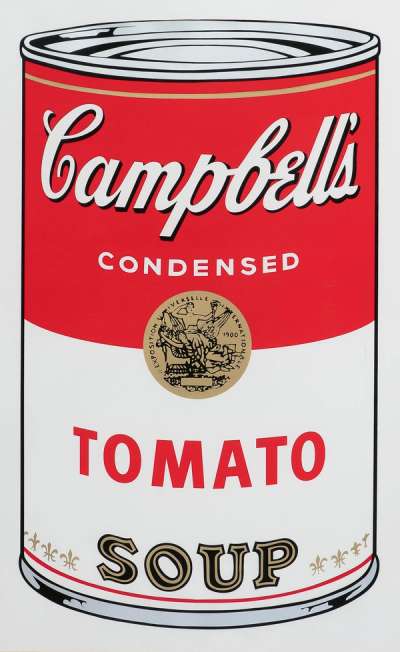

Campbell's Soup II, Oyster Stew (F. & S. II.60) © Andy Warhol 1969

Campbell's Soup II, Oyster Stew (F. & S. II.60) © Andy Warhol 1969 Market Reports

In April, the art world shifted its focus to financial matters, with continued attention towards Sotheby's new fee structure, sparking analysis of its impact on Patrick Drahi. Christie's also introduced an intriguing strategy placing an emphasis on prints & multiples. The New York print sales this month set the stage for the anticipated May Auctions and MyArtBroker released our first market report of the year. We engaged in discussions with ArtTactic to explore the significance of data analysis and hosted several live market panels.

Here is the art market in April 2024:

Art Finance

Sotheby's Strategic Fee Overhaul: Impact, Implications, and Global Rollout

In April, there's been increasing focus on Sotheby's revamped fee structure. While representatives from Sotheby's claim that the changes aim to “simplify” fee arrangements, ultimately drawing more participants to the market, this move appears strategic, especially considering the UBS Art Basel report highlighting increased sales volume in 2023. However, beneath the surface lies the reality of Patrick Drahi's stake in Sotheby's, which is reportedly tied to significant debt. Art world insiders and analysts have scrutinised this aspect with various interpretations. For example, Tim Schneider from The Art Newspaper predicts that Drahi may seek to alleviate this financial pressure by selling a minority stake in the auction house given that Drahi’s financial strategy has heavily relied on leveraging debt, a tactic less favourable in today's economic climate. With this insight in mind, it appears that the newly introduced fee structure for auction sales is a calculated move aimed at enhancing revenue generation and optimising financial efficiency.

Marion Maneker, host of the Artelligence podcast and who has a weekly article with Wall Power, offers an insightful parallel to Sotheby's art loan securitisation, where short-term, diversified loans ensure that regardless of borrower performance, Sotheby's stands to benefit—either through interest earned on loan repayments or through the sale of artworks in the event of loan default. In essence, Sotheby's stands to gain from both scenarios, securing cheaper capital while optimising its financial standing. Maneker posits that Sotheby’s art-backed loan structure and the introduction of the new fee structure are both positioned to attract buyers. With changes set to take effect globally - consigned items after April 15, 2024, will adhere to the new terms for sellers, while new buyer's premium will take effect on May 20, 2024 - sellers in the upcoming May New York auctions may not immediately feel the impact, but the industry will closely monitor the outcome of these changes.

Christie’s and Art Money

Sotheby’s isn't alone in reevaluating its purchasing process. While Christie's and Phillips have yet to adopt a new fee structure, they face similar risks. Christie's recently collaborated with the Australian startup Art Money, offering interest-free loans for purchasing artworks launching with Christie's April prints and multiples sale. Last year, art market demand shifted from high-end to more affordable pieces, due to various factors like the absence of blockbuster collections and economic challenges. Arguably, Christie's move indicates a gamble on the mid-tier market, particularly in prints, which ultimately, is an attempt to draw new buyers , the same as is Sotheby’s focus on a revised fee structure.

Art Analyst Insights: A Sit-Down With ArtTactic

This month, I had the pleasure of discussing the art market and the significance of data-driven market reports with Lindsay Dewar, ArtTactic’s COO. Our conversation highlighted the similarities between MyArtBroker’s and ArtTactic’s research approaches, emphasising our shared commitment to providing professional, data-packed reports tailored for industry experts. Lindsay stressed in the podcast that our reports are not just casual reading but are meticulously crafted for professionals, aiding in informed decision-making. While ArtTactic specialises in comprehensive art market reports across all mediums, MyArtBroker focuses on the print market. We discussed our respective data approaches, with ArtTactic sourcing and cleansing data independently, and MyArtBroker utilising our bespoke print market database and intelligent algorithm for real-time valuation.

