Revolutionising Art Commerce with MyArtBroker

MyPortfolio © MyArtBroker 2023

MyPortfolio © MyArtBroker 2023Live TradingFloor

In 2023, MyArtBroker took a significant leap forward, integrating art with the latest technology to transform the landscape of art collection and investment. This pivotal year marked a new chapter in MyArtBroker's commitment to revolutionising the art market, emphasising innovation, accessibility, and transparency. By harnessing the power of digital advancements, MyArtBroker has not only challenged conventional practices but also opened new pathways for collectors and investors to engage with art. This introduction is reshaping the future of art commerce, offering a glimpse into a world where art and technology converge to create unprecedented opportunities for participation and discovery in the art market.

MAB 100 Print Market Index © MyArtBroker 2023

MAB 100 Print Market Index © MyArtBroker 2023MyArtBroker’s Role in Art Commerce

The inception of MyArtBroker was a response to a shifting landscape, where traditional barriers to entry in the art world began to crumble under the pressure of digital innovation. Recognising the potential to leverage technology to make art collecting more accessible, MyArtBroker embarked on a mission to create a platform that would serve both new and experienced collectors alike. This mission was rooted in a belief that the beauty and value of art should be within reach of anyone, anywhere, driven by a passion for art rather than the depth of one's pockets.

As art commerce has undergone significant changes in recent years, marked by the increasing importance of online sales, digital galleries, and virtual auctions, MyArtBroker has been at the forefront of embracing and driving these changes. The platform has introduced a suite of digital tools and services, from comprehensive valuation algorithms like SingularityX to innovative trading and portfolio management solutions. These offerings not only reflect the current state of art commerce but also anticipate its future directions, ensuring that MyArtBroker remains a relevant and influential player in the market.

SingularityX: Revolutionising Art Valuations

SingularityX is the heartbeat of MyArtBroker's technological revolution, fundamentally altering the landscape of art valuations. This sophisticated algorithm harnesses the power of extensive market data, introducing an era of unprecedented transparency and precision to the art world. Unlike traditional valuation methods that often rely on subjective assessments or limited datasets, SingularityX processes information from a diverse range of sources and a multitude of other valuation metrics accumulated over the last 15 years.

By incorporating advanced analytics, including unsold rates, series relationships, and repeat regression technology, SingularityX provides a comprehensive and nuanced analysis that can significantly impact investment decisions. It addresses the critical challenges of market opacity, valuation complexity, and reliance on narrow data sets, paving the way for a more accessible, credible, and transparent art market.

Through SingularityX, MyArtBroker is not just predicting the future of art commerce; it is actively creating it, ensuring that the art market evolves into a space that values data-driven insight as much as aesthetic appreciation.

Trading Floor © MyArtBroker 2023

Trading Floor © MyArtBroker 2023MyPortfolio and Trading Floor: Democratising Access to the Art Market

The Trading Floor platform by MyArtBroker is a revolutionary tool reshaping how collectors and investors interact with art commerce. This innovative platform offers a dynamic and transparent window into the real-time supply and demand dynamics of the art world.

One of the most compelling features of the Trading Floor is its live data feed, which provides users with up-to-the-minute insights into market movements. Collectors can see which artworks are currently sought after, which are being offered for sale, and at what price, all in real-time. This immediacy of information supports collectors to make informed decisions quickly, a critical advantage in a market where timing can significantly impact investment outcomes.

This is particularly significant when considering the appeal of the prints and editions market, known for its attractive price points. This segment of the art market stands out for its approachability, offering novice and seasoned collectors alike the opportunity to invest in high-performing assets without the prohibitive costs often associated with original artworks. Starting at just a few thousand dollars, prints and editions present an accessible entry point into art collection and investment, introducing a wider audience to the potential of art as a valuable asset class.

MyPortfolio, a cutting-edge platform powered by the SingularityX algorithm, marks a significant departure from traditional art collection management methods, integrating advanced technology to provide a comprehensive, real-time perspective on the art market. Through its intuitive interface, collectors can easily add and monitor artworks, track market changes, and analyse the financial performance of their collection.

By levelling the playing field, these tools encourage participation from a broader spectrum of collectors and investors, from novices to seasoned aficionados. The platform's transparency ensures that all users have access to the same market information, fostering fairer transactions and promoting a more vibrant and competitive marketplace.

