Roy Lichtenstein Print Market Investments © MyArtBroker 2024

Roy Lichtenstein Print Market Investments © MyArtBroker 2024

Roy Lichtenstein

286 works

Roy Lichtenstein, renowned for his comic book-inspired Pop Art, transformed everyday scenes into compelling narratives through his signature BenDay dot technique. His ability to elevate the ordinary into high art has made his prints highly desirable investments. With a timeless appeal and strong market performance, Lichtenstein’s works continue to offer significant value to collectors and investors, reinforcing his legacy as a master of Pop Art and a key figure in the prints and editions market.

In this investment report, we examine Lichtenstein's print market performance spanning the past seven years. Leveraging auction and sales data from our dedicated database focused on prints and editions, our objective is to provide valuable insights to help you determine whether investing in Lichtenstein is a wise decision for 2024.

Is Buying A Lichtenstein Print A Good Investment?

Lichtenstein’s print market experienced a record year in 2024, achieving its highest total hammer value in the past four years at £8 million across 261 lots sold. This strong performance followed a steady upward trajectory in both sales volume and value, with notable growth since 2021. The sustained demand for Lichtenstein’s work underscores his enduring market strength, particularly among collectors seeking iconic Pop Art prints.

Looking ahead to 2025, early sales data is still limited, making it too soon to determine the market’s trajectory definitively. However, past trends suggest that Lichtenstein’s print market tends to see consistent activity throughout the year, with peaks often occurring during major auction seasons. If 2024’s momentum carries forward, we could see another strong year, particularly for rare or high-quality editions. Additionally, if supply remains limited, competition among collectors could drive prices even higher, reinforcing the trend of Lichtenstein’s prints appreciating in value over time.

What happened In Lichtenstein's Print Market Performance In 2024?

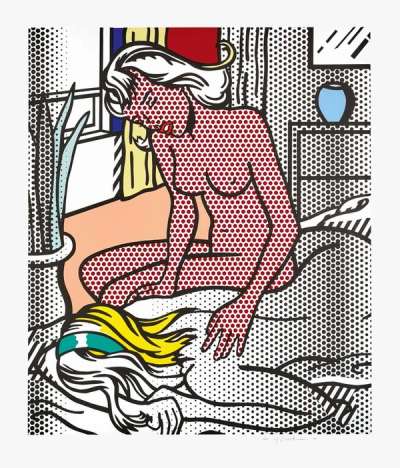

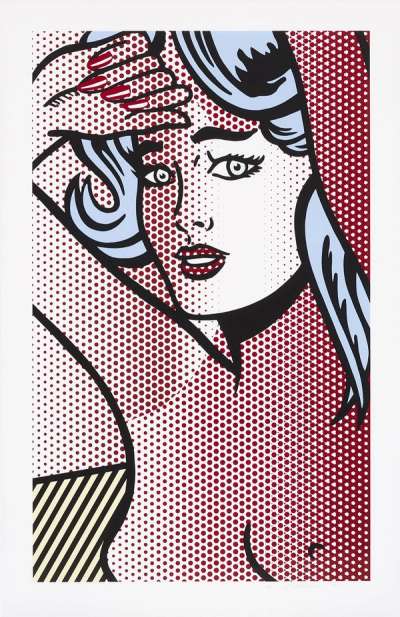

In 2024, Lichtenstein’s print market saw exceptional performance, reaching its highest sales value and volume to date. While the market remained strong throughout the year, it was the November auctions that truly set new benchmarks. Several prints from his Nudes series achieved near-million-pound results, breaking multiple auction records. This surge in demand highlights the growing appreciation for Lichtenstein’s depictions of modern, confident women in intimate settings. Unlike many blue chip artists, Lichtenstein’s market is driven by individual prints rather than complete sets, making his high-value works particularly unique. Given the impressive growth of the Nudes series, it will be fascinating to see which other collections gain momentum in 2025.

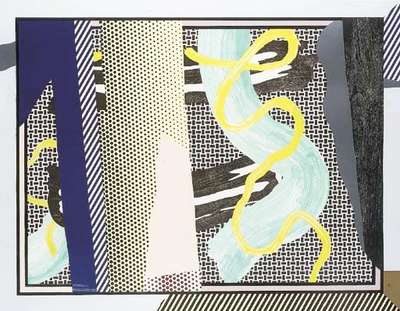

Lichtenstein’s print market saw a steady increase in average selling prices (ASP) from 2021 to 2024, with 2024 marking a record high at £34,300. This reflects a growing demand for his works, particularly in high-profile auctions where individual prints - such as those from the Nudes and Reflections series - have achieved exceptional results. While 2025 currently sits at £19,200, given past yearly performances, we may see values rise as more high-value works enter the market later in the year, particularly in key auction seasons. Collectors should watch for upcoming sales to gauge whether this trend holds or if new series emerge as top performers.