The key similarity between MyArtBroker and ArtTactic lies in our shared commitment to revolutionising the art market through data-driven analysis. Lindsay and I are aligned in our efforts to objectively capture shifts in the art market landscape. Stressing the significance of market reporting, we both strive to offer a neutral perspective, catering not only to the high-end market but also smaller segments. Recently, ArtTactic has released several reports focusing on the dynamic prints & editions market, reflecting the growing interest in affordability and investment potential for collectors. For further insights, explore our complete conversation on YouTube and Spotify.

The Banksy Report: Seven Years In the Banksy Market

This month, MyArtBroker launched our first market report dedicated to a solo artist: The Banksy Report: Seven Years In the Banksy Print Market. As specialists in the Banksy market, it was surprising that we hadn't released a dedicated report before, yet equally essential. Now seamlessly incorporated into our website, this report provides a vital and impartial examination of the Banksy print market, reflecting on both its corrections and achievements, unique to any other artists market. One significant insight is the concept of market saturation, particularly evident in the Banksy print market during 2020 and 2021. Market saturation and hype-driven purchases always entail volatile risks, leading to the inevitable cycle of rise and fall. Despite their absence in recent April print sales, Banksy prints in 2024 Q1 have displayed a commendable level of resilience, approaching the levels seen in Q1 of 2020, the pinnacle of the Banksy market's growth

Explore MyArtBroker’s Market Reports For More Insights.

