Damien Hirst Print Market Investments © MyArtBroker 2024

Damien Hirst Print Market Investments © MyArtBroker 2024

Damien Hirst

673 works

Damien Hirst gained fame through conceptual sculptures using preserved animals and pharmaceuticals. His innovative approach to prints - embracing AI and demand-based editions - has broadened his market appeal and solidified his status as one of the most prolific and recognisable blue chip artists in the Contemporary print world.

In this investment report, we examine Hirst's's print market performance spanning the past seven years. Leveraging auction and sales data from our dedicated database focused on prints and editions, our objective is to provide valuable insights to help you determine whether investing in Damien Hirst is a wise decision for 2025.

Is Buying A Hirst Print a Good Investment?

Hirst’s print market operates differently from other blue chip artists, driven by higher volume and more accessible price points rather than a reliance on rare, high-value works. Over the past five years, the market has experienced a steady decline in both sales value and volume. It peaked in 2022, reaching £3.6 million across 475 lots, following strong momentum in 2021 (£3 million, 371 lots). However, since 2023, both value and volume have gradually decreased, with £2.7 million and 350 lots sold in 2023, followed by £2.6 million and 329 lots in 2024.

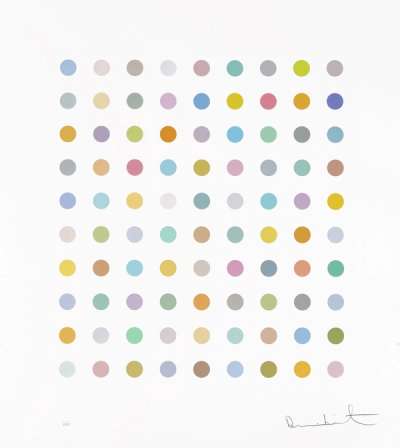

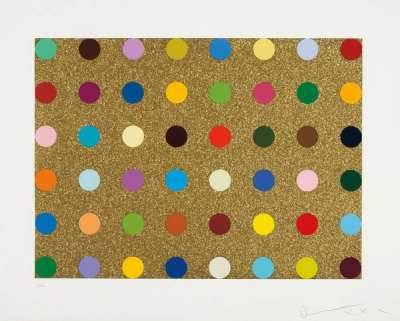

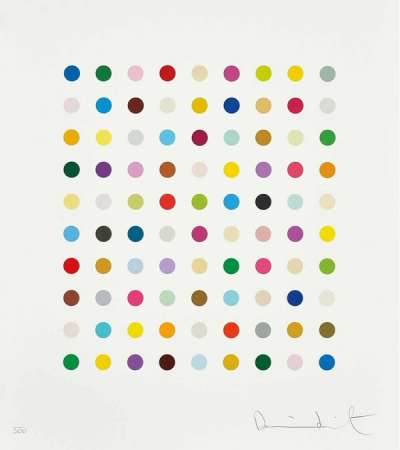

Unlike artists whose print markets hinge on sporadic appearances of rare editions, Hirst’s market is built on consistent supply, making it more sensitive to broader collector sentiment. Early 2025 figures show a decent amount of recorded sales. The trajectory of Hirst’s print market in 2025 will likely depend on continued demand for his most recognisable series, such as Spot Paintings, Butterfly prints, and The Virtues. Also of interest will be whether one of his HENI drops will take off and command consistent value on the secondary market.

What Happened In Hirst's Print Market Performance in 2024?

Hirst's print market in 2024, although it contracted slightly in sales value and volume Hirst still released two drops with HENI: The Secrets released in late January, eight unique prints full of colour, that merge digital precision with a splatter technique with the edition size determined by demand. and then the kaliedoscopes released in late October returned to hirst's signature butterfly kaliedscope tehcnique in landscape format,, five prints limited to 180 editions each + 20 APs. so this is another example of how hirst's market continues to sustain itself, especially in th eprimary sector where an influx of works become available. yet, at the same time, because there are so many, some go unsold on the secondary market or it will sell for.a low price point and then the online digital marketplace serves as a middle ground, reading the market, knowing when to send a work to auction which might result in favourable bidding or securing a buyer for a rare pioeves privately.