MAB100: Benchmarking the Prints and Multiples Market

The MAB100 index represents a groundbreaking advancement in the art market, particularly within the niche of prints and multiples. By offering an unprecedented overview of this specific market segment, the MAB100 has established itself as a vital tool for art collectors and investors seeking to navigate the complexities of art investment with clarity and confidence. This index, developed with the sophisticated SingularityX algorithm, harnesses a wealth of data to provide a comprehensive, objective analysis of market trends, value fluctuations, and investment potential.

What sets the MAB100 apart is its ability to distil vast amounts of market data into actionable insights. This includes analysis from over 300 auction houses, alongside private sales and valuation data, offering a panoramic view of the prints and multiples market that was previously unavailable. For collectors, this means the ability to identify emerging trends, assess the liquidity of different artworks, and make informed decisions about when to buy or sell. For investors, the MAB100 serves as a compass in a traditionally opaque market, highlighting opportunities for growth and advising on strategic acquisitions.

The index not only provides unprecedented access to information that was once the purview of a select few market insiders, but also elevates the entire ecosystem of art collection and investment. By providing a clear, data-driven perspective on the market, the MAB100 empowers participants to act with greater assurance and strategic foresight.

Beyond Fractional Ownership: MyArtBroker Enables Full Asset Control

MyArtBroker’s innovative approach marks a pivotal shift in the art collection landscape, steering away from the traditional constraints of fractional ownership. By advocating for complete asset control, MyArtBroker empowers savvy investors to fully own their passion assets, deepening their connection to the art world. This holistic ownership model not only enhances the personal value of each piece but also amplifies the potential financial returns for the collector.

Through platforms like MyPortfolio and the Trading Floor, MyArtBroker provides collectors with the tools necessary for informed decision-making, enabling them to acquire, manage, and appreciate their art collections without the need to share ownership. This direct control over one's collection allows for a more intimate and rewarding collecting experience, fostering a genuine sense of pride and personal investment in the art world.

MyArtBroker's commitment to full ownership democratises access to the art market, breaking down barriers that once limited collecting to a select few. By equipping collectors with data-driven insights and real-time market trends, MyArtBroker ensures that individuals can confidently navigate the complexities of art investment, securing 100% ownership of artworks that resonate with their personal tastes and investment goals, with the added benefit of exceptional, personalised service. This visionary approach reinforces the value of complete ownership in the digital age, setting a new standard for art collecting and appreciation.

MyArtBroker Top Market Picks

Predictions for the 2024 art market point towards continued favourable outcomes for the print market and established blue-chip artists like Andy Warhol, David Hockney, and Damien Hirst.

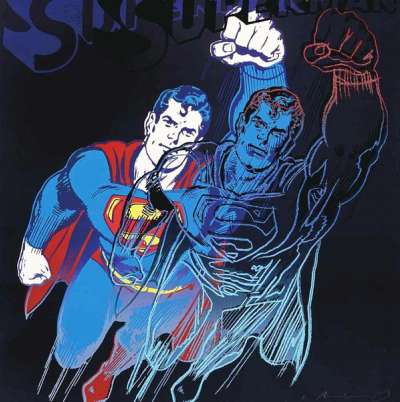

Andy Warhol

Warhol's print market thrived in 2023, showcasing a robust presence across various segments with a notable £33 million in sales. The year highlighted Warhol's appeal in celebrities, trial proofs, and complete sets, reflecting diverse collector interest. His celebrity series, particularly Mick Jagger and Marilyn Monroe prints, collectively fetched millions, with Marilyn's portraits setting auction records. Trial proofs emerged as a significant trend, with rare pieces like Superman and Rebel Without A Cause achieving record prices, indicating a strong market for unique Warhol works. Complete sets continued to captivate collectors, with the Endangered Species set and others achieving multimillion-dollar sales.