MyArtBroker's Live Art Market Panels

American Pop Print Market

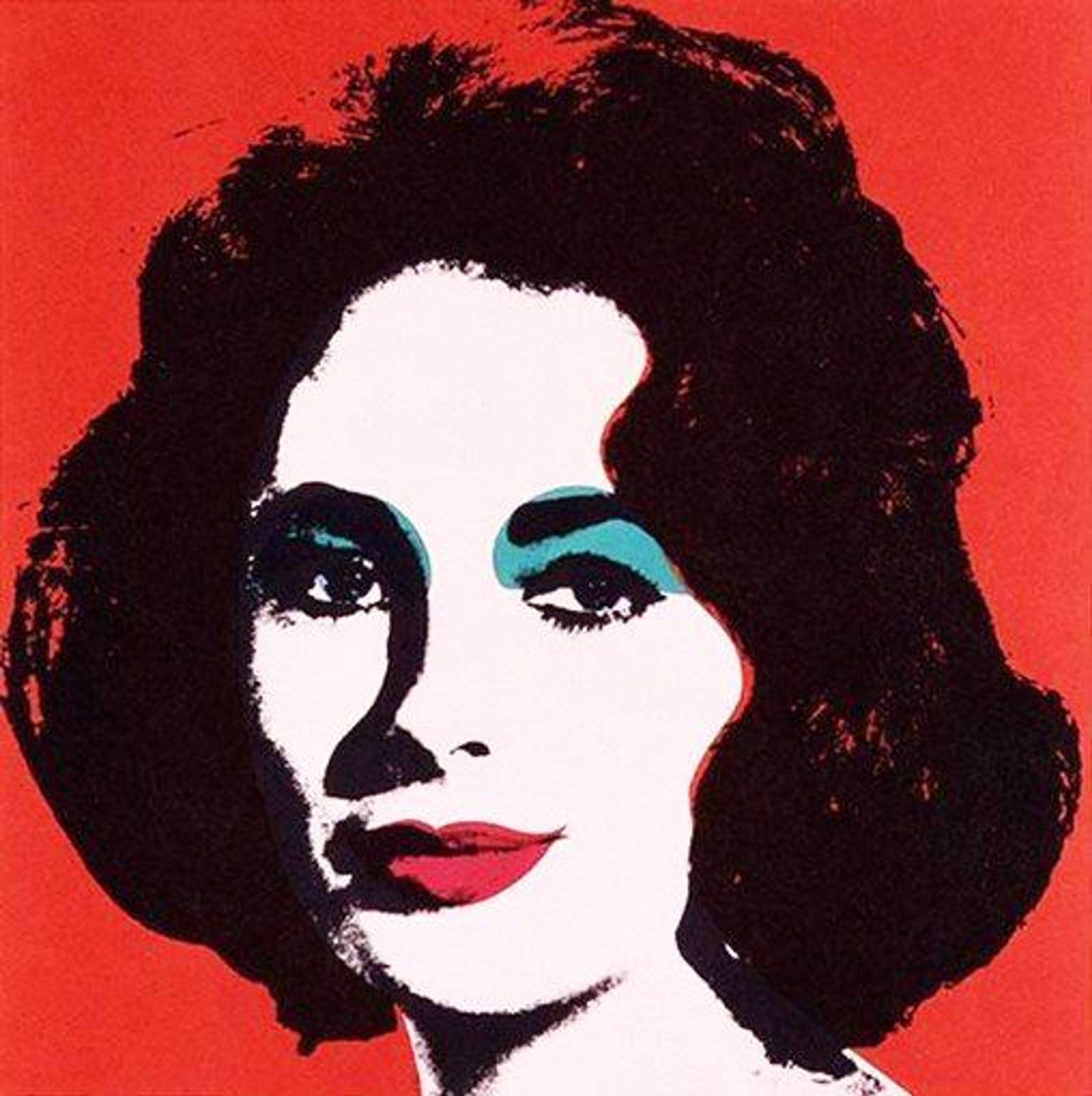

In April, MyArtBroker hosted two live panels featuring our team of sales specialists. On April 17th, we organised an American Pop Panel with guest Richard Polsky, author and art authenticator. Focusing on American pop icons like Andy Warhol, Jean-Michel Basquiat, Roy Lichtenstein, and Keith Haring, we explored the significance of provenance and authentication in valuing these artworks. To put the growth of the American Pop art market and the works of these artists into context, over the past seven years, Warhol, Basquiat, Haring, and Lichtenstein collectively experienced a 56% increase in lots sold. Despite ample supply, demand for their works remains strong. One factor contributing to the demand is the increasing presence of Trial Proofs within the market. MyArtBroker’s Rebecca Marsham touches upon this within the panel, emphasising their uniqueness in colourways and the excitement that these prints continually generate at auction.

Read the full write-up, Pop Art Prints & Editions: A Live Panel

David Hockney Print Market Panel

In a live panel hosted by Charlotte Stewart, MyArtBroker’s specialists Jasper Tordoff and Helena Poole discussed the trajectory of David Hockney's market. They highlighted his diverse career, initially funded by his print works, which allowed him to travel extensively and see the world through his unique lens. A key insight from this panel discussion is Hockney’s portrayal of relationships, reflecting his genuine connections with family, lovers, and his beloved dachshunds. This authenticity is palpable in his approach to various mediums, as discussed by Jasper and Helena. They explored Hockney’s diverse printmaking techniques, from xerox to photo collages, iPad drawings, and immersive lightroom installations. Hockney’s unique artistic essence shines through his chosen medium, particularly evident in printmaking, distinguishing his practice in a way that painting cannot replicate.

Read the full write-up: The David Hockney Print Market: A Live Panel

April Print Sales and Upcoming May Auctions

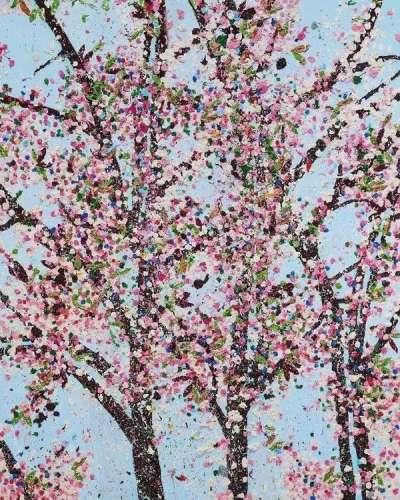

Christie’s, Sotheby’s, and Phillips conducted a series of April print sales, witnessing record-breaking bids for works by Warhol, Hockney and Damien Hirst. Hirst continues his unstoppable momentum with The Virtues. H9-8 Control set a new auction record during these sales selling for $27,940 at Sotheby’s against a $12,000 high estimate. Playing off the popularity and success of this series, Hirst just released a new drop with Heni of four limited edition large-scale works based on his Cherry Blossoms.

Read our full Auction Report on the April Prints & Editions Sales.

Listen to our Podcast recapping featured works in the April Sales.

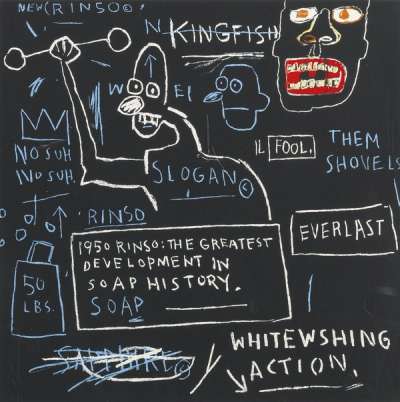

Also in the April print sales, of notable interest were posthumous prints by Basquiat, indicating promising outcomes for the upcoming May auctions. Basquiat, once again, will be featured centre stage in the May New York sales, with Phillips featuring Untitled (ELMAR) (1982) expected to fetch up to $60 million (USD). At Christie’s, The Italian Version of Popeye has no Pork in his Diet (1982) showcases Basquiat's iconic symbols and is set against an undisclosed estimate, indicating negotiation room on the final price from the seller, while Sotheby’s presents a collaborative piece by Warhol and Basquiat featured at the widely successful LVMH exhibition in Paris in 2023. This work makes its auction debut with an estimated value of $20 million (USD). The New York sales commence on Monday, May 13th, starting with Sotheby’s. Stay tuned for our comprehensive auction reports, podcasts, and complete coverage of the events.