What Is The Average Value Of My Damien Hirst Print?

Hirst’s average selling price (ASP) has experienced some fluctuations over the past five years, reflecting shifts in market dynamics and collector sentiment. Between 2021 and 2022, his market saw strong growth, with the average value rising from £8,000 to £9,600, signalling high demand and competitive bidding. However, in 2023, this momentum slowed, leading to a price correction as the average dropped to £7,600 - likely due to an oversupply of works, shifting buyer priorities, or broader economic factors.

By 2024, despite a decline in both total sales value and lots sold, the average price stabilised at £8,100. This suggests that while overall demand softened, buyers remained willing to pay stable prices for select works, particularly for complete sets and individual prints of The Virtues, which consistently exceeded expectations in public sales. Now, just a few months into 2025, the ASP has climbed to £9,000, signalling early market confidence.

Top Performing Print Collections In Hirst's 2024 Market

Hirst's print market demonstrates variations between collections in terms of sales value and lots sold. Leading in transaction volume, The Empresses topped the chart with 41 lots sold, reinforcing its strong and affordable market presence. Close behind were Fruitful and Forever with 35 lots and Spots with 31, highlighting the continued appeal of Hirst’s signature spot motifs. Meanwhile, The Virtues recorded 29 sales, maintaining its popularity among collectors, while Where The Land Meets The Sea followed with 28 lots. Other collections, such as For The Love of God (16 lots), Colour Space (15 lots), and H7 (14 lots), saw more moderate success, catering to specific collector interests.

However, when analysing sales value, The Virtues emerged as the top-performing collection, generating £512,627 - despite ranking fourth in lots sold. This suggests a higher price per print and strong collector demand. Spots followed with £362,693, reinforcing its long-standing desirability. Love Poems also generated interest in 2024 with multiple complete sets setting new record and individual prints outperforming estimates. Where The Land Meets The Sea generated £107,904, balancing both transaction volume and value. Lower-volume collections, such as Psalms (£65,377) and Mickey Mouse (£60,125), maintained strong relative value despite selling fewer lots and sees a broad collector interest in Asian countriues.