Top Performing Print Collections In Lichtenstein's Current Market

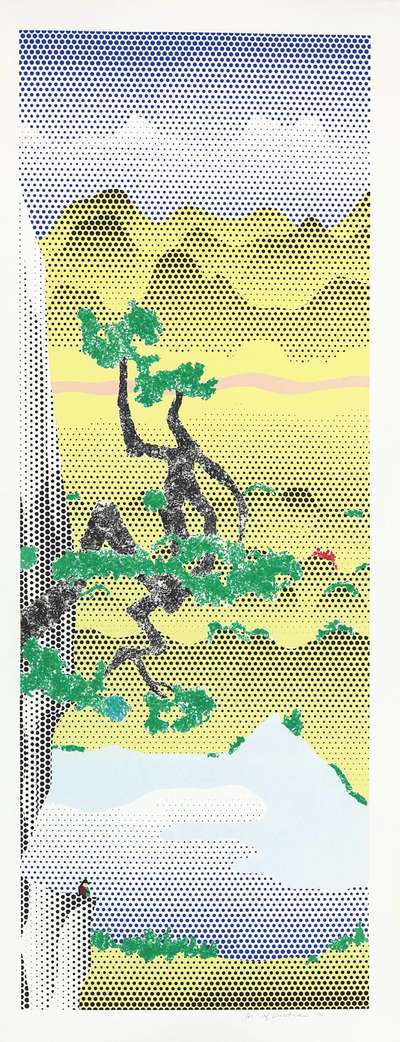

Lichtenstein’s print market continues to showcase an interesting contrast between sales volume and total sales value across different collections. The Landscapes, Moonscapes, Seascapes collection was the most actively traded, with 20 lots sold, reflecting strong market demand. However, despite its high transaction volume, it ranked only fourth in total sales value at £408,000, suggesting that these works remain relatively affordable. Similarly, the Mirrors collection, which saw 14 lots sold, generated just £125,000, indicating that while widely collected, these prints fall on the lower end of the price spectrum.

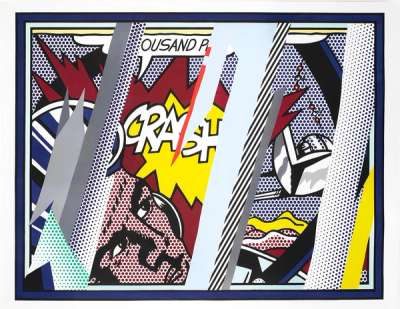

In contrast, Lichtenstein’s Nudes series dominated in terms of total sales value, achieving an impressive £2.9 million far exceeding any other collection. This aligns with recent auction trends, where Nudes prints have repeatedly set record prices, particularly in the November sales of 2024. The Water Lilies collection followed, securing £1 million despite a lower transaction volume, emphasising its desirability and high individual valuation. The Reflections series, ranking third in sales value at £602,000, further reinforced its position as one of Lichtenstein’s most valuable print collections. Despite only 9 lots sold, its strong total value indicates high individual price points. The Interior series, though selling only 7 lots, still achieved £375,000, proving that select prints from this collection maintain strong market interest.

Overall, these results highlight a diverging trend in Lichtenstein’s print market. While certain collections remain widely accessible due to more affordable price points, high-value collections such as Nudes and Water Lilies continue to command significant premiums.

The Most In-Demand Lichtenstein Prints Within Our Network

Our latest Collector’s Guide to the Print Market in 2025 highlights key trends shaping Lichtenstein’s print market. One of the most notable takeaways from 2024 was the Nudes collection’s exceptional performance during the November sales. These works, consigned from the collection of Dorothy and Roy Lichtenstein, achieved record-breaking prices in a single auction. While some prints from this series, such as Nude Reading, appeared earlier in the year, they did not reach the same record heights.

The success of these prints can be attributed to two primary factors: the strong provenance of the collection and the rarity of the highest-performing works within the collection, including Nude With Yellow Pillow and Nude With Blue Hair. Additionally, the imagery in these pieces aligns with broader cultural narratives around feminism, further enhancing their desirability.

