Auction Watch: David Hockney Phillips Sale September 2024

Dog Wall (complete set) © David Hockney 1998

Dog Wall (complete set) © David Hockney 1998Live TradingFloor

Phillips launched its third annual David Hockney-only sale in a live auction format on Thursday, September 19th, at its London headquarters. Hockney maintains an extensive print portfolio, ranging from highly sought-after works to more experimental pieces, which offers a rich landscape for collectors.

In this auction report, I had an in-depth conversation with Helena Poole, our Hockney sales specialist, to break down the recent sale's highs and lows, exploring key market trends and discussing which pieces stood out and which underperformed. For a comprehensive analysis, listen to our full discussion in the latest episode of MyArtBroker Talks.

Phillips Third Annual Hockney Sale Outperforms 2023

Phillips kicked off their September live auction season with a dedicated Hockney sale featuring 61 lots, of which four remained unsold. This marked the first time in their three Hockney-only sales that they didn’t achieve a 100% sell-through rate. However, this minor setback is overshadowed by the overall performance. The sale achieved a hammer total of £1.4 million, just 3% below the low presale estimate, but still 2% higher than the previous year’s hammer total, resulting in a broadly successful outcome with a 93% sell-through rate.

Helena, drawing from her auction house experience, noted that the strong sell-through rate remains intact despite some unsold lots. She emphasised that this is likely due to pricing and estimates rather than a lack of demand. She suggested that if reserves had been adjusted, the sell-through rate could have approached 100%. This sentiment reflects a cautious market where sellers' expectations for high prices may not always align with buyers' current appetite. The unsold works, therefore, indicate more of a pricing issue rather than diminished interest. For comparative analysis review Phillips David Hockney Sale September 2023.

Resale Analysis, Phillips David Hockney Sale 2024 © MyArtBroker

Resale Analysis, Phillips David Hockney Sale 2024 © MyArtBroker Results Fall Within Expectations

The provenance analysis reveals several resales of the same editions, with impressive returns on most of them despite varied holding periods–from less than 12 months, which can be risky, to up to 34 years. For instance, Hairy Legs (1961), an early etching, achieved a commendable resale value of £33,020 with fees, doubling its purchase price from 1990 and resulting in a positive compound annual growth rate (CAGR) of 2.5%. In contrast, Painted Environment II (1993) a more recent digital laser print from the Moving Focus series, held for just 12 months–a short-term gamble–resulted in a significant negative CAGR of 60%, despite the estimated values remaining relatively consistent year-over-year.

When I asked Helena for her perspective of the resale analysis she related art flipping to broader visibility, where a piece purchased at one auction, possibly less noticed or undervalued, is quickly resold at another auction with broader visibility. She notes that this can potentially result in a significant profit, especially if the work attracts more attention and bids in the second sale, but more so, it highlights the cyclical nature of the art market, with certain pieces frequently reappearing at auctions, and the importance of timing and strategy in achieving a profitable resale.

Helena and I agreed that the sale largely met expectations. She elaborated, explaining that while some unsold works were surprising, it’s not uncommon for pieces to either outperform or fall short of their estimated values due to the nature of the auction model. Helena highlighted that private or gallery sales often command premiums because they reflect what buyers are willing to pay in a more deliberate purchasing environment. For a deeper understanding of the distinctions between auction and private sales, you can refer to our guide on Auction vs. Private Sale.

Etchings

A significant part of the success of Phillips’ Hockney-focused sales can be attributed to the thoughtful curation and chronological presentation of his print works. The sale began with older etchings and works on paper, featuring a range of options. More affordable prints, such as The Sexton Disguised As A Ghost (1969), from Illustrations for Six Fairy Tales from the Brothers Grimm, sold for £2,032, while A Rake's Progress and Other Etchings by David Hockney (B. 6) (1963) achieved £3,048. Higher-value works, like the rare etching Myself And My Heroes (1961), reappeared on the market after a 16-year holding period and sold for £13,970. Another standout was French Shop (1971), which continued its strong performance in 2023, selling for £11,430, just shy of its previous auction record. These pieces offer a refreshing glimpse into Hockney’s diverse oeuvre, showcasing themes beyond his well-known depictions of sunshine and swimming pools, such as fantastical characters inspired by poetry, pacifism, and his unique perspectives on travel and everyday life.