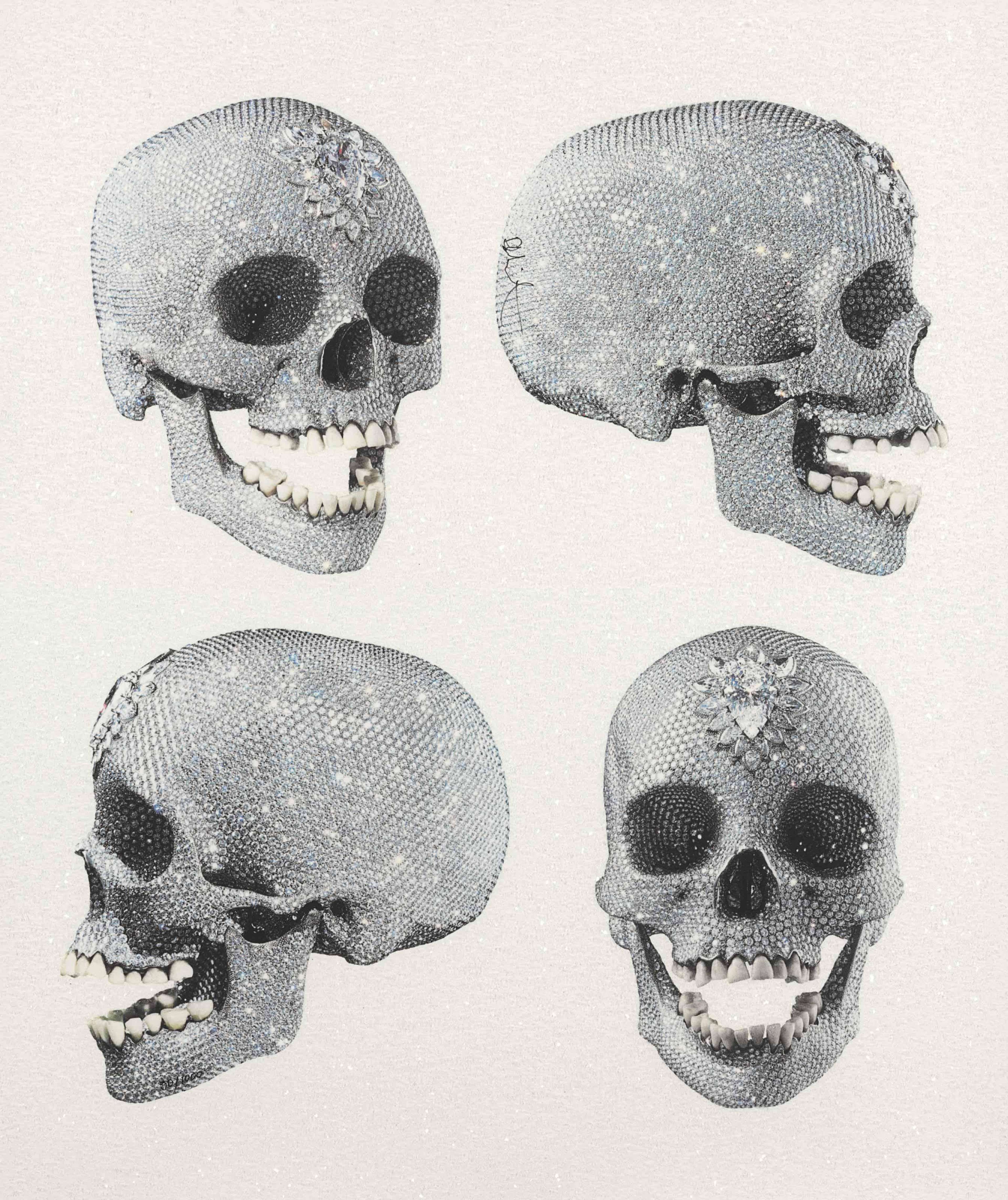

The Most In-Demand Hirst Prints Within Our Network

Within our network, Hirst’s most in-demand prints remain The Virtues and The Empresses, though their market behaviour differs depending on the selling platform. The Virtues series often sees collectors opting to sell individual prints privately rather than at auction, where higher circulation can lead to mixed results - while some prints achieve strong prices, others risk going unsold or underperforming due to market saturation. Similarly, The Empresses series tends to command lower values at auction, yet private sales can often yield more favourable deals, offering collectors solid opportunities to buy or sell strategically. Beyond these newer releases, Hirst’s skull and butterfly prints continue to attract collectors, particularly his earlier editions, which hold strong historical appeal. These works, often more affordable than his more recent releases, resonate deeply with buyers drawn to Hirst’s iconic themes of life, death, and transformation, reinforcing their enduring popularity within the market.

Seven Blue Chip Artists Markets To Know

The chart showcases the comparative sales value of several major artists, highlighting shifts in market demand over time. Hirst remains a steady performer with a consistent sales value, although in a lower bracket compared to other artists, never experiencing a comparable spike.

Hirst's sales values have been more in line with artists such as David Hockney, Roy Lichtenstein, and Keith Haring, all of whom exhibit relatively stable, lower-value sales compared to Andy Warhol and Banksy. However, Hirst’s market shows resilience, and his print market - while not seeing explosive growth - continues to sustain a reliable presence.

Compared to Jean-Michel Basquiat, who maintains a relatively lower but consistent presence in print sales, Hirst’s market appears less volatile, though it lacks the surging demand of more speculative artists.