Beyond the Nudes collection, Lichtenstein’s Reflections series has also gained traction, particularly in the private market. Many collectors and sellers are showing increased confidence in private transactions, especially for high-value works, signalling increased attention outside the auction space.

Seven Blue Chip Artists Markets To Know

Lichtenstein's print market has remained relatively stable over the past five years, exhibiting neither the dramatic peaks nor the sharp declines seen in artists like Banksy or Jean-Michel Basquiat. The graph highlights how Lichtenstein's sales value has been consistent, maintaining a steady trajectory rather than experiencing the speculative surges seen in other blue chip artists' markets.

Compared to the explosive fluctuations in Banksy’s print market, which saw highs of nearly £200,000 in 2021 before a significant drop, Lichtenstein's market has been characterised by gradual increases and moderate declines. His print values have remained within a relatively narrow range, signalling steady collector interest and confidence in his work.

This stability suggests that Lichtenstein prints appeal to long-term collectors rather than short-term speculative buyers. While his market does not see the same rapid growth spikes as others, it also avoids extreme downturns, making it a reliable segment within the blue chip print market. Given the consistency in his print sales and the continued appreciation for certain collections, there is potential for select works to gain momentum in 2025, particularly if more rare editions come to auction.

Where To Start When Looking To Buy A Lichtenstein Print?

The price distribution of Lichtenstein's prints highlights that the majority of sales occur within the lower price brackets, demonstrating strong collector interest in more accessible works. Out of 261 total lots sold, nearly 60% of sales were for prints priced at £15,000 and below, reinforcing the trend that affordable editions remain the most liquid segment of his market.

Prints priced between £15,000 and £30,000 accounted for an additional 19% of total sales, meaning that nearly 80% of all Lichtenstein prints sold at auction fell under £30,000. This segment represents the strongest opportunity for new and seasoned collectors looking to enter the Lichtenstein market with lower financial commitment.

While higher-value works (£50,000 and above) made up only 15% of total sales, they remain significant in terms of market value, as individual rare works and sought-after collections continue to perform well. However, this data confirms that Lichtenstein's print market remains primarily driven by volume and demand for accessible editions.

Works Under £30,000

The sub-£30,000 category remains the most active segment of Lichtenstein’s print market, accounting for nearly 80% of all sales. This price range includes sought-after series such as Landscapes, Moonscapes, Seascapes, Modern Head, and Bulls, which frequently appear at auction. However, the value of these works is highly dependent on condition - prints in excellent condition consistently achieve higher prices, reflecting the premium that collectors place on well-preserved editions.

Lichtenstein Posters

Lichtenstein's artistic repertoire extends beyond his renowned print series to include a diverse array of posters. While these posters, some being original silkscreen pieces, offer accessible options for collectors, they occupy a somewhat ambiguous position in Lichtenstein's print market, as noted by Richard Polsky, an authority in American pop art authentication. Polsky highlights that while these posters retain some value, their lack of numbered edition status somewhat diminishes their overall market worth in comparison to signed limited editions.

Examples of Lichtenstein posters sold in 2023 include the Guild Hall East Hampton Poster, Modern Art Poster, The Poetry Project Symposium Poster, and Foot Medication Poster, all acquired for under £10,000. Polsky also highlights concerns about potential damage to these posters, underscoring the importance of seeking expert guidance when considering investments in poster mediums. However, these works still represent a category of Lichtenstein's print market and provide affordable entry points for collectors looking for authentic pieces with resale value.

The Most In-Demand Lichtenstein Prints From Investors

For investors, the most sought-after Lichtenstein prints are those that balance rarity, condition, and provenance. In today’s selective art market, collectors aren’t just looking for any Nudes print - they want the rarest and most exceptional example. Investors also seek works that highlight Lichtenstein’s distinct use of BenDay dots, a defining feature of his technique. This is why condition is critical in his market; ensuring that this art historical pixel of the past remains crisp and intact is essential. Only pristine prints command top prices, as even the most desirable works can struggle to retain their value if they show signs of wear.

Provenance is equally crucial. Lichtenstein’s collaboration with Tyler Graphics, his most esteemed print publisher, significantly enhances a work’s desirability. Prints produced by Tyler Graphics are recognised for their superior quality and historical significance, making them particularly appealing to serious investors. While high-value transactions can come with a degree of financial risk, those who strategically acquire the right print from the right collection stand to benefit from strong long-term returns in Lichtenstein's market.

