderful examples of how the spectacle of auction works its magic. You only have to watch the sale of his painting Devolved Parliament to see how the salesroom, telephone and internet full of bidders made prices soar to obtain a once-in-a-lifetime opportunity for a specific work of art. Watch the auction of Banksy’s Devolved Parliament at Sotheby’s:

However, the same cannot be said for Banksy prints and editions. Over the last five years, trends in the Banksy market have shown that the traditional auction model is no longer the best way to sell these works. Increasingly, private sales can offer greater financial returns and control for Banksy collectors.

Why Auction Houses No Longer Serve the Banksy Market

While auction houses like Christie’s and Sotheby’s have sourced and sold some exceptionally rare prints at record-breaking prices – such as Sotheby’s Girl With Balloon - Colour AP (Gold) for £1.1 million, estimated at just £400,000-600,000 - the fees collectors pay to sell a Banksy print at auction at this level can be staggering. While the seller’s fee can be negotiated for high-value works such as this, these negotiations start at 15%, meaning that the seller of a £550,000 artwork could be paying fees anywhere from £0-82,500 - depending on how much the auction house wants to sell the work.

The return at auction is also rarely better than if the same work was sold on the private market. For instance, if an artwork hammers at £100,000 at auction, the seller will return £85,000 and the buyer will pay £130,000 after respective fees and VAT. On the other hand, when an artwork sells for £100,000 through MyArtBroker’s private model, the seller will return £100,000 and the buyer will pay £118,000 (with our 18% average buyer fee).

Sadly in more recent auctions containing Banksy prints, sellers have ended up with ‘burnt’ works - works offered without selling - which can cause the work's reputation and therefore value to decrease dramatically. In Sotheby’s most recent Banksy-only sale (19 September 2024), for instance, 48% of lots were unsold. These 12 lots henceforth experienced reputational damage, making it even harder to sell the works publicly.This can be the outcome of auctions swelling the market and then consigning long into the future due to historical, but not current demand. For instance at the height of the Banksy market in March 2021, Sotheby’s totalled just over £4 million across 46 prints, averaging £88,830 a print, while Christie’s totalled £4.5 million across 44 prints, averaging £101,392 a print. Now, nearly two years after the first ‘Banksy Only’ sale, the market has become more stable, but sadly this public auction feeding frenzy has driven collectors still hell-bent on offering at auction, into a hole.

Sell-through rates for Banksy prints at auction have dropped, with Sotheby’s Banksy-only sale falling from an 85% sell-through rate in 2023 to 52% in 2024, meaning works are burnt and sellers are disappointed. You're far better to offer your work at a reputable dealership that can commit to a return you're comfortable with, who will either sell it privately, or hold it without the reputational risk.

For sellers, the consequences of a work not selling at public auction can be hugely damaging. A ‘burned’ artwork is judged as undesirable because it failed to find a buyer and, in the short-term, it can decrease in value if it is offered at auction again. Which, in the case of prints, each with a unique edition number is very high risk.

The very nature of editions means there is never just one chance to buy an artwork, making the fundamentals of auction much less exciting for all concerned.

With editions, if the price isn’t right for the buyer at that moment of sale, there is no particular incentive to keep bidding. A print's auction - whether live or online - lacks the once-in-a-lifetime energy reserved for a masterpiece. There is always an opportunity elsewhere for a print from the same series.

With major Contemporary art collectors looking for the best return on their investments, it’s no wonder the trends are favouring online platforms offering the same global reach and world-class expertise as leading auction houses, for a fraction of the price.

If you are looking to sell your Banksy print exactly when you want, without cost, and without ever having to move the work until it’s sold (these are the demands of most of our clients), then most auction houses simply can’t accommodate the request, due to their pre-planned calendar and the overheads of running a traditional auction model.

Whether you’re selling via auction or private sale, it is crucial to remember that every genuine Banksy print or original artwork must be accompanied by a Pest Control Certificate of Authenticity (COA), which verifies that the work is an authentic Banksy. Without this certification, an artwork is considered unverified and may not be accepted for sale by major auction houses or reputable dealers.

How Does Auction Work?

Auctions work by taking a commission off the buyer and the seller: to sell, you’ll pay approximately 15% of the hammer price plus marketing, cataloguing, shipping and storage fees; and to buy, you’ll pay up to 25% of the hammer price plus VAT. If the artwork sells for well over the high estimate you could also be subject to a 1-2% performance commission. The traditional auction model takes food off both sides of the table.

For a expert insights into how the art auction process actually works, read our comprehensive guide.

Here’s what to do if you want to buy at auction:

- You’ll need to wait for the auction date and either be there in person, on a pre-arranged call with a specialist, or you can be logged in online at the right time at the right lot (they recommend allowing 60-100 lots per hour). Or you can leave an absentee bid and hope for the best.

- Being at the right place, at the right time, is essential.

- Know your top bid that you’re willing to pay, (add 30%) and stick to it – even when the bidding gets tough.

Here’s what to do if you want to sell at auction

- Choose an auction house and approach them. First off is the task of finding the right auction for your print. Some of the major auction houses offer annual Banksy-only auctions, which have been exhibiting declining sell-through rates in recent years. Banksy lots are also frequently offered in broader Modern & Contemporary sales. Choosing the right sale for your Banksy work will be a decision made in consultation with one of the house’s specialists, who will normally want to see your work in person. They will advise on pricing strategy, and then suggest which sale would be best for it.

- Once everything is decided between you and the specialist, an administrator will contact you with your paperwork. It will then be up to you to manage and pay for your work to be shipped to the auction house’s storage facility ahead of the auction.