Complete Sets

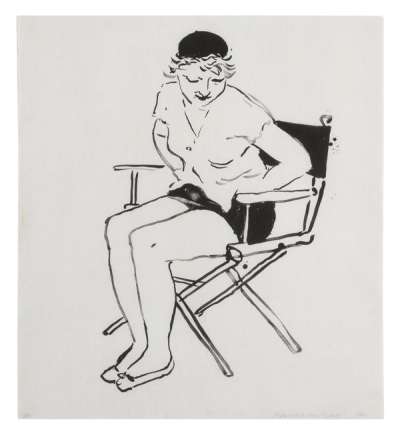

Two complete sets were featured early in the sale. The first, a resale of A Rake’s Progress (1961-63), a series of 16 etchings in monochrome and red, reimagines William Hogarth’s narrative through Hockney’s perspective, where, as Helena notes, “he portrays himself as a doppelganger, though he has denied that it is him.” This set sold for £254,000. Also notable was Dog Wall (1998), capturing intimate poses of Hockney’s dachshunds, Stanley and Boodgie. Described by Helena as “cozy and intimate,” this set achieved £317,500 after a lively bidding war, making it the star lot lot of the sale.

There is a growing interest in acquiring complete sets with matching edition numbers. Helena explains that matching numbers are crucial for a complete set. While one can piece together a series by purchasing individual prints, a set with consistent edition numbers and shared provenance–indicating they were sold as a unit and kept together–holds significant monetary value. This continuity and integrity enhance the set's appeal and worth, reflecting its unbroken history and original state as intended by the artist.

Extremely Limited Prints

Within the print market there is the occasional appearance of exceptionally limited prints within an artist’s extensive body of work. Whether these prints are widely recognised or relatively obscure, they are considered rare and valuable due to their limited availability and unique qualities.

Swimming Pools

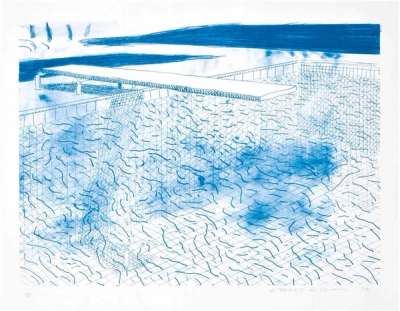

Several swimming pool interpretations featured in the sale. Pool Made with Paper and Blue Ink for Book, from Paper Pools (1980) sold predictably for £40,640, reflecting its consistent market presence. However, Lithograph of Water Made of Lines (T.G. 246) (1978) didn’t meet its £65,000 reserve, likely due to its minimal colour palette. Helena highlighted the surprising outcome, noting that clients often show high demand for these pieces. This result seems to reflect current market caution, with collectors carefully selecting the best investments amid fluctuating conditions.

We also discussed Hockney's other interpretations of water, such as Water Pouring Into Swimming Pool, Santa Monica (1964). Helena noted how this piece bridges multiple aesthetics–minimalism, modern abstraction, and even pop art–emphasising that Hockney’s water-themed works consistently sell at a premium. Carrying a presale estimate of £8,000, this piece significantly outperformed expectations, achieving £16,510 highlighting the high demand for Hockney’s unique depictions of water, regardless of the subject's specific form or context. We observed that both observed that Hockney’s market is so extensive that certain works and key periods are often overlooked. For those looking to explore his collection, it’s wise to consider these lesser-known areas, especially those with water themes, as they show strong growth potential in the coming years.

The Weather Series

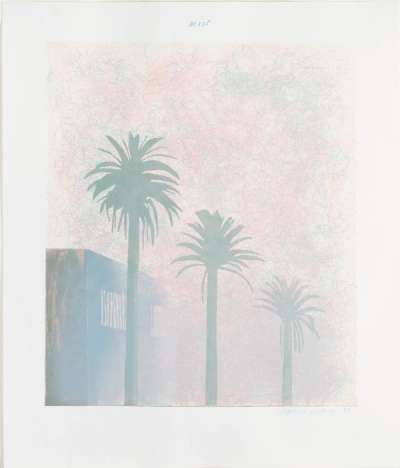

Hockney's limited works using Japanese woodblock techniques have emerged as a niche yet fascinating trend in his print market, as noted by Helena. This auction featured two pieces from The Weather Series (1973). Helena described Mist as an LA landscape with palm trees against a pinkish sky, while Snow evokes Hokusai-inspired imagery. Both prints performed well, achieving £36,830 and , respectively. These works explore themes of weather and movement, showcasing Hockney's unique artistic versatility.