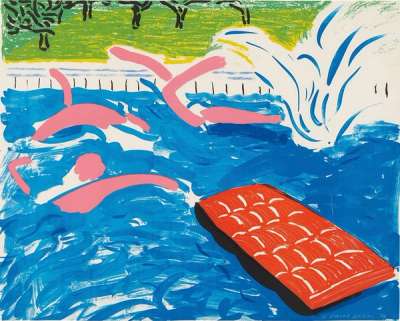

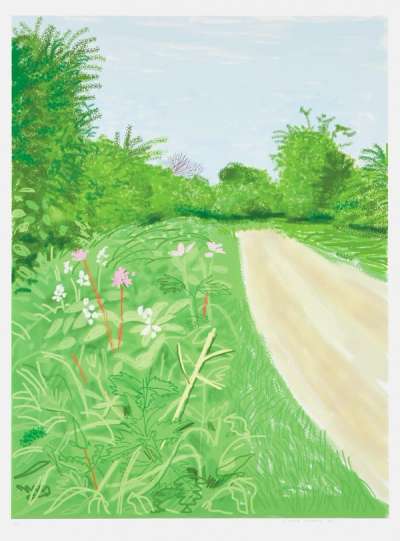

David Hockney

Hockney's print market demonstrated remarkable strength in 2023, with consistent sales each quarter and a significant year-over-year growth, totaling £9.9 million in hammer sales, a 24% increase from 2022. His diverse portfolio, including the iconic Swimming Pool series and lesser-known works like Illustrations For Six Fairy Tales From The Brothers Grimm, underscored his broad appeal. The latter set a record at Christie’s New York in Q4, fetching $119,700. Hockney's foray into digital art, particularly his iPad drawings and the limited edition Arrival of Spring series, continued to captivate collectors, with prices for these pieces consistently exceeding £100,000, signaling strong interest in his digital prints. Hockney’s Weather Series also made a notable impact, with a complete set selling for $277,200 at Christie’s New York in Q4, highlighting the enduring demand for Hockney’s work across various mediums and themes, despite the prevailing economic conditions.

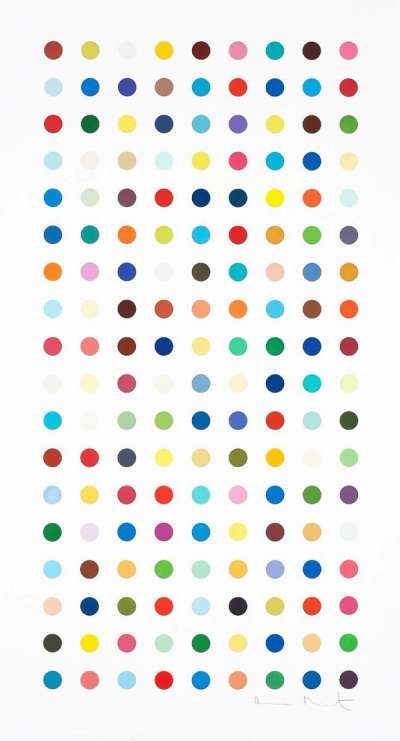

Damien Hirst

Hirst's print market in 2023 demonstrated resilience and adaptability amidst a year of transformation. The early momentum, with over £1 million in sales from 110 prints in Q1, gradually adjusted to a softer Q4, closing with 42 prints at nearly £460,000. Overall, Hirst’s annual performance remained robust, with 300 prints totaling £2.4 million in sales, affirming the consistent collector interest with an average sale price of £8,201. Key highlights from the year included Hirst’s The Virtues series, which stood out for its high demand, reaching £101,600 along with Spots, a series known for its distinctive, colourful dot patterns. Record-breaking sales of individual prints like Methamphetamine and Tetrahydrocannabinol in Q2 and Q4 respectively, showcased the high market value of his thematic works.

MyPortfolio © MyArtBroker 2023

MyPortfolio © MyArtBroker 2023MyArtBroker's Impact on the Art World

MyArtBroker has revolutionised the art collection landscape, democratising access with unparalleled real-time insights and analytics. By championing transparency and equitable market practices, MyArtBroker challenges conventional norms, fostering a more inclusive environment for art enthusiasts worldwide. Its dedication to providing collectors with full ownership rights marks a significant departure from traditional models, amplifying its role as a catalyst for empowerment within the art community. Through these transformative efforts, MyArtBroker is not just reshaping the present art market—it's setting the foundation for a future where art is accessible, valued, and shared on a global scale.