- The slated auction will likely be a few months down the line as auction seasons are static. Even if the auction is soon, consignment deadlines are usually two to three months prior.

- You may even be asked, particularly with a print, to wait until the next auction after, especially if the house has a print from the same series already consigned. This is so that two prints from the same series don’t depreciate each other.

- If your work sells at auction, you will receive payment a few weeks after the sale completes. Auction houses also charge a 1-2% Performance Commission fee in the event that your print sells for above the high estimate you agreed with the specialist.

- If your work doesn’t sell, you’ll be expected to manage and pay for the safe return of your work, and pay the unsold fees to the auction house – often 1.5% of the average of the high and low estimate they catalogue it at. You will then have anything from two weeks to one month to collect the unsold work from their storage facility before it starts accruing storage fees.

Auction vs Private Sale: A Financial Breakdown

The Hidden Costs of Selling at Auction

Selling at auction incurs significant costs for both buyers and sellers:

- Seller’s commission: 15% on average (negotiable for high-value works).

- Buyer’s premium: Up to 25% on top of the hammer price.

- VAT on buyer’s premium: Adding further cost to the total price.

- Additional fees: Marketing, shipping, insurance, and cataloguing charges.

If a Banksy print hammers at £100,000 at auction, the seller receives approximately £85,000 after commission, while the buyer pays around £130,000 after fees and VAT.

However, private sales via MyArtBroker can offer the following outcome:

- If the same work sells privately for £100,000, the seller receives £100,000 (0% seller’s fees).

- The buyer pays £118,000 (with MyArtBroker’s 18% average buyer fee, significantly lower than auction).

For a more detailed breakdown of auction fees, refer to our article A Guide to Art Auction Fees.

The Risk of ‘Burning’ Banksy Prints at Auction

Unlike one-of-a-kind paintings, Banksy prints exist in limited editions, meaning multiple versions of the same artwork can enter the market simultaneously. This makes prints particularly vulnerable to market saturation and price fluctuations at auction.

- If a Banksy print fails to sell at auction, it is considered “burnt” and can lose value.

- Auction houses frequently place multiple Banksy prints from the same edition in the same sale, creating internal competition that drives down prices.

- Private sales, on the other hand, allow for strategic release and pricing, ensuring demand remains high.

How MyArtBroker Works for Banksy Collectors

At MyArtBroker, our objective is to return you the same as you would have at auction, at a time convenient to you, on your terms, and without risk. Our seller’s fees are always at 0%. You have the ability to sell whenever you want, at the very best time to release the value of your work. We own the largest dedicated international online network of Banksy buyers and sellers of Contemporary and Modern prints and editions in the world, and as a specialist online platform, that audience is undiluted and focuses primarily on Banksy.

What Does It Cost To Sell Privately Via MyArtBroker?

Nothing - we offer 0% seller’s fee, guaranteed, with no hidden fees. Having amassed an extraordinary community of buyers and sellers in the Banksy market over 20 years, it’s not difficult for us to find the right buyer for a work, and supported by digital innovation unlike our competitors, we offer 0% to our sellers, simply because we can.

How it works here: we make contact, we assign you a dedicated specialist, you agree on a price, we offer your work immediately, and start looking for a buyer. Once a buyer is found and the funds are cleared, we help ship the work directly, no storage facility needed. That’s it. We do not hold you to a date to offer your work, nor do we charge for marketing it to our 30,000-strong collector network.

How Does MyArtBroker Offer 0% Sellers Commission And Auction Houses Can’t?

Having operated in the Banksy editions market since its heyday in 2010, we’ve been listening to our buyers and sellers and adapted the platform and network in a way that’s important to make it work for all. Our optimised service means we do not have many of the same overheads attached to running a traditional auction house, allowing us to invest heavily in digital innovation and marketing your work to our network. When it comes to selling your artwork, to get the best price, it all comes down to accessing a niche market with a specific network of collectors. If you have a print to sell, you are far better off going to a specialist in the print market than you are going to an auction house, whose collectors are interested in much broader categories of artworks. Our network of buyers is unique to prints and multiples. For buyers, we offer you the time to carefully consider each purchase without the pressures of a live auction, and we can bring a greater selection of artworks to market in a simple, secure way. Our brokers are specialists in their fields and we act as a conduit between you and sellers. We also pride ourselves on balanced market advice to first-time buyers and sellers.

Should You Sell Your Print Online?

If you’re planning to sell your prints yourself online, we recommend you speak to experts first and do not try to enter this field alone. Art will always be a tangible and very personal investment – online platforms alone, no matter how smart, will not be enough to cater to the new collecting market or the previous generation of collectors with substantial inventory.

When you buy or sell with MyArtBroker, your experienced personal broker can guide you through the whole process, find the right artwork or buyer, and even handle the process of authentication, price negotiation, and delivery.

How To Sell Art Safely Online?

Use a secure platform, read the testimonials and speak to experts. Although there is growing trust in the online art trade, platforms such as eBay still stumble when it comes to the issue of artist authenticity. The Banksy market is not immune to forgeries, even with a Pest Control Certificate of Authenticity. Buying through a fine art professional offers absolute assurance and our brokers can help guide you in the right direction.

We provide the opportunity to post listings for sought-after artworks within a global community of buyers and sellers - perfect for collectors seeking rare and hard-to-find pieces.

As the online auction market expands and global trading platforms gain prominence, the availability of advanced collection management tools and the transparency offered by digital buying channels are reshaping the art market. This growing sector reflects the evolving preferences of collectors, steering the narrative away from traditional selling channels and toward digital technologies and private sales.