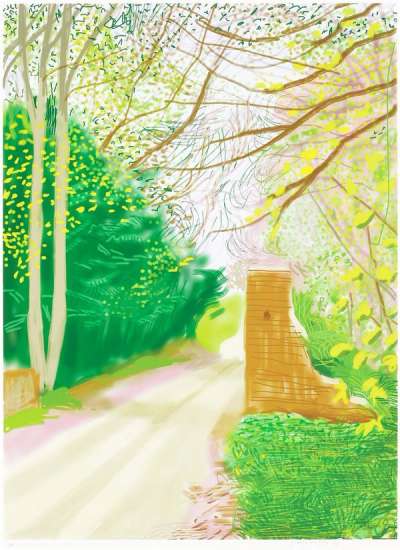

The Arrival Of Spring

Hockney’s Arrival of Spring works are always highly anticipated at auction, yet their rarity is notable due to small edition sizes, with many pieces never having appeared publicly. One of the highlights of this sale was expected to be The Arrival of Spring in Woldgate, East Yorkshire in 2011 - 16 May, a large-scale piece produced in an edition of only ten. Valued at £280,000, this work surprisingly did not meet its reserve. Helena noted that the spring and summer pieces from this series are ”hugely sought after,” making the outcome unexpected, given their typical secondary, auction and gallery, market performance.

Two other smaller-scale Arrival of Spring works made their auction debut: The Arrival of Spring in Woldgate, East Yorkshire in 2011 – 14 March and The Arrival of Spring in Woldgate, East Yorkshire in 2011 - 30 April. Both exceeded expectations, achieving £177,800 and £190,500 respectively, nearly doubling their high estimates.

Other Market Trends: What Hit and What Missed

The sale also saw strong results for Hockney’s coloured lithographic still-life and floral portraits. Pretty Tulips (1969) and Lillies (1971), from Europäische Graphik Mappe VII (European Prints Portfolio VII) achieved £30,480 and £27,940 respectively, both surpassing expectations. New auction records were set with Celia In The Director's Chair (1980), which sold for £19,050, breaking its previous record of £18,750 set in 2012, and Slow Rise (1993) from Some More New Prints, which achieved £30,480 against its previous high of £25,000 in 2020.

The most notable miss came from Hockney’s Moving Focus series, his most extensive print collection. While not entirely a setback, and most pieces sold within their estimates, results were more varied and slightly lower compared to previous sales of the same works. However, as Helena pointed out, most works offered in this sale met their expected targets. Overall, the sale provided a realistic reflection of the current market conditions, which remain challenging. Despite this, the auction outperformed its 2023 counterpart, demonstrating strong resilience in Hockney's print market.

Impact of Single Artist Sales

Single-artist sales offer significant advantages by focusing attention on an artist’s entire body of work, setting new benchmarks, and establishing market value across various techniques and periods. This is particularly compelling in the case of Hockney, whose extensive printmaking has been expertly showcased through Phillips' curatorial approach. The early success of these annual sales is a testament to the auction houses ability to craft a narrative that elevates the cultural importance of Hockney’s oeuvre. For an artist like Hockney, these events not only highlight the breadth of his work but also provide a comprehensive view of his career, ultimately boosting market confidence in his printmaking legacy.

The inherent risk, of course, is that if a sale underperforms, it can adversely affect both public and private sales. Fluctuating demand also poses a challenge, as the success of these auctions is heavily dependent on current market interest, and high demand can sometimes lead to market saturation. Despite these potential pitfalls, a well-curated single-artist sale, such as Phillips’ Hockney auctions, has proven to successfully highlight the artist’s diverse accomplishments and reinforce their prominence in the art world.