Where To Start When Looking To Buy A Hirst Print?

Damien Hirst’s print market in 2024 remains defined by accessibility and volume. For those just beginning their collecting journey, over half of all Hirst print transactions take place below the £5,000 mark - an ideal entry point offering both affordability and variety. From there, options scale gradually depending on budget and collecting intent, from mid-market series to high-value investment pieces.

Hirst Print Works Below £5,000

Prints under £5,000 account for 52% of Hirst’s total market transactions in 2024. This is the most diverse segment of his output, with a wide range of well-known series available to collectors. Popular choices include individual butterfly prints from The Souls series (on both white and black backgrounds), his colourful Till Death Do Us Part skulls, and works from The Currency - a project that gained attention for its crossover between physical and digital art.

Works Most In Demand by Investors

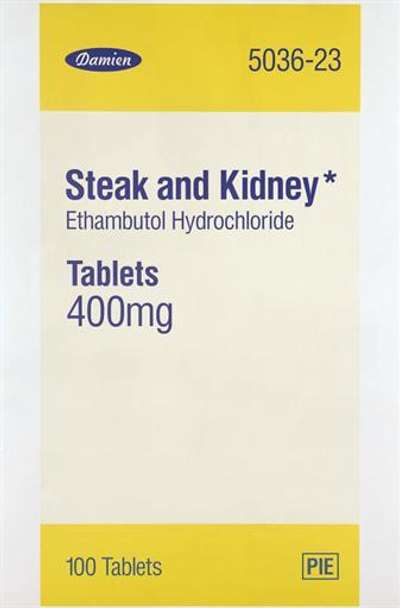

The £5,000–£15,000 range accounts for an additional 37% of Hirst’s print sales. For collectors seeking an accessible entry into complete sets, The Empresses falls within this bracket, while individual prints from the set can often be found for less. Post-2010 Spot screenprints - many titled after pharmaceutical substances - also fall into this range, offering larger-scale works at a mid-market price point.

Higher-value Hirst prints make up a much smaller portion of the market, illustrating how his success is largely built on lower-value prints traded at high volume - an approach that has made his market commercially unique. That said, prints priced between £15,000–£30,000 still account for 7% of sales and remain stable, with collections like the Psalms and Mickey Mouse works (popular particularly in Asia) sitting in this range.

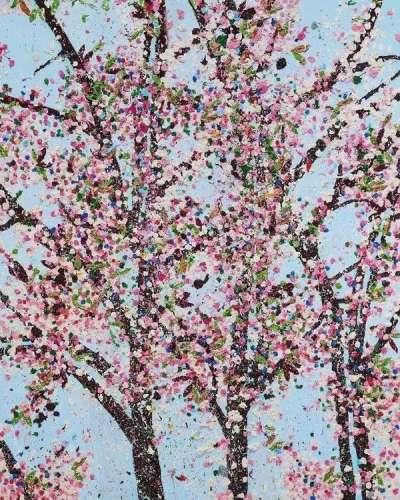

At the top end, individual prints from The Virtues series often exceed £30,000 at auction, and complete sets - along with those from the currently resurgent Love Poems - regularly achieve over £100,000. Despite occasional market fluctuations, Hirst’s most iconic motifs - cherry blossoms, butterflies, skulls, and spots - continue to show remarkable year-on-year consistency, underscoring the breadth and resilience of his print market.

Heni Drops

Hirst's collaboration with Heni dates back to as early as 2016, marked by the release of H1 Enter The Infinite (the tapestries), prints inspired by his early spin paintings. Among the various Heni x Hirst print publications, one of the most attention-grabbing drops was The Currency, a disorderly yet uniquely interpreted take on his Spot paintings, unveiled in July 2022 and marking the artist's debut with Palm NFT studio. The most successful Heni x Hirst drop on the secondary market has been H9 The Virtues, following his Cherry Blossom paintings (2018-2020). Individual prints and complete sets of these works continue to fuel high demand.