Liquidity Of Lichtenstein's Prints

Lichtenstein’s print market remains one of the more stable and liquid segments within the blue chip print sector, but its performance is highly dependent on specific collections, rarity, and condition. The Nudes and Reflections series continue to dominate demand, frequently achieving strong results at auction, yet liquidity is strongest for mid-range works priced between £15,000–£50,000, which see consistent turnover. However, high-value Lichtenstein prints require longer holding periods to maximise returns, particularly as collectors exercise caution in today’s market. Prints in pristine condition with provenance from Tyler Graphics also see faster resale cycles, as collectors prioritise well-documented works from his most recognised publisher. While the market for Lichtenstein prints remains active, shifting buyer sentiment and broader economic factors play a crucial role in determining short-term liquidity.

Regional Market Performance

The United States dominates Lichtenstein’s print market, accounting for over 71% of all lots sold, reaffirming its position as the strongest hub for his collectors and investors. This overwhelming market share highlights the deep-rooted demand for Lichtenstein’s works in the U.S., particularly given his prominence in American Pop Art history. Europe and the United Kingdom follow with 12% and 11% of sales, suggesting steady, but significantly smaller, demand compared to the U.S. Meanwhile, Asia represents only 5% of the market, indicating a potential area for future expansion, especially as Asian collectors continue to engage with Western contemporary art.

Where Is the Opportunity in Lichtenstein’s Market?

While the U.S. remains the dominant force, emerging marketplaces in Europe and Asia are becoming increasingly significant, particularly in the print market. This shift is being accelerated by the rise of alternative sales channels, including digital trading floors and private sales, which provide broader visibility, accessibility, and global distribution. These platforms are revolutionising the way collectors and investors engage with the market, allowing for seamless, real-time transactions across borders.

As the art market becomes more interconnected through digital technology, the ability to expand beyond traditional strongholds will be key. This is especially relevant as Brexit-related economic shifts continue to impact the UK, and Trump’s tariff policies introduce uncertainty into the U.S. market. These external factors could reshape the regional distribution of Lichtenstein’s market share, making Europe, Asia, and digital marketplaces crucial areas to watch for collectors and investors looking to capitalise on future demand.

2025 Market Outlook: Will Lichtenstein Maintain His Momentum?

Coming off a record year in 2024, Lichtenstein’s market appears well-positioned to maintain its strength, but whether it will continue setting new records will depend on broader economic conditions and collector sentiment. While rare prints from high-value collections will continue to be in demand, market caution could impact liquidity at the top end meaning that it may require more effort to secure the right buyer for high-value works. Mid-tier prints priced between £15,000 and £50,000, which make up nearly 80% of total lots sold, are expected to remain the most active and accessible segment for buyers.

Roy Lichtenstein Top Selling Prints

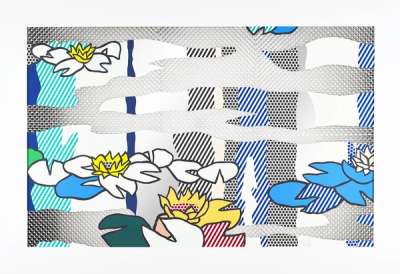

Water Lily Pond With Reflections

Lichtenstein’s Water Lilies (1992) series reinterprets Monet’s Nymphéas through a bold Pop Art lens. Featuring six screenprints on stainless steel, these works blend art historical depth with Lichtenstein’s signature style. The series gained momentum in 2023, with Water Lily Pond With Reflections setting a £1.5 million record in May. In 2024, it returned to Sotheby’s, selling for £1.1 million, reaffirming sustained demand for this series and highlighting the continued growth of the prints and editions market.

Roommates

Lichtenstein’s Nudes series remained highly coveted in 2023, and while fewer prints have surfaced in 2024, strong demand persisted at Sotheby’s November sales. Featuring works from the Dorothy and Roy Lichtenstein Collection, the auction underscored the series' enduring appeal. Roommates, one of the rarer Nudes editions, achieved £952,284 with fees, setting a new record and more than doubling the previous £300,000 benchmark from April 2021, reinforcing the collection’s continued strength in the market.

Nude With Yelllow Pillow

Nude With Yellow Pillow (1994) is a rare print that has commanded increasing attention at auction. In October 2023, an Artist Proof (AP) sold for £450,000 at Phillips, setting a notable record. However, that milestone was eclipsed at Sotheby’s November 2024 sales, where the print soared to £952,284, cementing its status as one of Lichtenstein’s top-selling prints.