Hirst has continued to disrupt traditional art world structures by curating print collections that offer scaled-down versions of his most recognisable paintings. Sidestepping the conventional gallery system, he challenges standard notions of limited editions by making many of his prints available on-demand - ensuring that anyone who wants a print can get one. This model, pioneered through his HENI drops, has redefined accessibility in the art market and is further validated by strong investor demand.

Liquidity In Hirst's Print Market

Although Hirst’s frequent, demand-driven drops can contribute to a degree of market saturation, they also provide notable liquidity by reshaping how collectors access his work. By tailoring edition sizes based on direct buyer interest, Hirst has created a model that ensures a steady circulation of prints across both primary and secondary markets - bolstering the commercial strength of his print portfolio. He’s not alone in this approach; the conversation around scaling access in the art world is one we explored in our live panel Scaling Access, featuring insights from Woolwich Contemporary Print Fair, Avant Arte, and Jealous Gallery. As our Commissioning Editor Erin Argun puts it, “Hirst’s collaborations with HENI represent a radical shift in printmaking - transforming how we talk about both art production and market participation.” Despite the polarising views around his practice, the structure, scale, and liquidity of Hirst’s market remain clear indicators of its enduring momentum.

Recent Market Performance and Current Opportunities in Hirst's Print Market

Hirst’s print market continues to be heavily concentrated in the United Kingdom, which accounts for a dominant 67% of total lots sold - more than two-thirds of the global share. This is a reflection of his continued local demand and resonance with UK-based collectors, where many of his primary market drops and auction appearances tend to occur.

The United States represents the second-largest market, with 15% of sales, followed by Europe (9%), Asia (7%), and Other regions (2%). While Hirst’s reach is clearly international, the concentration in the UK highlights how regional proximity, auction house presence, and collector familiarity remain strong drivers of performance.

Looking ahead, Hirst remains a key figure in the contemporary art landscape with upcoming exhibitions and the potential for further releases through HENI. His continued focus on theme-driven series - especially those that reference mortality, nature, and science - ensures that both collectors and investors remain engaged. With his print market built around affordability, frequent releases, and recognisable iconography (butterflies, skulls, spots), Hirst’s commercial appeal shows no signs of slowing.

Damien Hirst's Top Selling Prints

Image © Phillips / Day In Day Out © Damien Hirst 2003

Image © Phillips / Day In Day Out © Damien Hirst 2003Day In Day Out

In October 2024, Phillips held its first dedicated Damien Hirst auction centred on prints and editions, with top lots featuring editions of Hirst’s iconic Pill Cabinets from the early 2000s.

Day In Day Out, depicting a grid of brightly coloured pills neatly arranged within a white cabinet, achieved £230,759, while End Of Days, its darker counterpart featuring pills in a black cabinet, sold for £127,000. Both works exemplify Hirst’s early and enduring fascination with pharmaceuticals, exploring themes of health, mortality, and consumer culture. These two editions are the highest-selling Hirst editions at auction across both 2023 and 2024.

The Virtues (complete set)

Hirst’s complete set of The Virtues has been met with consistent demand since it's entry to the secondary market in 2021. While prices have since levelled out, the series remains in high demand, with frequent appearances at auction throughout the year continuously attracting strong bidding.

In February 2024, a full set sold at Phillips for £121,083, followed by another in June that achieved £101,600. Both results held firm - or exceeded - the benchmarks set in 2023, highlighting the ongoing collector interest and stable market presence of this standout series.

Love Poems (complete set)

With their vibrant colours and delicate compositions, Hirst’s Love Poems prints convey a sense of both beauty and fragility, reflecting on the transience of love and life. Individual works from the series are seldom offered publicly, while complete sets are even more elusive. In January 2024, a full Love Poems set appeared at Phillips, standing out as one of the key lots in the sale. Making only its third appearance on the secondary market, it achieved a record result of £78,740.